Crude export expansion is being propelled by shale-driven, record U.S. crude production that hit 12 million barrels per day at the beginning of March, the Morningstar Commodities Research analysts said. (Source: Shutterstock.com)

Crude exports from the U.S. continue to gain ground as record-breaking production from U.S. shale propels a tsunami of pipeline projects along the Gulf Coast.

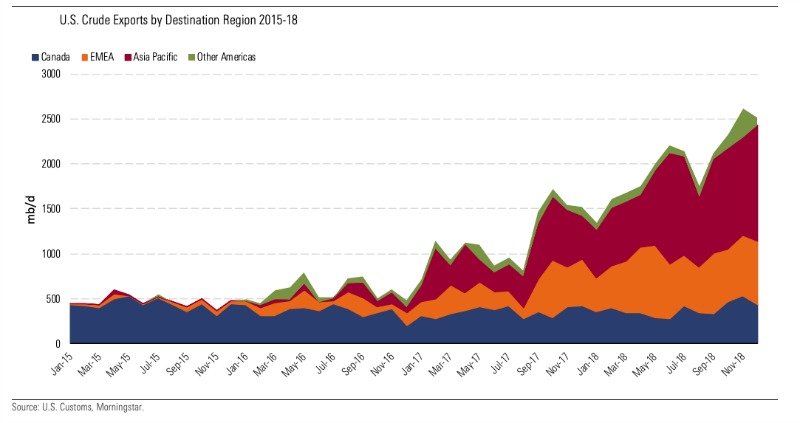

U.S. crude exports soared last year, rising 73% to average 2 million barrels per day (bbl/d), according to a Morningstar Commodities Research note published March 18, which noted this could grow further as the International Energy Agency forecast U.S. crude exports to double by 2024.

The country’s surge in crude exports comes after a decades-long export ban on U.S. crude oil ended in 2015. And, as a result, the U.S. is now third behind Russia and Saudi Arabia in crude exports.

The Morningstar research, led by Sandy Fielden, director of oil and products research, assessed departure points for the surging crude exports from the U.S. and how companies plan to expand Gulf Coast capacity to support growth.

Export Map

Crude export expansion is being propelled by shale-driven, record U.S. crude production “that hit 12 million bbl/d at the beginning of March 2019, according to weekly data from the Energy Information Administration (EIA), and is expected to average 12.3 million bbl/d in 2019 and 13.3 million bbl/d in 2020,” Morningstar noted citing a EIA short-term energy outlook.

Permian Basin light and sweet grades such as West Texas Intermediate that aren’t needed by U.S. refineries are being welcomed by international buyers due to their competitive price. To capture this market, companies plan “a wave of pipeline projects set to deliver crude to the Texas and Louisiana Gulf Coasts.”

Most (91%) of these exports leave from the U.S. Gulf Coast, with Canada absorbing the rest on overland routes, the report said.

The Houston region has overtaken the rest of the Gulf Coast region as a crude export departure point with an annual average of 706,000 bbl/d—a 38% share. The Corpus Christi, Texas, point of departure has shrunk from a 35% share of Gulf Coast shipments in 2017 to 24% in 2018.

In 2018, Asia absorbed 45% of total U.S. exports, doubling from the previous year. Meanwhile, exports to Europe, the Middle East and Africa also doubled, comprising 30% of U.S. crude exports in 2018. Canada’s share fell to 19% but was up in terms of volume from 2016 and 2017, as the rest of the Americas made up 5%.

In terms of future markets for U.S. crude exports, the Morningstar analysts said that China is expected to resume significant purchases once the trade dispute with the U.S. is resolved. India and Taiwan also hold promise. European and Mediterranean markets are tied to competition in Africa and the Middle East, which can produce similar grades to the U.S. and have lower delivery costs.

Pipeline Projects

To handle this export potential, U.S. companies plan larger and more efficient export terminals along the Gulf Coast, according to the Morningstar report.

In early March, permits were filed, according to analysts, for the Seaport Oil Terminal (SPOT) and Texas Crude Oil Loading Terminal (COLT), which would include associated infrastructure offshore able to load 2 million-barrel supertankers in the Gulf of Mexico.

SPOT is an offshore deepwater terminal proposed by Enterprise Product Partners LP. Texas COLT is a joint venture between Enbridge Inc., Kinder Morgan Inc. and Oiltanking Partners LP. Kinder Morgan recently dropped out of the proposed $800 million project.

“Both terminals will be fed via pipeline from storage tank farms on the Gulf Coast connected to multiple crude delivery pipelines in the Houston, Freeport and Texas City area,” Morningstar said.

Other proposed projects include a Trafigura installation off the coast of Corpus Christi and five other deepwater terminal projects announced by: Port of Corpus Christi and Moda Midstream in the Corpus Christi outer harbor; Jupiter Midstream offshore Brownsville, Texas; Tallgrass Energy LP offshore Louisiana; and Sentinel Midstream offshore Freeport, Texas.

“If all eight of these projects are completed, they would open at least 4 million bbl/d of incremental export capacity in the Gulf Coast region,” according to the report.

For this potential to be reached, there must be surplus barrels at the Gulf Coast ports supported by a crude price of $50 to $60 to keep the shale basins and offshore Gulf of Mexico production economic, the report noted. “The merry-go-round comes to a halt when world markets can’t absorb U.S. production, pushing prices below breakeven rates in the shale basins and putting the brakes on new drilling.”

But for now, all systems are go, the report said.

Recommended Reading

The Jones Act: An Old Law on a Voyage to Nowhere

2024-04-12 - Keeping up with the Jones Act is a burden for the energy industry, but efforts to repeal the 104-year-old law may be dead in the water.

US Orders Most Companies to Wind Down Operations in Venezuela by May

2024-04-17 - The U.S. Office of Foreign Assets Control issued a new license related to Venezuela that gives companies until the end of May to wind down operations following a lack of progress on national elections.

Vietnam Seeks Delicate Balance Among US, China, Russia

2024-02-08 - Ongoing U.S. tensions with China and Russia offer Vietnam an opportunity to boost economic ties with the former if American investors can steer past geopolitical smokescreens and destine funds for infrastructure, power and LNG projects all somewhat tied to Vietnam’s manufacturing sector.

Kinder Morgan Exec: Building Pipelines ‘Challenging, but Manageable’

2024-04-05 - Allen Fore, vice president of public affairs for Kinder Morgan, said building anything, from a new road to an ice cream shop, can be tough but dealing with stakeholders up front can move projects along.

FERC Again Approves TC Energy Pipeline Expansion in Northwest US

2024-04-19 - The Federal Energy Regulatory Commission shot down opposition by environmental groups and states to stay TC Energy’s $75 million project.