Proceeds from the sale of a 50% stake in Unit’s midstream affiliate will be used to accelerate the drilling program of its E&P in the Midcontinent and Texas Gulf Coast regions. (Image: Hart Energy)

[Editor's note: This story was updated at 1:28 p.m. CT April 1.]

Unit Corp. (NYSE: UNT) said March 29 it agreed to sell a stake in its midstream affiliate for $300 million, which will partly be used to boost the company's E&P drilling program.

The sale comprises a 50% equity interest in Superior Pipeline Co. LLC, a wholly-owned subsidiary of Unit. The buyer, SP Investor Holdings LLC, is jointly owned by OPTrust and funds managed and/or advised by Partners Group, a global private markets investment manager.

Before closing the sale, which is expected on April 3, Superior’s employees will become employees and handle operations of a new, wholly-owned subsidiary of Unit named Superior Midstream Operating LLC.

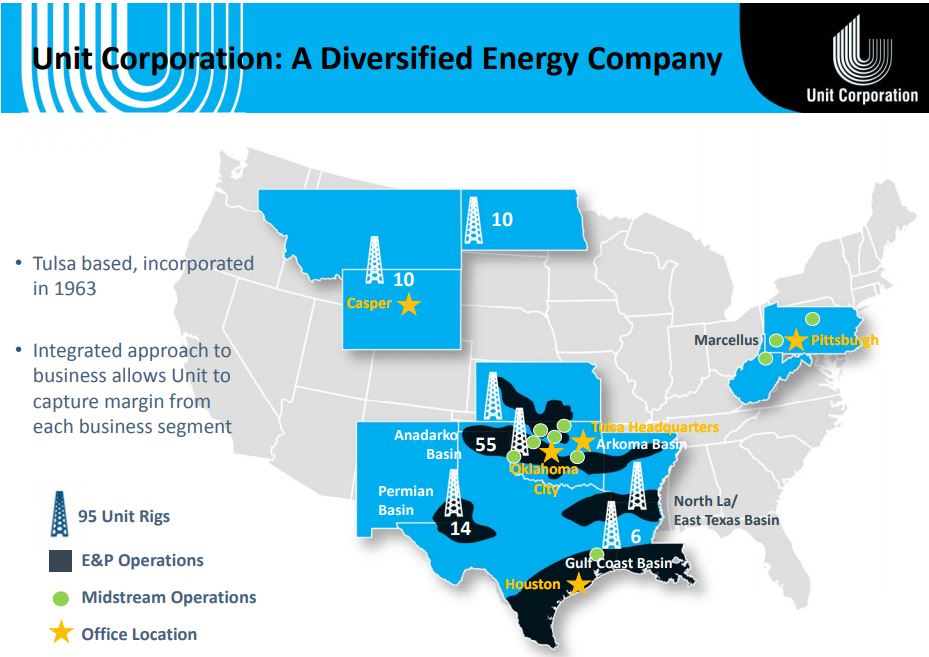

The transaction implies a total value for Unit’s midstream segment of $600 million. In addition to Superior, Tulsa, Okla.-based Unit operates through two other segments: its E&P affiliate Unit Petroleum Co. and Unit Drilling Co., a contract drilling business.

Larry Pinkston, Unit’s CEO and president, praised the structure of the transaction as it not only provides an opportunity for Superior’s continued expansion, but also allows Unit to retain day-to-day operational control which provides economic and technical support to Unit’s E&P segment.

“Our goal at Unit is to focus on growing our various business segments while maintaining a capital expenditures program in-line with our available cash. Through this transaction, we now have significant capital partners invested with us in our midstream business with the objective of accelerating Superior’s growth,” Pinkston said in a statement.

Unit said it will use proceeds from the sale to accelerate its E&P's drilling program, which Pinkston said will enhance the company’s production and reserve growth and also the throughput on some of Superior's existing systems.

Unit Petroleum’s key operations include Granite Wash, Hoxbar and Stack assets in the Midcontinent region across Texas and Oklahoma as well as assets in the Wilcox play along the Texas Gulf Coast, according to the company's website.

“We believe that this transitional transaction is a key step to help accelerate the growth of our business while continuing to maintain the capital discipline our shareholders expect,” he said.

The company also plans to use sale proceeds to make additional capital investments in Superior, reduce corporate debt and for general working capital purposes.

Unit’s midstream subsidiary Superior buys, sells, gathers, processes and treats natural gas for third parties and itself with operations in Oklahoma, Texas, Kansas, Pennsylvania and West Virginia.

In total, Superior operates three natural gas treatment plants, 13 processing plants, 22 active gathering systems, and roughly 1,455 miles of pipeline. Its processing capacity is 340 million cubic feet per day.

Houston lawyers with Sidley Austin LLP represented Partners Group in its acquisition. Unit was advised by Tudor, Pickering, Holt & Co. on financial matters and Vinson & Elkins LLP on legal matters.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

Buffett: ‘No Interest’ in Occidental Takeover, Praises 'Hallelujah!' Shale

2024-02-27 - Berkshire Hathaway’s Warren Buffett added that the U.S. electric power situation is “ominous.”

The One Where EOG’s Stock Tanked

2024-02-23 - A rare earnings miss pushed the wildcatter’s stock down as much as 6%, while larger and smaller peers’ share prices were mostly unchanged. One analyst asked if EOG is like Narcissus.