Guyana and Peru are among the countries where Tullow Oil is targeting hydrocarbon resources. (Source: Shutterstock.com)

London-based Tullow Oil Plc is getting back into its exploration groove. Although the three-well drilling campaign offshore Guyana is the headliner this year, the independent E&P already has zeroed in on the next possible hot spot—Peru.

The company and partner Karoon Energy plan to drill their first well in Peru in early 2020.

“Petroleum systems offshore Peru with their abundant natural oil seeps present Tullow with an exciting basin-scale opportunity,” Angus McCoss, exploration and subsurface director, told analysts July 24. “We consider Peru to be a future hot spot and others in our industry are beginning to think so, too. … You can’t afford to get into a hot spot after it’s a hot spot. So, we’ve made an early move.”

RELATED: Tullow Oil Opts For $33 Million Interim Payout, Revises Output Down

Earlier this year, Peru’s government approved Tullow’s entry to two offshore licenses, but the company aims to secure four more.

The Marina prospect, set to be drilled next year, is located in the Tumbes Basin off the northern part of the country. Karoon is the operator.

“There are compelling analogies with the prolific Californian basins, which have been producing oil for over 140 years; yet, in Peru, the industry intensity has been far lower,” McCoss said, “and so there is much yet to find.”

Tullow said the Marina well will be the first to target deeper water plays in the Tumbes Basin.

The basin is better known for production onshore, where more than 1.7 billion barrels have been produced, according to Karoon. The offshore part of the basin containing Block 38, where the Marina prospect will be drilled, has several play types such as Neogene-aged tilted faulted blocks, wrench and ramp anticlines and pinch-out plays.

“Reservoir targets extend from the Pliocene La Cruz Formation to the Oligocene Mancora Formation. At Albacora and Corvina, the producing reservoirs are Middle Miocene in age; however, at Amistad, younger sandstones also produce gas,” Karoon said on its website. “These younger formations have superior reservoir characteristics compared with the older Zorritos Formation and are the primary target in Karoon’s Z-38 Block.”

As industry attention builds in South America offshore Peru, activity elsewhere on the continent has already picked up offshore Guyana. The Exxon Mobil Corp.-led exploration effort offshore Guyana on the Stabroek Block has led to more than a dozen discoveries with more than 5.5 billion barrels of oil equivalents in estimated gross recoverable resources.

“Our exploration campaign in Guyana has been a decade in the making and we’re drilling right now,” McCoss said. “You can’t read my body language. There is nothing to report there yet.”

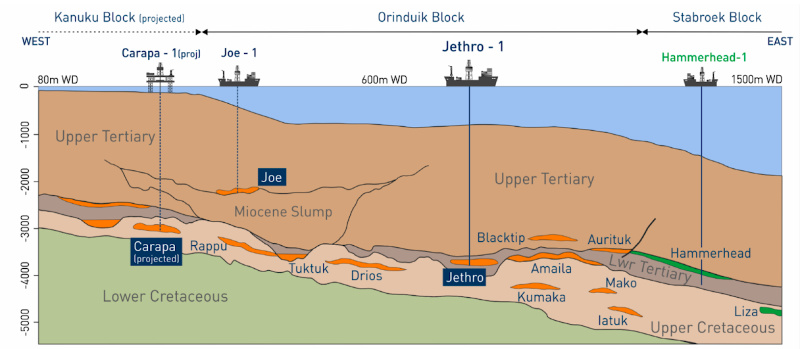

Tullow is testing three play types offshore Guyana this year with its operated Jethro and Joe prospects on the Orinduik Block and the nonoperated Carapa prospect on the Kanuku Block.

Drilling at the Lower Tertiary-aged Jethro prospect is underway with the Stena Forth drillship. A result is expected in August.

“We’re targeting over 100 million barrels deploying a drillship in 1,315 meters of water at a net cost of $28 million. Success would have material follow-on potential,” McCoss said.

The second well will be spud in August, using the same drillship and targeting the Upper Tertiary. The water depth is 650 m with a cost of $11 million for Tullow.

The third well, on the Kanuku Block, in even shallower water—70 m—will target some 200 million barrels in the Cretaceous. Tullow’s share of the well cost is about $20 million. The company said the Rowan EXL II jackup rig has been contracted to drill the prospect. Drilling is scheduled to start in September with a result anticipated in the fourth quarter.

Tullow’s acreage offshore Guyana is updip of the Exxon Mobil-operated Liza discovery.

“After a good number of years of resetting exploration, we’re now back to having a conveyor belt of three to five high impact exploration wells per year,” Tullow Oil CEO Paul McDade said.

The company has an annual exploration budget of $150 million.

The new ventures team also has exploration plans for Suriname, where the Goliathberg-Voltzberg North prospect will be drilled in 2020; Côte d’Ivoire and Comoros, sites of seismic acquisition campaigns starting in September; and Argentina, where Tullow said it plans to

begin initial geological studies, 2-D reprocessing and 3-D acquisition in 2020.

The company is also hoping to line up seismic work in Namibia, where in June it entered an agreement to acquire interest in an offshore license from Calima Energy Ltd. The transaction awaits government approval.

“The business is in good shape,” McDade said. “We’ve got good growth opportunities ahead, and we will continue to look to deliver value.”

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

Exclusive: Chevron Balancing Low Carbon Intensity, Global Oil, Gas Needs

2024-03-28 - Colin Parfitt, president of midstream at Chevron, discusses how the company continues to grow its traditional oil and gas business while focusing on growing its new energies production, in this Hart Energy Exclusive interview.

Exxon’s Payara Hits 220,000 bbl/d Ceiling in Just Three Months

2024-02-05 - ExxonMobil Corp.’s third development offshore Guyana in the Stabroek Block — the Payara project— reached its nameplate production capacity of 220,000 bbl/d in January 2024, less than three months after commencing production and ahead of schedule.

What's Affecting Oil Prices This Week? (Feb. 5, 2024)

2024-02-05 - Stratas Advisors says the U.S.’ response (so far) to the recent attack on U.S. troops has been measured without direct confrontation of Iran, which reduces the possibility of oil flows being disrupted.

Tinker Associates CEO on Why US Won’t Lead on Oil, Gas

2024-02-13 - The U.S. will not lead crude oil and natural gas production as the shale curve flattens, Tinker Energy Associates CEO Scott Tinker told Hart Energy on the sidelines of NAPE in Houston.

What's Affecting Oil Prices This Week? (March 18, 2024)

2024-03-18 - On average, Stratas Advisors predicts that supply will be at a deficit of 840,000 bbl/d during 2024.