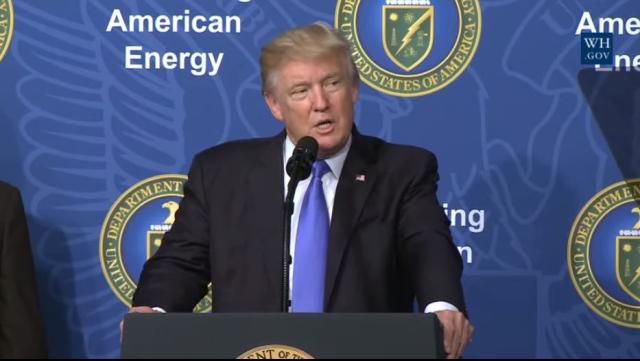

President Donald Trump speaking on June 29 about new policy initiatives to promote a 'golden era of American energy.' (Source: whitehouse.gov)

U.S. President Donald Trump is moving forward with plans to change the five-year offshore oil and gas leasing program approved by the Obama administration in his quest to open up more federal land—including the Atlantic and in the Arctic—to drilling.

Flanked by Vice President Mike Pence and Energy Secretary Rick Perry, Trump said June 29 the federal government is creating a new offshore oil and gas leasing program, a move that follows his executive order late April to expand offshore drilling.

“America will be allowed to access the vast energy wealth located right off our shores. This is all just the beginning, believe me,” Trump said during a briefing. “The golden era of American energy is now underway.”

A request for information (RFI), published in the Federal Register on July 3, will be the first step in developing the new program. The RFI begins a 45-day public comment period.

The planning process for crafting a five-year program typically takes two or three years, the Interior Department said in a news release.

The current 2017-2022 Outer Continental Shelf (OCS) Oil and Gas Leasing Program has 11 scheduled lease sales, ten of which are in the Gulf of Mexico region. The other is for blocks in Alaska’s Cook Inlet.

Oil and gas industry players had pushed for additional acreage, including in the Atlantic region.

News of the program’s restart was praised by industry groups, such as the National Ocean Industries Association (NOIA).

“The 2017-2022 [OCS] leasing plan is one of the most energy damming actions taken in the last few years in that it actually reduced the offshore area available for potential exploration to an unprecedented low,” NOIA President Randall Luthi said in a statement. “As a result, 94% of our offshore areas are closed to any and all exploration for new sources of oil and natural gas. It appears that no other country with an offshore oil and natural gas program has closed so much of its offshore acreage.”

The move presents an opportunity for the federal government to “begin the process to change that precedent and unleash more American energy,” Luthi added.

For Dan Naatz, senior vice president of government relations and political affairs for the Independent Petroleum Association of America (IPAA), the news shows the administration “recognizes the benefits to be gained from safe, responsible development of America’s abundant natural resources,” he said.

“Offshore production is a highly-regulated process that is underscored by advanced technological innovation and a commitment to our environment and safety,” Naatz said in a statement. The “IPAA has long-advocated for opening access to all areas of the [OCS], including the Eastern Gulf of Mexico, the mid-Atlantic, and Alaska’s waters.”

During a press call June 29 before the president’s address, Interior Department officials spoke about expanding the leasing program and the process.

Katharine MacGregor, acting assistant secretary for the Land and Minerals Management, pointed out that oil and gas remains an important source of revenue for the Treasury Department, following taxes.

“The energy resources that flow every day from the offshore development in the Gulf of Mexico generates jobs, revenue and energy security for our nation,” MacGregor said. “It keeps prices low for American families and businesses. We need to be growing this business not holding it back with a plan that places 94% of our OCS off limits. The Trump administration is dedicated to energy dominance.”

RELATED: Energy Secretary: US To Aim For Energy Dominance

During the briefing, Trump also announced plans to lift restrictions on U.S. sending coal overseas, expand nuclear energy sector and boost LNG exports from the Lake Charles LNG plant in Louisiana.

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

Kinder Morgan Sees Need for Another Permian NatGas Pipeline

2024-04-18 - Negative prices, tight capacity and upcoming demand are driving natural gas leaders at Kinder Morgan to think about more takeaway capacity.

Summit Midstream Launches Double E Pipeline Open Season

2024-04-02 - The Double E pipeline is set to deliver gas to the Waha Hub before the Matterhorn Express pipeline provides sorely needed takeaway capacity, an analyst said.

FERC Approves ONEOK Pipeline Segment Connecting Permian to Mexico

2024-02-16 - ONEOK’s Saguaro Connector Pipeline will transport U.S. gas to Mexico Pacific’s Saguaro LNG project.

Enbridge Announces $500MM Investment in Gulf Coast Facilities

2024-03-06 - Enbridge’s 2024 budget will go primarily towards crude export and storage, advancing plans that see continued growth in power generated by natural gas.

Midstream Operators See Strong NGL Performance in Q4

2024-02-20 - Export demand drives a record fourth quarter as companies including Enterprise Products Partners, MPLX and Williams look to expand in the NGL market.