Little-known Castleton Resources made a major statement in 2016 when it acquired the East Texas assets of Anadarko Petroleum for a cool $1 billion.

At the same time, but on the other side of the state, startup Rockcliff Energy II was positioning itself in the Permian Basin before eventually pivoting successfully to East Texas in the cheaper Haynesville Shale.

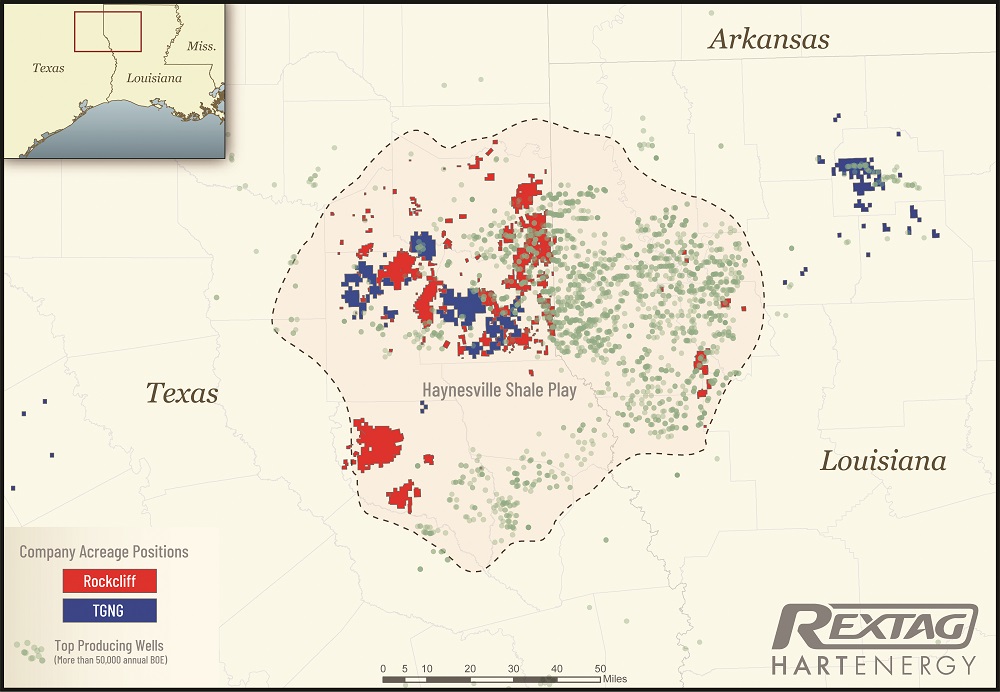

Together, the pair comprise a chunk of the firm now known as TG Natural Resources—a major Haynesville power player established when parent company Tokyo Gas acquired Castleton and then completed a roller coaster, 18-month courtship of Rockcliff with a $2.7 billion deal.

Despite weak natural gas prices and a sudden, so-called pause on new LNG infrastructure permitting by the Biden administration, the Haynesville is still booming. The ongoing LNG construction surge along the U.S. Gulf Coast is such that even election-year political posturing cannot slow it down.

The shale industry is rapidly consolidating amid healthy, stable crude oil prices from the Permian to the Williston Basin. But most of the natural gas dealmaking is happening in the Haynesville, where the proximity to LNG hubs is prized. Chesapeake Energy is building out its footprint, agreeing to spend $7.4 billion on Southwestern Energy to create the nation’s largest, pure-play gas producer.

“You’re just a more valuable company with scale, and there’s that staying power and cash flow,” TG President and CEO Craig Jarchow, who previously led Castleton, told Oil and Gas Investor. “All the good things that come with scale, we realized with this transaction. And so, we’re one of the biggest players in the Haynesville now.”

What’s old is new again in the 16-year-old Haynesville. The rock is hot—literally and metaphorically. The fractures are massive and the laterals are long. Chesapeake is on track to dominate the Haynesville once more, adding to the foundation laid by the late Aubrey McClendon, who led the company when it was among the first to pioneer the region. Japan is a newer player on the block, but the gas-deprived and eager Asian nation is growing a presence with TG and Osaka Gas-owned Sabine Oil & Gas.

The Haynesville region is producing about 13.6 Bcf/d of gas—down just a bit from the record highs of early 2023 despite much lower prices. Compare that to the 10 Bcf/d in 2011 when the Haynesville hit its first peak. After nearly quadrupling its output with the Rockcliff deal, TG now produces well more than 1.3 Bcf/d, trailing only Chesapeake and privately held Aethon Energy, and virtually even with the Jerry Jones-controlled Comstock Resources.

“We’re ready to finally get excited about gas,” Andrew Dittmar, senior vice president for Enverus Intelligence, told OGI. Pure-play gas’ $6 billion represented a fraction of a record-breaking $192 billion worth of assets traded in upstream M&A last year. The Chesapeake-SWN deal alone has already surpassed the 2023 total for gas dealmaking.

The industry’s bullishness on natural gas pricing remains strong even as values dipped below $2/MMBtu in early 2024. The rebound might take another year or so because new LNG facilities won’t come online and increase demand until well into 2025.

“We have to wait a little bit longer on pricing,” Dittmar said. “But there’s excitement around the Haynesville from playing that LNG story, and people are looking at deals there. The two kind of obvious ones happened very quickly with TG-Rockcliff and then the SWN-Chesapeake merger.”

Happily ever after

The TG-Rockcliff tale is an 18-month courtship of international romance, war and a whirlwind reunion.

Or, maybe, it’s just a story of two neighboring, natural partners teaming up once it became fiscally responsible and mutually beneficial.

But TG hopes the rest of its story is a happily-ever-after built on production consistency and LNG optionality.

TG can run a few drilling rigs: three on Rockcliff’s acreage and one on TG’s to scale up or down slightly as needed and without being forced into additional dealmaking or pivots, Jarchow said. Still, additional acquisitions or even entering other gassy basins will remain on the table, he said.

The two companies operated a combined five rigs for most of 2023 and TG can always scale back up, said Alex Gafford, senior energy analyst at East Daley Analytics. The beauty of the deal is the access to pipelines, primarily the Williams Cos. Trace system and its upcoming Louisiana Energy Gateway system, coupled with Tokyo Gas’ fleet of 10 LNG carriers and the potential to invest more in U.S. LNG facilities, he said. The larger Appalachia Basin might be cheaper to drill, but that discount is offset by both the lack of takeaway capacity and Gulf Coast proximity.

“The acquisition not only enhances Tokyo Gas’ portfolio, but also provides a natural hedge, allowing the company to navigate higher LNG costs during periods of increased U.S. natural gas prices by selling within the U.S. at strategic hubs like the Henry Hub and along the Gulf Coast,” Gafford said.

That optionality, consistency and long-term thinking make up the Tokyo Gas mantra, Jarchow said, along with not being overly reactive to pricing swings.

“It’ll be pretty steady. We’re in it for the long term, and so our underwriting of the Rockcliff assets is where we would put three rigs on that asset, and that’s enough to maintain production fairly flat for many, many years out,” Jarchow said. “And we think that’s the right approach here. We could put more rigs on it and accelerate it, but that just doesn’t make sense to us right now.”

Rocky roller coaster

That steady approach is what ultimately won Rockcliff for TG.

With Rockcliff approaching its eighth year of operating and private equity backer Quantum Capital Group ready to flip amid higher pricing, the decision was made in early 2022 to sell the pure-play Haynesville assets through a marketed auction process that began near summertime, said Rockcliff co-founder and CEO Alan Smith.

The initial problem was that—amid the earlier stages of the Russia invasion in Ukraine—prices unexpectedly were almost too high, hovering close to $10/MMBtu.

“All the public guys likely weren’t going to touch it at that kind of price deck. No one wants to be accused of buying at the top,” Smith told OGI. “So, I think most people chose to ultimately sit out of the process at that time, primarily just due to market timing, but there were a couple of entities that have a long-term view on gas and have an LNG mindset.”

TG stood out by fourth-quarter 2022, Smith said. Having TG as an East Texas neighbor with a decent footprint made a lot of sense. “And with Japan short of gas, it just fit well with their global plans.”

The next issue was Tokyo Gas’ due diligence. By the time that front-end work was being completed, gas prices dropped pretty steeply in early 2023.

“The way that most Asian buyers work is they prefer to do a lot of the work and due diligence on the front end, and that takes quite a bit of time to get that done,” Smith said. “By the time that we got to the point where it looked like we could close, natural gas prices were cratering and there became a value disconnect.”

It was reported they were near a $4.6 billion sale, but Smith said that number was somewhat misinterpreted and the real price was not quite that high. “What got leaked out there was a top-line number and did not include any adjustments for the hedges that were massively out of the money.”

Instead, timing had inflicted a grievous blow on the potential deal, Jarchow acknowledged. It was admittedly “frustrating” for both sides, although they only blamed the macro environment.

“It was Rockcliff’s feeling and our feeling that a year ago was not a good time to actually transact. So, … we mutually agreed to go separate ways and just wait things out and see what happens with the natural gas markets and M&A market and what’s going on in the Haynesville,” Jarchow said. “We reengaged just a few months ago, and we had the advantage of having done all the work.”

When prices began to stabilize in the late summer and into early fall, TG and a few other potential bidders approached Rockcliff again, Smith said, and all of that previous due diligence suddenly became a positive.

“We got so far along the year before that, when TG came back to the table, we were able to negotiate a price that worked for everybody,” Smith said. “They just needed to update all their due diligence that they had already done before, which was a pretty distinct advantage because they were so far down the road.”

As Jarchow explained it, “Effectively all of that was done a year ago and we just needed to refresh all of that, which did take some time. But, once we agreed on a new price and agreed to move forward, things moved quite rapidly and we were able to get to close by the end of the year.”

He and Smith both describe the $2.7 billion deal as a major win-win for all sides.

Rocky starts and stops

But the fuller story starts nearly a decade ago with the first iteration of Rockcliff and its private equity backer, Quantum.

Alan Smith came from Quantum plays to lead the new private producer in early 2015. Soon after, Rockcliff’s asset in northern Louisiana was sold to Memorial Resource Development.

Smith’s Rockcliff II in 2016 initially took aim at the Delaware Basin, and quickly made one deal by selling a proven tract to Marathon Oil.

“Acreage prices continued to escalate, and we just got blown out after that,” Smith said. “So we bowed out of there and retreated back to the Haynesville.”

They targeted two core Haynesville assets in Louisiana being sold by Chesapeake, but Covey Park and Indigo Natural Resources also were eager buyers in 2017.

“We bid on both of them and they beat us, beat us pretty handily. So, then we retreated back to East Texas, and that’s where we did all the mapping,” Smith said. “We knew the state line was meaningless as to the geology, and we felt like that with the wells on the Texas side, most of them had been under-stimulated and certainly had not seen the longer laterals.”

After some other swings and misses, Rockcliff finally took aim at Samson Resources.

“We’d been chasing Samson before it was in bankruptcy, [while it was] in bankruptcy, and then out of bankruptcy, and finally bought the entire East Texas package for $525 million,” Smith said. “And then we were set. We had close to 200,000 total acres and off to the races we went.”

Meanwhile, Jarchow was watching from the sidelines.

“The genius of the Rockcliff team was recognizing that very good rock actually resides in East Texas and close to the border with Louisiana,” Jarchow said. “Then they proceeded to demonstrate that, given the right drilling and completion recipes, which they developed, this rock performs. The economics of this rock in East Texas rival that of the core of the core.”

But, after almost eight years, a private equity-backed producer is typically ready to sell.

“It’s like preparing a meal,” Jarchow said. “You have to get all the parts together and cook ’em a little bit, and serve it when it’s still hot, and that’s what they did.”

Hot and ready to ship overseas

The story of TG begins with Castleton Commodities International eyeing a reinvigorated Haynesville with its Castleton Resources subsidiary.

The $1 billion Anadarko deal in 2016 was the big needle mover.

But, arguably, the bigger but less pricy deal came six months later when Tokyo Gas decided to buy a 30% stake in Castleton Resources for a foothold in U.S. gas and LNG.

It was “highly unusual” for Tokyo Gas to buy in as an equity owner and not just take a working interest deal, Jarchow said.

“Most investors in upstream, particularly from Asia, preferred working interest deals. They didn’t want you hedging on their behalf,” Jarchow said. “And we convinced Tokyo Gas that, in the case of a working interest deal, among partners, you can have a winner and a loser. And, up to that point, seven years ago, just about every deal where the minority player took a working interest, particularly from Asia, that partner lost. Actually, it was 100%. And we said to Tokyo Gas, ‘Well, why don’t you come into the equity? Either we both win or we both lose. At least we’re aligned.’”

And they agreed.

“Of course, when we first started out, like any good investor, they kept a very close eye on us. And the amount of diligence they did for that 30% investment was tremendous,” Jarchow said with a laugh. “It was borderline extreme, but good for them.”

From there, the deals kept coming.

In 2019, Castleton bought Shell’s Haynesville assets from legacy BG for $150 million, and Tokyo Gas upped its stake to 46%.

In 2020, Castleton acquired Range Resource’s Terryville acreage in North Louisiana for $245 million, and Tokyo Gas hiked its ownership to a majority 70%.

In 2021, the name change to TG Natural Resources became official and Tokyo Gas eventually took an ownership stake of just more than 90%.

A clear pattern was emerging with Tokyo Gas. And then the Rockcliff deal was by far the largest move for the Japanese utility giant.

“They’ve seen how the assets perform, they’ve seen how we perform, they’re on our board. And with time, I think the familiarity and the trust has evolved. So, if you came into our office today, you would see that we operate like most every other upstream company,” Jarchow said of Tokyo Gas. “They look to us to assess assets and operate the assets. But would they do that with a new team? I don’t think so. It’s a relationship that’s been seven years in the making.”

For his part, Jarchow is a Santa Barbara, Calif., native who fell in love with geophysics and plate tectonics as a teenager entering college.

He earned his doctorate from Stanford University and started with Amoco working the Gulf of Mexico. Then he moved on to Apache Corp.

But, after gaining expertise in operations and acquiring an MBA from MIT, he decided he needed financial mastery, as well, to advance into a CEO role. He joined First Reserve under William Macaulay just before the shale boom took off. Then he moved to a managing director and partner role at Pine Brook Partners under Howard Newman, continuing to learn from some of the PE energy pioneers.

That experience ultimately led him to the leadership role at Castleton in 2015.

LNG boom and pause

Now that TG and Rockcliff are wed, the true link moving forward for TG and the Haynesville overall is with LNG markets.

Spurred in part with much of the world’s interest in avoiding any reliance on Russian gas, optimism was rising with the U.S. shipping nearly 14 Bcf/d in LNG around the world and the federal government having permitted enough projects to triple existing U.S. volumes.

Not all of what’s been permitted will come online, but U.S. LNG capacity is expected to nearly double within the next few years from what’s already approved.

Still, the industry is deeply concerned by the Biden administration’s new decision to put a hold on additional LNG project permitting while the Department of Energy determines how to incorporate climate change threats and a risk of overbuilding into the approval equation.

“I think many of these LNG plants have already started, so the momentum is there. They will be completed. The economics still make sense, probably will continue to make sense,” Jarchow said, arguing that any impacts are minimal—for now.

“But, one thing that this order will do is it will chill investment in future LNG facilities further out in the U.S. I would imagine that the Europeans are wondering about what this means for gas supply,” he added. “If it happened once as an investor, you have to think, ‘Well, it can happen again. And do I want to invest a lot of money in an LNG facility? It costs a lot of money to get a plan to the permitting stage. Am I going to make that bet and incur the risk of, well, is this going to happen again?’”

Luciano Di Fiori, a partner at McKinsey & Co., said global gas markets are largely in balance for now, but oversupplies are expected in the coming years as the U.S. and Qatar bring on new LNG capacity. It might take almost a decade, but demand will eventually catch up and surpass supplies again if new infrastructure projects do not move forward.

“The ban today is fine because we don’t expect to see a lot more projects coming online or going through FID in the next few years,” Di Fiori told OGI. “But we would need some of those projects to get final investment decision in, say, five to six years so they can be ready when the market becomes shorter.”

What’s next?

For Quantum and Smith, they’re already plotting out Rockcliff Energy III and whether to buy back into the Haynesville or look elsewhere in Texas or what touches Texas.

Tellurian just put its Haynesville assets in Louisiana up for sale, and new buying opportunities for Rockcliff, TG and others will arise.

But, for now, TG is focusing on integration and synergies. And that means removing a lot of equipment from the field for both cost savings and emissions reductions.

“We’re very big on centralizing our facilities,” Jarchow said. Instead of every well site having a separator, a compressor and tanks, TG connects them to flow to centralized facilities. “It’s a very big deal because it simplifies the well site. So, on our typical well site, all you have is the wellhead. Then, you have maybe a tank for injecting chemicals downhole to prevent corrosion, and you have the meters. But no other tanks, no separators, no compressors, and that simplifies things. And it allows us to have many more wells per lease operator than most of the companies because our well sites are just simpler.”

For instance, TG eliminated 432 tanks just from Range’s Terryville assets, he said. That equates to big environmental gains because it’s eliminating potentially leaky equipment, including the pneumatic pumps and valves and thief hatches.

But TG certainly could look to scale up in the Haynesville or even evaluate other basins, Jarchow said. There’s just not any rush or pressure. If Tokyo Gas wanted to grow without assuming much more risk, TG could always take on another investor or weigh an IPO.

TG is not interested in Appalachia because of its constraints and the TG team’s lack of experience there, Jarchow said. But the firm might consider the Eagle Ford Shale, Midcontinent or even gassier portions of the Permian.

Any asset acquisition would have to be at least 60% dry gas for parent Tokyo Gas, he said. TG’s current asset base is about 80% dry gas.

“If we go into a new basin, we’re going to make sure that we have the people in place so that we know where the skeletons are in the closet,” Jarchow said. “We have people very experienced in the Eagle Ford. We have people very experienced in the Permian, and very experienced in the Midcontinent. I think we know where the skeletons are in the closet.”

Recommended Reading

PropFlow Names David Ward as CEO

2024-05-13 - As CEO, David Ward will lead and build out PropFlow’s operations of eliminating debris from proppant at well sites in the Permian Basin and other plays.

LandBridge Chair: In-basin Data Centers Coming for Permian NatGas

2024-06-28 - Newly public Delaware Basin surface-owner LandBridge Co. has a 100-year lease agreement with one developer that could result in ground-breaking in two years and 1 GW in demand.

Scott Sheffield Among Investors in Australian Shale Gas IPO

2024-06-27 - The operator who sold Pioneer Natural Resources Co. to Exxon Mobil in May for $59.5 billion joins his son Bryan Sheffield in shale gas investment Down Under.

Solaris Stock Jumps 40% On $200MM Acquisition of Distributed Power Provider

2024-07-11 - With the acquisition of distributed power provider Mobile Energy Rentals, oilfield services player Solaris sees opportunity to grow in industries outside of the oil patch—data centers, in particular.

Liberty Energy Warns of ‘Softer’ E&P Activity to Finish 2024

2024-07-18 - Service company Liberty Energy Inc. upped its EBITDA 12% quarter over quarter but sees signs of slowing drilling activity and completions in the second half of the year.