Source: Hart Energy

Titan Energy LLC will sell its 25% interest in the CO2 flood Rangely Field in Rio Blanco County, Colo., for $105 million, the Fort Worth, Texas, company said June 12.

Titan CEO Daniel Herz said the company’s sales will de-lever the business through “credit-accretive asset sales.”

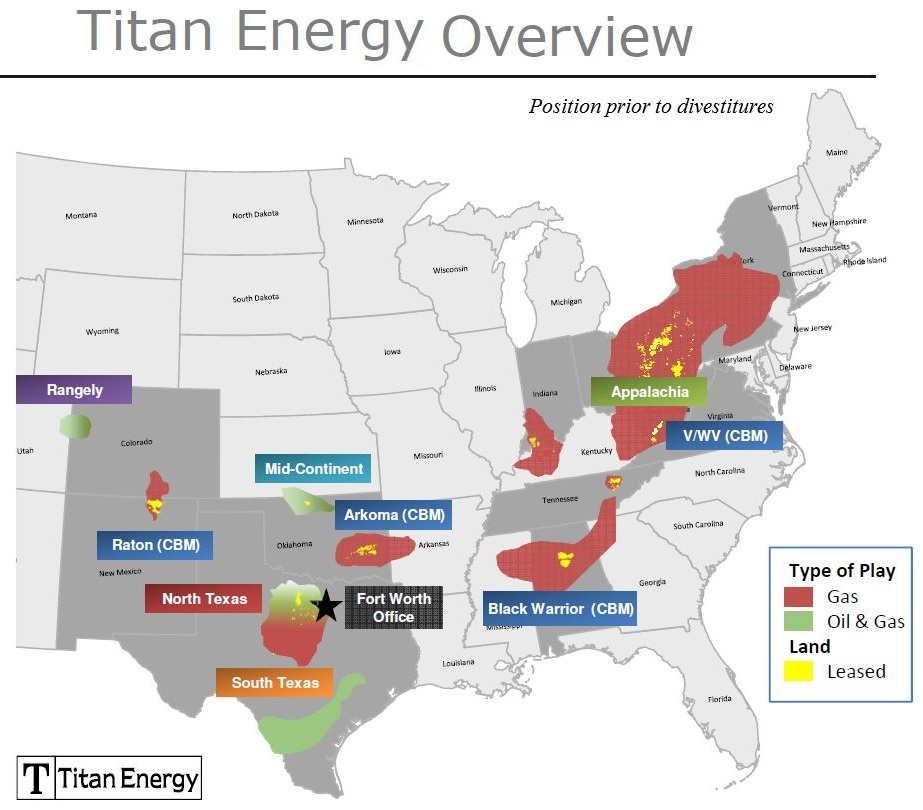

The announcement follows a May deal in which the company parted with conventional Appalachia and Marcellus assets for $84.2 million as the company continues to eliminate debt and focus on the Eagle Ford Shale.

“This transaction, along with the previously announced sale of Appalachia, reduces Titan’s debt by $189 million and allows the company to focus on development of the Eagle Ford Shale, where well results continue to exceed type curve expectations,” Herz said.

In addition to its interests in Rangely, Titan is also selling its 22% interest in Raven Ridge Pipeline, a CO2 transportation line, as well as surrounding acreage in Rio Blanco and Moffat counties, Colo.

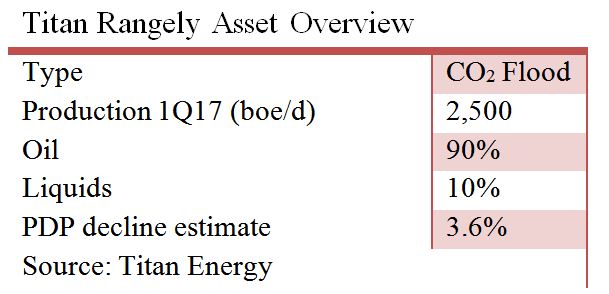

The Rangely assets averaged about 2,500 barrels of oil equivalent per day (90% oil, 10% liquids) in first-quarter 2017. The assets are operated by Chevron Corp. (NYSE: CVX).

Titan said in April that it also plans to sell coalbed methane assets in the Raton Basin in New Mexico and Colorado. In fourth-quarter 2016, the assets produced about 63 million cubic feet of gas per day. The company said 600 miles of gathering assets are in place in the vicinity.

Titan has about 10,500 net acres in Atascosa County, Texas, in the Eagle Ford with an estimated 70 Lower Eagle Ford locations.

The Rangely transaction is subject to customary closing conditions. The deal is expected to close in August with an effective date of May 1.

Net proceeds will be used to repay a portion of outstanding borrowings under Titan’s first lien credit facility.

RBC Richardson Barr marketed Titan’s Rangely Assets. Jones Day advised on the legal aspects of the transaction.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

HighPeak Energy Authorizes First Share Buyback Since Founding

2024-02-06 - Along with a $75 million share repurchase program, Midland Basin operator HighPeak Energy’s board also increased its quarterly dividend.