CNX has continued its repurchase initiative so far into 2024, acquiring an additional 800,000 shares through Jan. 11. (Source: Shutterstock)

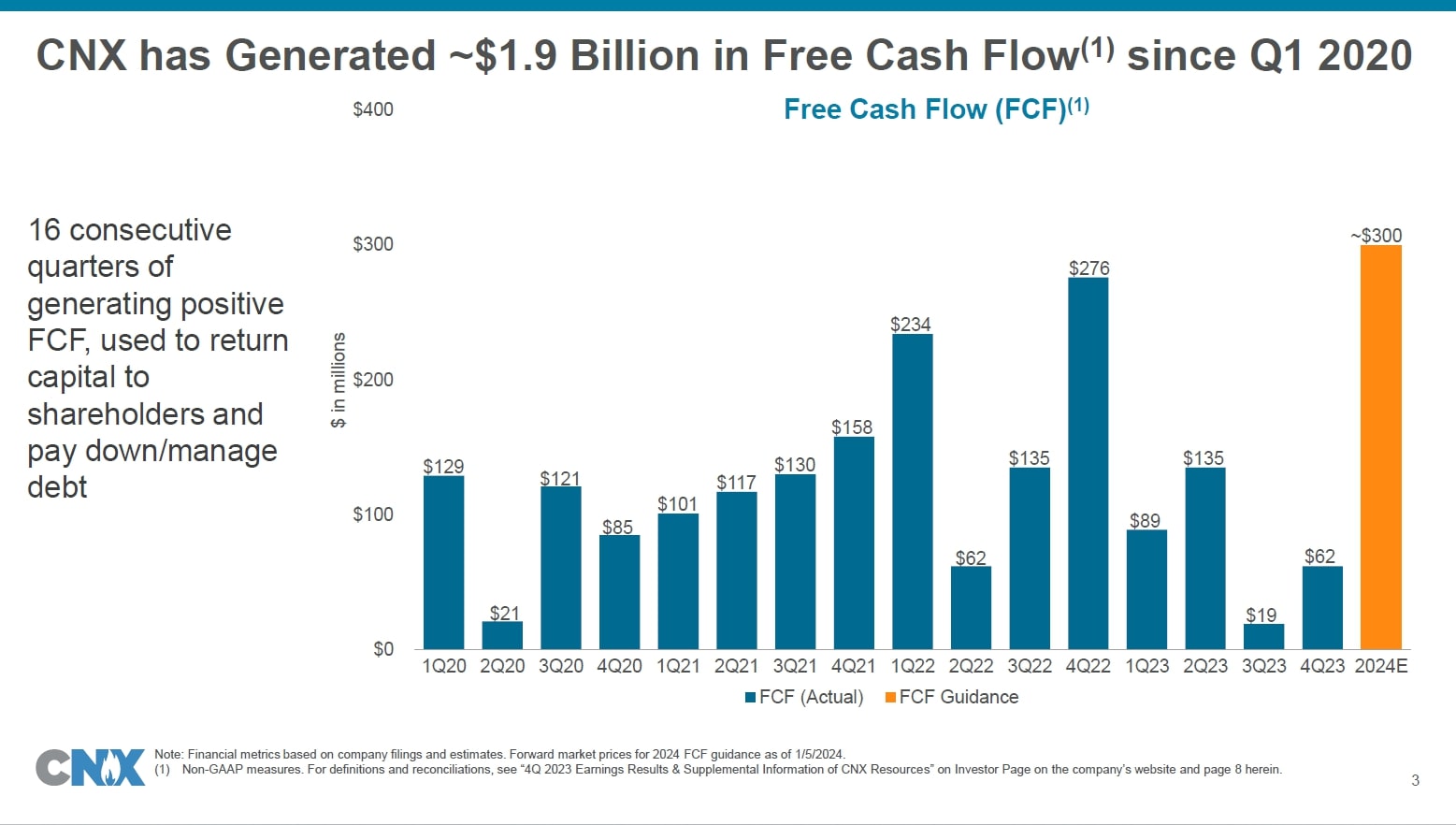

CNX Resources delivered a strong financial and operational performance in the fourth quarter of 2023, recording a free cash flow of $62 million—its 16th consecutive quarter of free cash flow, according to its Jan. 25 earnings report.

In line with its third quarter earnings call in October, CNX’s New Technologies Group played a major factor in generating free cash flow, amounting to $15 million for the quarter and $34 million for the year. These proceeds were mainly derived from the monetization of environmental attributes associated with waste methane abatement operations in Virginia and Pennsylvania.

The operational team achieved robust results during the quarter, with accelerated well turn-in-line execution driving production to 147 Bcf. The 2023 full-year production reached 560 Bcf, which exceeded the high end of their guidance range. Total capex for the quarter decreased to $108 million due to reduced completion activity as the 2023 capital program concluded.

CNX generated $376 million in revenue and total production volumes were 146.9 Bcf, up 4.5% year-over-year. Since the third quarter of 2020, outstanding net debt was reduced by approximately $331 million.

During the fourth quarter, CNX prioritized share repurchases as part of its 7-year plan to generate long-term value for shareholders, repurchasing 5.3 million shares, or an additional 2.4% of outstanding shares. The total repurchases for 2023 amounted to 17.7 million shares at an average price of $18.10 per share, totaling approximately $320 million.

“Right now we have been extremely successful in that plan. We are at 33% of the share repurchases. We still [have] 3 years left to go on that plan,” Nick Deluliis, CEO and president of CNX, said during their Jan. 25 earnings call.

The company has continued its repurchase initiative so far into 2024, acquiring an additional 800,000 shares through Jan. 11 at an average price of $20.41 for a total cost of $16 million. Since the third quarter of 2020, CNX has repurchased around 33% of its shares outstanding, demonstrating a commitment to creating long-term per-share value.

Despite exiting the Adams Fork ammonia project due to tax credit concerns and an inability to reach commercial terms with developers, growth from the New Technologies Group is expected to continue. Previously, CNX was in the “prototype and testing phase” for a lot of its new ideas, but 2024 is the “year we start to see that those opportunities start to take commercial scale,” Ravi Srivastava, president of New Technologies Group, said during the call.

“This alternate fuel opportunity, where hydrogen projects, or getting into CNG LNG market opportunities, creates opportunity for New Tech to grow its cash flows. And again, I think it dovetails with the technology of an IP opportunity that we have that creates CNG and LNG opportunities for us,” Srivastava continued. “We are pretty excited about what we have in our portfolio, and those three different buckets [of environmental opportunities, technology and alternative fuels] combined is what’s going to drive new tech cash flows in the coming years.”

Furthermore in 2024, CNX anticipates production volumes between 570 Bcf to 590 Bcf, which is in line with its annual guidance of approximately 580 Bcf.

The successful drilling of two CPA Utica Shale wells positions the company for additional production in 2024. The execution of the 2023 capital program enables CNX to drive capital lower while maintaining production volumes at approximately 580 Bcf. However, CNX still expects 2024 to have a slow start for them before production volumes build up.

“Q1 will probably be the low number for our volumes and that will build throughout the year,” Alan Shepard, CFO of CNX said. “We should end the year at the highest kind of quarterly run-rate. But on average, as we talked about, we are trying to maintain kind of a flat production profile on an annual basis about 580 Bcf.”

For free cash flow in 2024, CNX expects to generate approximately $300 million. Total capex is projected to be in the range of $575 million to $625 million, covering drilling and completion capital, non-drilling and completion investments and allocations for the New Technologies Group.

Beyond 2024, CNX expects a decline in well turn-in-lines and the utilization of the frac crew, resulting in a trend of lower total capex in 2025, with expectations that 2025 capital should decline below $500 million.

Recommended Reading

Shipping Traffic Freezes Up in Port Waters After Baltimore Bridge Collapse

2024-03-26 - U.S. port of Baltimore traffic was suspended until further notice following a bridge collapse. At least 13 vessels expected to load coal were anchored near the port at the time of the incident.

Segrist: The LNG Pause and a Big, Dumb Question

2024-04-25 - In trying to understand the White House’s decision to pause LNG export permits and wondering if it’s just a red herring, one big, dumb question must be asked.

Exclusive: Chevron Balancing Low Carbon Intensity, Global Oil, Gas Needs

2024-03-28 - Colin Parfitt, president of midstream at Chevron, discusses how the company continues to grow its traditional oil and gas business while focusing on growing its new energies production, in this Hart Energy Exclusive interview.

Imperial Expects TMX to Tighten Differentials, Raise Heavy Crude Prices

2024-02-06 - Imperial Oil expects the completion of the Trans Mountain Pipeline expansion to tighten WCS and WTI light and heavy oil differentials and boost its access to more lucrative markets in 2024.

Carlson: $17B Chesapeake, Southwestern Merger Leaves Midstream Hanging

2024-02-09 - East Daley Analytics expects the $17 billion Chesapeake and Southwestern merger to shift the risk and reward outlook for several midstream services providers.