In this photo, pipelines can be seen running in the direction of the setting sun. TC Energy Corp. is selling a 40% interest in its Columbia Gas Transmission and Columbia Gulf Transmission pipelines in a deal with Global Infrastructure Partners (GIP). (Source: Shutterstock.com)

TC Energy Corp. is selling a 40% interest in its Columbia Gas Transmission and Columbia Gulf Transmission pipelines in a deal with Global Infrastructure Partners (GIP).

TC Energy is divesting a 40% stake in the pipeline systems for $3.9 billion (CA$5.2 billion) in cash, the company announced in a July 24 news release.

The Columbia Gas and Columbia Gulf pipeline systems will be organized in a joint venture partnership between Calgary-based TC Energy and private equity firm GIP. The two companies will jointly invest growth capital to enhance the systems’ capacity and reliability, in addition to annual maintenance and modernization investments.

TC Energy will continue to operate the pipelines after closing, which is expected to occur in the fourth quarter.

GIP is expected to fund gross capital expenditures of around $1 billion annually over the next three years to cover its 40% stake in the gas pipelines.

The Columbia Gas and Columbia Gulf pipelines, which TC Energy acquired in 2016 in a roughly $13 billion deal, collectively span more than 15,000 miles.

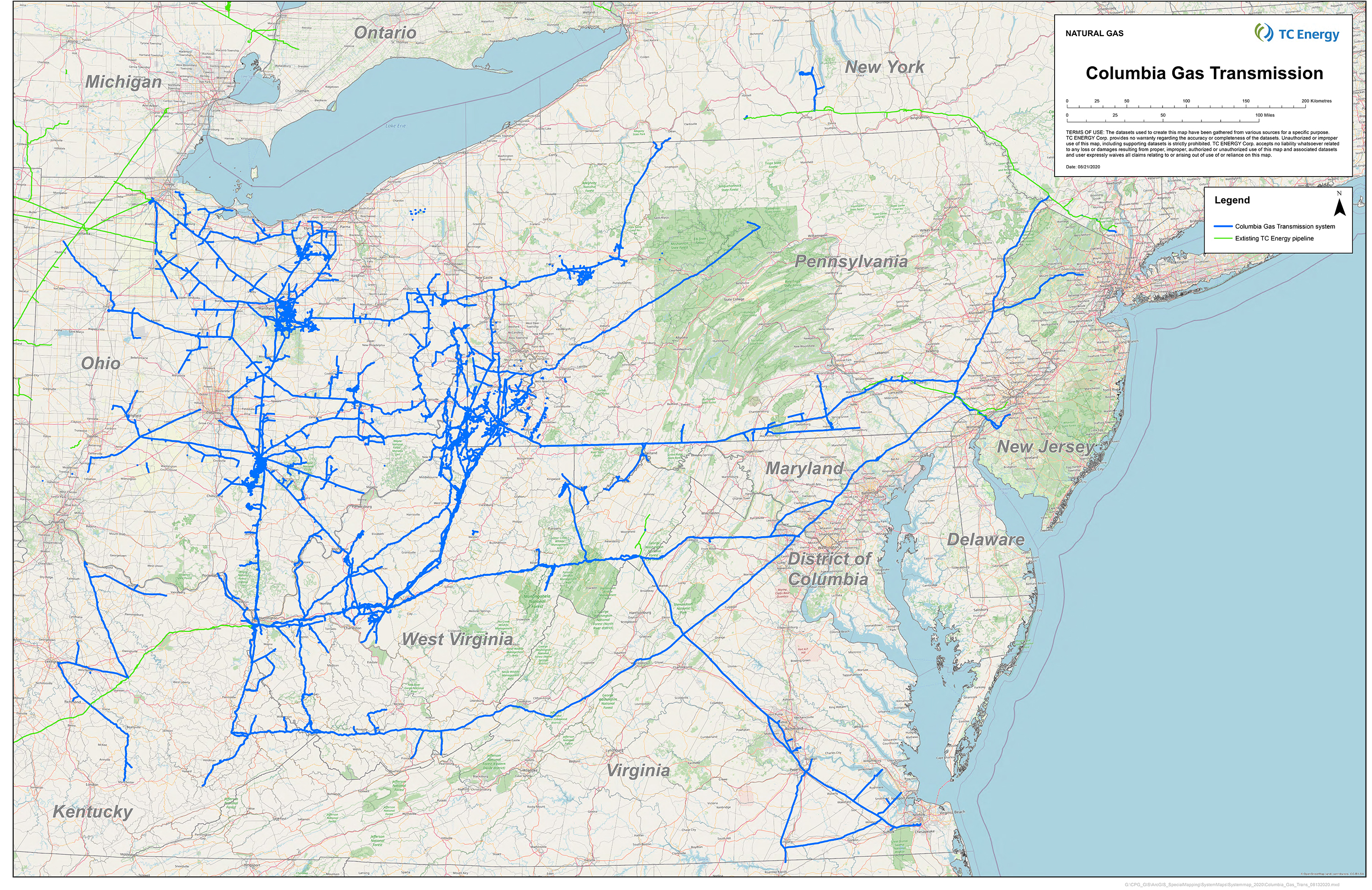

The nearly 12,000-mile Columbia Gas Transmission system reaches from New York state into major markets in the Midwest and Southeast. The roughly 3,300-mile Columbia Gulf Pipeline serves natural gas demand in Louisiana, Mississippi, Tennessee and Kentucky.

RELATED: Moving On: TransCanada Buys Columbia Pipeline In $13 Billion Merger

The Columbia assets also supply nearly 20% of the nation’s LNG export capacity, according to TC Energy.

Last November, TC Energy said it aimed to sell more than CA$5 billion in assets or minority positions in the company’s 2023 divestiture program.

“To date, we have advanced our deleveraging goals by delivering on our $5+ billion asset divestiture program ahead of our year-end target, while maximizing the value of our assets and safely executing major projects, such as Coastal GasLink and Southeast Gateway,” TC Energy President and CEO François Poirier said.

“As part of our ongoing capital rotation program, we continue to evaluate opportunities to further our deleveraging objectives and optimally fund our secured capital program,” he said.

Analysts at Fitch Ratings viewed the agreement as neutral to TC Energy’s credit quality and expect proceeds from the divestiture will facilitate debt reduction this year, according to a July 24 report.

RELATED: TC Energy Sees Higher Costs for Coastal Gaslink Pipeline in 2023

Recommended Reading

Energy Transition in Motion (Week of April 12, 2024)

2024-04-12 - Here is a look at some of this week’s renewable energy news, including a renewable energy milestone for the U.S.

Energy Transition in Motion (Week of March 8, 2024)

2024-03-08 - Here is a look at some of this week’s renewable energy news, including a record-setting 2023 for U.S. solar.

Energy Transition in Motion (Week of March 1, 2024)

2024-03-01 - Here is a look at some of this week’s renewable energy news, including Chevron’s plans for a solar-to-hydrogen facility in California.

Energy Transition in Motion (Week of Feb. 9, 2024)

2024-02-09 - Here is a look at some of this week’s renewable energy news, including the latest on a direct lithium extraction technology test involving one of the world’s biggest lithium producers and the company behind the technology.

Energy Transition in Motion (Week of Feb. 16, 2024)

2024-02-16 - Here is a look at some of this week’s renewable energy news, including the outlook for solar and battery storage in the U.S.