Roughly two years ago, Gulf of Mexico producer Talos Energy took a strategic leap of faith and started picking up acreage both onshore and off with the mindset of injecting—not extracting—carbon.

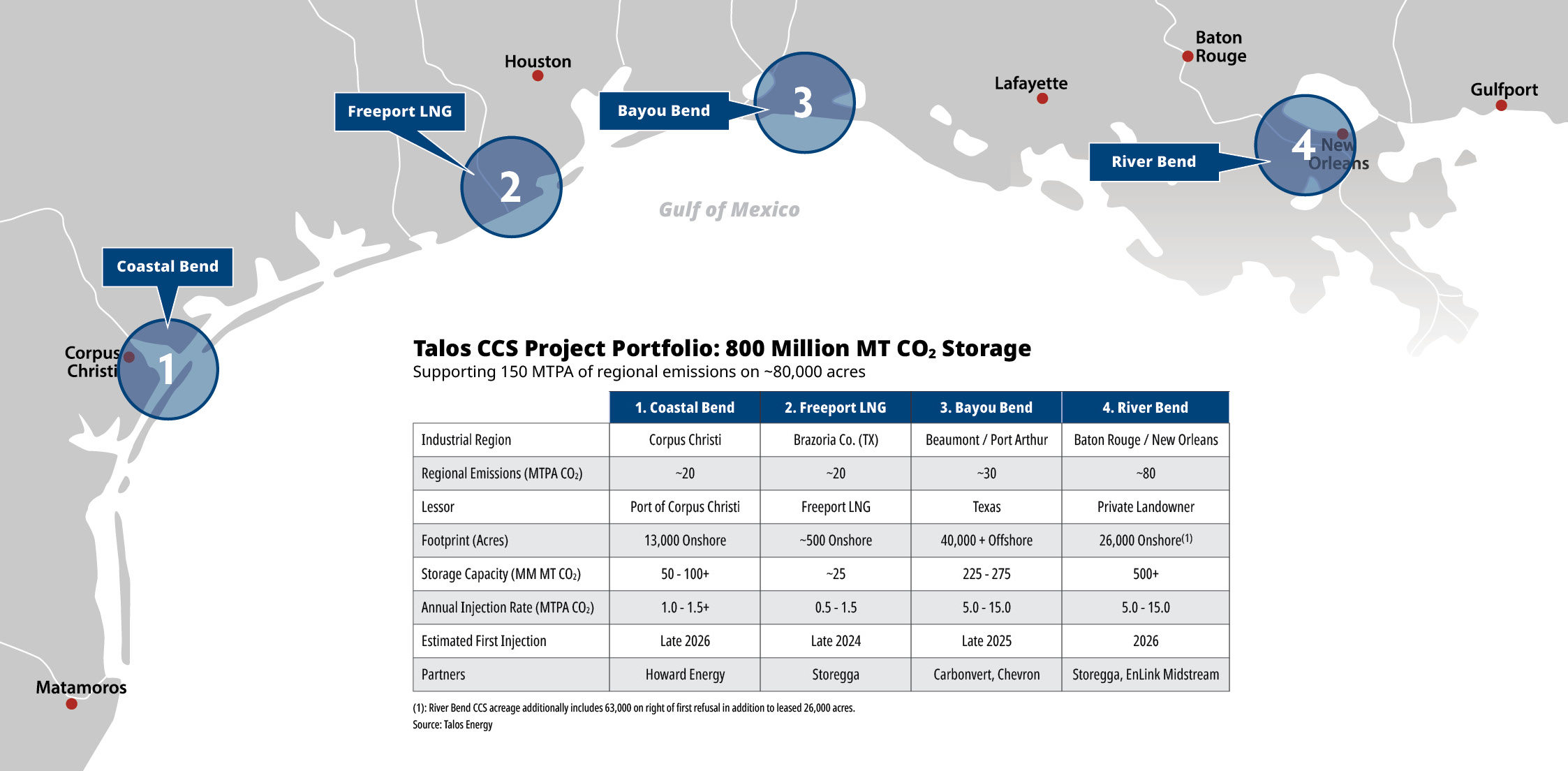

And, thus, were born a slew of developing carbon capture and storage (CCS) projects: the flagship Bayou Bend CCS offshore of Port Arthur, Texas; River Bend CCS in Louisiana; Coastal Bend CCS near Corpus Christi, Texas; and a point-source project with Freeport LNG in Texas.

As potential pioneers in offshore CCS with Bayou Bend, Talos and partner Carbonvert found themselves in the enviable position of being approached by Chevron to join the team, said Robin Fielder, Talos’ executive vice president for its low carbon strategy and the chief sustainability officer.

Chevron Corp. came onboard last year as a 50% project owner and, in March, the expanded team added to Bayou Bend’s 40,000 offshore acres with 100,000 onshore acres between Houston and Port Arthur.

Fielder sat down with Hart Energy for an exclusive interview on CCS topics:

Jordan Blum: I don’t think there’s been a whole lot of public focus on the extra acreage on the east side of the Houston Ship Channel. Most of the emphasis is on offshore and the Chevron partnership.

Robin Fielder: Yeah. It was the expansion of Bayou Bend, but with it they became operators. So we had two operators.

JB: I was interested in—separate from the Chevron component—delving into the expansion itself. Could I get you to elaborate on just how important, how big a deal it is with the proximity to the ship channel and everything?

RF: It’s a great expansion. It unlocked a whole second industrial region for us. So now, we’re in that onshore acreage that crosses Chambers and Jefferson counties. It’s right there on the eastern side where you’ve got Beaumont, Mont Belvieu. So, a lot of power, a lot of fractionation and a lot of industrials. And a large storage site is needed to address that market. We could have taken it to offshore, but it would’ve been on much farther transport and and higher costs. So, it would’ve been harder to be competitive there. So, now that we’ve got the onshore, we can address both markets. But, also, we see at some point we can connect both stores up via pipe and have that flexibility if we need to swing volumes, for instance. We have some built-in redundancy because our customer base really wants to see that.

JB: Was there any legacy ownership of the onshore acreage before the Chevron deal?

RF: It came in through our joint venture, so our joint venture decided to go and purchase that. Chevron was the lead on a lot of that, but we, as Talos, were working with them on that as well.

JB: Would you kind of take me though the next steps from here? Bayou Bend is the biggest project, obviously, but you’re moving multiple levers at the same time. So, take me through how you see the timeline from here. I know nothing is set in stone.

RF: Each project has its own project manager, subsurface team. So, you’ve got a lot of parallel processes in each project. So, you’re working through emitter agreements, commercial negotiations. We’re talking with the insurance market and what that can look like. We’re talking with the EPCs (engineering, procurement and construction)—sometimes it’s ourselves—on doing the actual pre-FEED or FEED studies to get the more detailed cost estimates and full designs where you’ve got all the P&IDs (piping and instrumentation diagrams) and everything mapped out for what the location modifications need to be, where the pipe is going to go in the ground, where the right-of-way would be. So, it’s really getting all that detailed process engineering and process work done while we’re building a stakeholder engagement plan and engaging. So, you’ve got all these parallel pieces and then, oh yes, there’s the funding piece. So, we’re keeping the door open for each of these projects to have project-level funding or financing if you’ve got the contracts that are long term and underwritten by investment grade counterparties. That’s exactly what sets itself up for project-type lending.

So, we kind of keep that end in mind as we’re negotiating these agreements to make sure that that’s an option. The stakeholder piece is important. It’s sort of early and often. One of the nice things, for instance, in partnering with the Port of Corpus Christi is they are a huge stakeholder for that region. They were able to introduce us to all of the local mayors and commissioners, and start making those introductions before we even announced we were thinking about a project last year. So it was good just to have the early dialogue so no one gets surprised by a press release that we’re going to go explore carbon management or CCS projects. So, when we signed the lease this year, there were no surprises.

People want to just understand what it is you’re trying to do, and to let them know before they hear it in the news. Part of it’s just getting the buy-in, and it’s just the best way to do business. So, we’ve got folks that have worked in or even grew up or lived in these various regions. It’s just approaching it with that stakeholder mindset that we’re a community partner, we’re a neighbor. But it’s very important and part of the EPA process, frankly. If you’re going to seek any Department of Energy funding, they certainly want to see your thoughts around environmental justice and what does your community engagement programs look like.

JB: Will you compare and contrast the onshore versus offshore CCS and how a lot of the things are the same, but what factors are different as well?

RF: In general, when you’re drilling wells onshore, it’s a little bit cheaper when you’re thinking about the rigs. The availability is fairly good to drill a somewhat shallow onshore well, and you can lay a pipeline fairly easily in the states like Texas and Louisiana. Offshore is a little bit more expensive when you’re thinking about the rig rates. The luxury of onshore is, when you get a nice big contiguous piece of leasehold that’s not shopped up by a lot of private landowners. You’ve got a single landowner from the pore space through the minerals. So, you’ve got that luxury of working with one counterparty, building your stakeholder plan, building all of that permitting. But that’s harder to find.

For offshore, we meet with the GLO (Texas General Land Office) every six months and update them on the project. It’s one entity. And you’re farther away from potential communities where you have trucks driving in someone’s neighborhood. We’re all offshore. So, you’re kind of away from that when it comes to some of the nuisance things. So, there’s a plus and minus to both. We think we’ll need both to be successful across the U.S. portfolio. We think there’s a luxury in both. Today, the California Low Carbon Fuel Standard (emissions trading mechanism) requires an onshore solution. I think one day that could be expanded to offshore. But it comes down to cost and having a single contiguous landowner where you can put together an onshore position, but there’s usually a lot of parties involved.

JB: Are you looking anywhere beyond the Gulf Coast?

RF: We’ve also looked very briefly at a few international projects. But what’s really turned was the (U.S.) Inflation Reduction Act last year. A lot of the focus is now back on doing projects here in the States because of the incentives and the Department of Energy’s willingness to fund some of these projects or lend against it through the (DOE) Loans Programs Office. So the real excitement is here and the Gulf Coast has some of the best geology. So, it makes sense that that’s where the focus continues to lie.

The Gulf Coast has some of the best geology for storage. So, you’ve got conventional rock. It’s got really good porosity, really good permeability in these very contiguous, continuous sandstone reservoirs that are filled with water. Contrast that to shale: very low permeability and porosity, very tight formations. The (offshore) reservoirs are large. You have a lot of storage capacity, which means ability to scale these projects.

JB: I know the devil is in the details a bit. The insurance component is an obvious part. But, can you talk about why that is so critical and potentially tricky dealing with the Class VI CCS wells?

RF: Part of it is for the EPA permit. Some of it’s just … large investment-grade industrial counterparties … want some assurances that if they’re going to do a large investment, particularly on the capture side, they want to make sure they can get access to that tax credit. In order to have the credit, the IRS has a clawback period. For three years, you’ve got to ensure the CO2 is still being permanently sequestered. They’re not going to give you a credit for something that obviously didn’t work. And so, we have to show and demonstrate through our monitor, reporting and verification (MRV) plan both to the EPA and the IRS that the CO2 is still being stored in this reservoir. But then we also need to have assurances in place if something changes. And so, that’s where you can have insurance products. I’d say it’s still fairly immature as far as how those are developing with the market, but all the major insurance providers are working on various products right now.

JB: It almost seems like we’re in a little bit of the wild, wild west for carbon capture where everybody’s trying to get a piece of the funding. Talos is more advanced, so that’s different. But is there a concern about some bad actors potentially giving CCS a bad name down the line?

RF: I think early on, some folks tried to compare the CCS game to the shale revolution. There were a lot of independents and private equity, in particular, going out [and] leasing up acreage, trying to develop a project and flip it. I don’t think that’s going to be successful long-term because of the long-term liabilities to the assurances that are required here. Your customers are, in most cases, large industrials that make a product day in and day out. So, they just need to know that this waste product is being taken care of. While there are a few smaller guys trying to get started and they’ve submitted some permits, I would bet that they’re not all going to be at the same rigor that we’re expecting to put together with our partners. So, I don’t know how successful they’ll be over the long term. Will they be able to monetize some of that acreage? Perhaps somebody can bolt on some of that, but I don’t think they’re going to be making it to FID (final investment decision) unless they have the right counterparty or balance sheet partner that will be willing to take that on.

JB: You’re doing stratigraphic test wells. How important is it economically to have those multitask so the test wells can eventually become the CCS injection wells?

RF: So, you can reuse it? That is important. We drill these stratigraphic test wells that are data acquisition wells. We have that mindset where we’re trying to have them as keeper well bores where you can convert them to be either the injector wellbore of the future or a monitoring wellbore. And so, as we’re choosing our location to drill those test wells, it’s important to have that broader picture and development plan in mind. You could have kind of a throwaway well as you sometimes do in deepwater exploration, but it’s not the most economic version. So, we’d like to keep it. What that does mean though is, up front, we’re looking for some of the specialty metallurgy and anticorrosive pipe to run in some of these. That way, when we come back, it can handle the CO2 in the future.

JB: Can you kind of summarize the Talos CCS strategy?

RF: This whole energy transition subsector is about partnering and collaboration. There’s not one single company that’s best suited to do all the different pieces. So, you have to work and think across the value chain. We’re not a technology developer, so we need to work with the technology providers. We can be a liaison to those different EPCs or capture tech developers. I think that’s the key. It’s about collaborating with your stakeholders, all the government bodies. These are big infrastructure projects, so they have a lot of moving pieces and parts. And a lot of thought needs to go into all these parallel processes. So, you just have to have a lot of good collaboration. That’s why sometimes it makes sense to bring in your major partner (Chevron) and lean on some of those great

Recommended Reading

Oil and Gas Chain Reaction: E&P M&A Begets OFS Consolidation

2024-04-26 - Record-breaking E&P consolidation is rippling into oilfield services, with much more M&A on the way.

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-21 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

TechnipFMC Eyes $30B in Subsea Orders by 2025

2024-02-23 - TechnipFMC is capitalizing on an industry shift in spending to offshore projects from land projects.