(Source: Shutterstock.com)

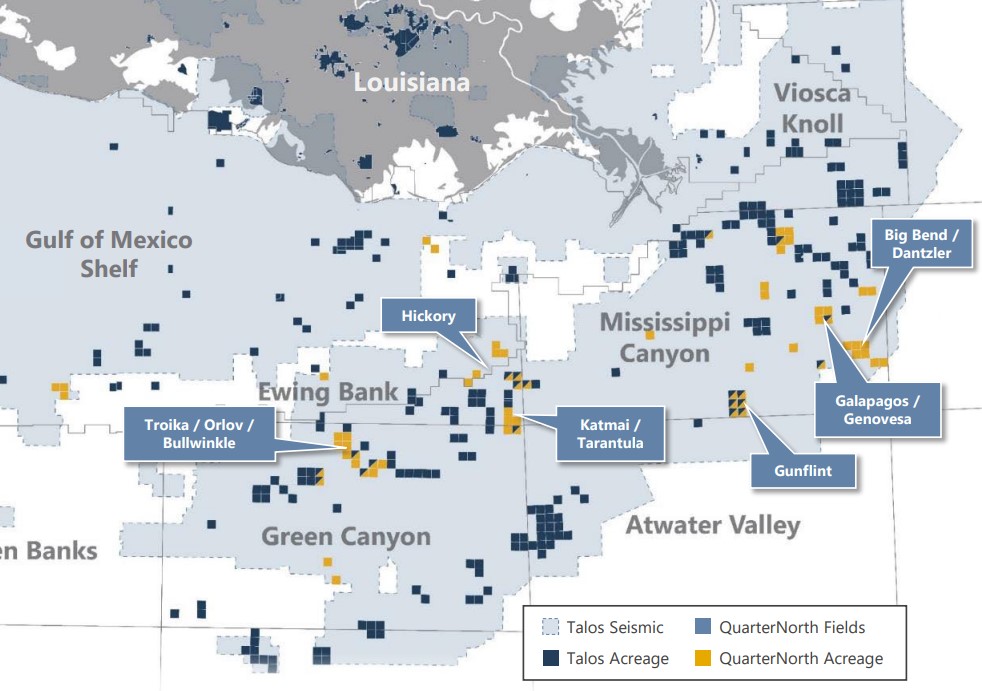

Talos Energy closed its acquisition of QuarterNorth Energy, adding scale in the Gulf of Mexico.

Talos estimates QuarterNorth’s average daily production for 2024 will come in at an average 30,000 boe/d (75% oil), including planned downtime.

QuarterNorth’s producing assets include six major fields that are approximately 95% operated and 95% in deepwater.

Talos announced the $1.29 billion cash-and-stock acquisition of QuarterNorth in January.

“We are excited to close this important transaction ahead of schedule as we focus on operational execution and acceleration of synergies from the transaction,” said Talos President and CEO Tim Duncan in a March 4 news release.

“We expect the addition of these predominantly operated, oil-weighted deepwater assets and related infrastructure will enhance our ability to consistently generate substantial free cash flow while expanding our portfolio of growth opportunities,” Duncan continued.

RELATED: Talos Energy to Acquire QuarterNorth for $1.29 Billion

Talos issued approximately 24.4 million shares of common stock to QuarterNorth shareholders as equity consideration of the transaction. The deal also included a $965 million cash payment.

After completing the acquisition, Talos has approximately 183 million shares of outstanding common stock.

QuarterNorth was the successor company to Fieldwood Energy, which emerged from bankruptcy in 2021.

RELATED: BSEE Releases Investigation Findings from Fieldwood GoM Oil Spill

Recommended Reading

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

E&P Highlights: April 8, 2024

2024-04-08 - Here’s a roundup of the latest E&P headlines, including new contract awards and a product launch.

Tech Trends: Halliburton’s Carbon Capturing Cement Solution

2024-02-20 - Halliburton’s new CorrosaLock cement solution provides chemical resistance to CO2 and minimizes the impact of cyclic loading on the cement barrier.

Rystad: More Deepwater Wells to be Drilled in 2024

2024-02-29 - Upstream majors dive into deeper and frontier waters while exploration budgets for 2024 remain flat.