Tall Oak is an Oklahoma City-based midstream service provider in the Midcontinent region founded in early 2014. (Source: Shutterstock.com; Tall Oak Midstream LLC)

Tailwater Capital LLC agreed on Jan. 27 to acquire Tall Oak Midstream II and III from EnCap Flatrock Midstream for an undisclosed amount.

Tall Oak is a midstream service provider in the Midcontinent region founded in early 2014 by an Oklahoma City-based team comprised of CEO Ryan D. Lewellyn, CFO Max J. Myers, CCO Carlos P. Evans and COO Lindel R. Larison.

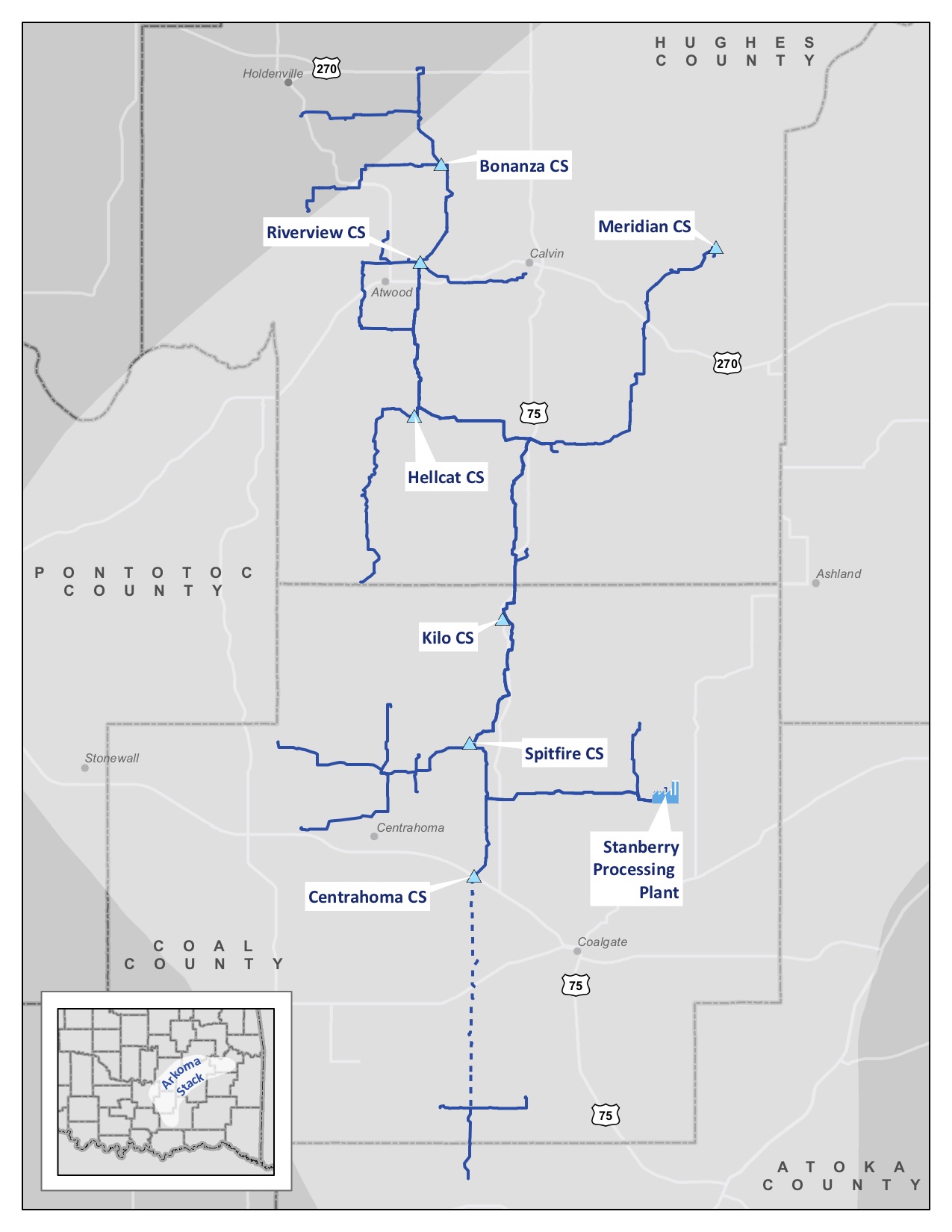

In a joint release, Tailwater said it will acquire the Tall Oak III portfolio in the Arkoma Basin and, in a separate transaction, a majority of assets of Tall Oak II, also located within the Midcontinent in Oklahoma. Financial terms for either transaction were not disclosed.

As part of its acquisition of Tall Oak III, Tailwater said it will merge the company’s assets with Tailwater’s existing portfolio company in the same region, Connect Midstream, with the Tall Oak team assuming operatorship.

Connect Midstream operates across three Oklahoma counties in the Arkoma STACK basin’s rich gas window. Since its formation in 2017, Tailwater said Connect Midstream has grown its footprint substantially, secured a number of dedications from leading players in the region and completed construction and commenced processing operations at a processing facility in Oklahoma’s Coal County.

“These transactions are the next logical step in both Tailwater and Connect Midstream’s long-term Arkoma STACK consolidation and growth strategy and will significantly expand our footprint and processing capacity in the liquids-rich Arkoma Basin,” Jason Downie, co-founder and managing partner of Dallas-based Tailwater Capital, said in a statement on Jan. 27.

Brandon Webster, president and CEO of Connect Midstream, also commented: “It has been a privilege to partner with the Tailwater team over the past few years. One of our driving principles has been centered on nimble, strategic decision making and this transaction is no exception.”

“We are proud of the system we have built at Connect Midstream and believe the Tall Oak team is perfectly situated to drive its continued growth,” Webster added.

Tall Oak III, formed in 2017 with an initial equity commitment of up to $200 million from EnCap Flatrock, currently operates more than 120 miles of low-pressure and high-pressure pipelines in the Arkoma Basin. The company also recently developed the Panther Creek Plant that moves processed gas to MarkWest Energy Partners LP’s Arkoma Connector.

Lewellyn, who also serves as president of Tall Oak, said the agreement with Tailwater Capital and Connect Midstream position the Tall Oak companies for increased market leadership and sustainable, long-term success.

“These transactions will provide our business with tremendously improved system capacity infrastructure and an increasingly diverse customer base, positioning us to compete with larger peers in the region and to capitalize on a number of exciting opportunities alongside our new partners at Tailwater,” Lewellyn said in a statement on Jan. 27.

Tailwater said its acquisition of Tall Oak II did not include its assets in Oklahoma’s Custer County, which EnCap Flatrock Midstream will retain ownership of in a new entity that will also be managed by the Tall Oak management team.

Founded in 2015 with an initial equity commitment of up to $300 million from EnCap Flatrock, Tall Oak II was established to pursue greenfield and acquisition opportunities in oil and gas plays across North America. Tall Oak II’s portfolio currently consists of over 750 miles of low and high-pressure gathering lines across eight Oklahoma counties in the STACK extension.

Tudor, Pickering, Holt & Co. served as exclusive financial adviser and Thompson & Knight LLP provided legal counsel to Tailwater Capital and Connect Midstream in connection with negotiation and documentation of the transactions. Winston & Strawn LLP served as legal counsel to Tall Oak Midstream and Shearman & Sterling LLP represented EnCap Flatrock Midstream.

Recommended Reading

Rystad: More Deepwater Wells to be Drilled in 2024

2024-02-29 - Upstream majors dive into deeper and frontier waters while exploration budgets for 2024 remain flat.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

After 4Q Struggles, Transocean’s Upcycle Prediction Looks to Pay Off

2024-02-21 - As Transocean executives predicted during third-quarter earnings, the company is in the middle of an upcycle, with day rates and revenues reaching new heights.

E&P Highlights: April 8, 2024

2024-04-08 - Here’s a roundup of the latest E&P headlines, including new contract awards and a product launch.