Stratas Advisors predicts growth for North American shale plays including expectations for ‘bigger and badder’ wells becoming the norm this year. (Source: Hart Energy and Shutterstock.com)

This excerpt is from Stratas Advisors’ North American Shale Service. Subscribers have access to the full report.

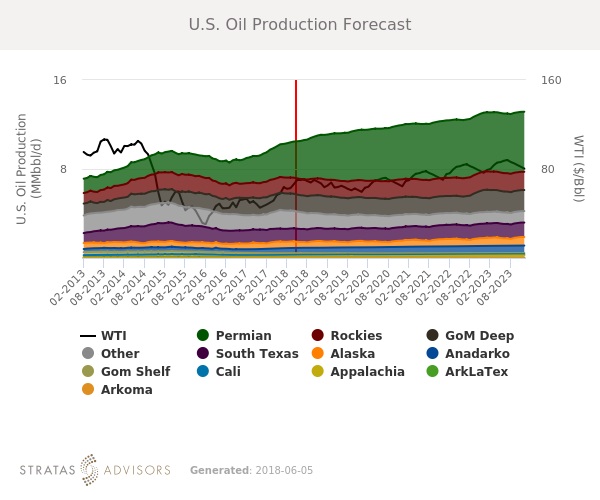

With the Permian leading the way, Stratas Advisors expects U.S. oil production to rise to 10.2 million bbl/d in 2018, a 10% increase over 2017. Key drivers supporting the expected increase include relatively high crude prices and robust activity, which is partially offset by rising costs.

Crude prices in 2018 are expected to average $67.40 per barrel, with West Texas Intermediate (WTI) up $16.48 per barrel (32%) from 2017 levels. These prices should support robust and resilient activity in all prospective resource areas.

The Permian will capture substantial capital inflows ($40 billion+, based on Stratas estimates), leading to Permian production of 3.47 million bbl/d, an increase of 900,000 bbl/d vs. 2017. Elsewhere, Stratas expects rising activity in the Powder River and Anadarko basins and resiliency in the Eagle Ford and Bakken. In the Niobrara and Scoop/Stack, Stratas expects production increases of about 100,000 bbl/d each, respectively.

Lower-48 Capex To Top $105 Billion In 2018

Stratas Advisors forecasts capital spending for the Lower-48 onshore production at $105 billion, an increase of $25 billion (32%) overestimated 2017 spending levels. On a basin level, Stratas estimates Permian spending will top $40 billion in 2018, compared to an estimated $31 billion in 2017. Key drivers behind the increase include higher average rig counts (up 22%), longer laterals and more costly completion designs.

In the Anadarko, Stratas expects spending to rise by 11% to $10.6 billion. Increases in the Anadarko are primarily related to the Scoop/Stack ($7.9 billion). In the Rockies, Statas expects rising activity in the Niobrara, both in the Wattenberg and Powder River, along with some other oily targets in the Powder River. In Appalachia, low gas prices will continue to challenge 2018 spending.

Well Costs Rising, With Bigger And Badder Wells Being The New Norm

In recent years, operators and their contractors have made great strides at driving down costs in drilling and completing wells. Two factors appear to be pushing costs higher this year. First, operators are increasingly opting for longer-lateral length wells. The longer laterals and more dense completion designs are key factors in rising costs. The second factor is scarcity of equipment and materials in highly competitive regions. On average, Stratas anticipates completed well costs will rise by 26% in the Lower-48 onshore this year.

The trend to bigger (longer lateral) and badder (intensely fracked) wells is expected to continue. Stratas estimates lateral lengths will increase by another 10% in 2018. Stratas calculated this average using our estimated well counts by play to weight changed in lateral length by play. Proppant intensity is a good proxy for the level of intensity on the completion. Stratas estimates proppant intensity to increase 10% in 2018.

Recommended Reading

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.