Free markets correct themselves, usually too quickly for an amateur to participate and, thankfully, too fast for government to interfere. Even when slow about it, markets do always right themselves eventually. So why, at press time, did Energy Partners Ltd.’s stock price continue to hold the elevated stature a late-August bid from Woodside Petroleum Ltd. gave it, although EPL has rejected the Woodside bid? Also unusual: Stone Energy Corp.’s stock price has remained in the tank. For those not following the story, Stone’s share price shouldn’t seem to have much to do with that of the others. Add this to the mix: Plains Exploration & Production Co. Fashionable today is the faux-mance (a brief fling the media or one party mistakes for a romance) and the bro-mance (pronounced with a long “o†and used, for example, to describe the friendship of Lance Armstrong and Matthew McConaughey). Recent dalliances with Stone are looking increasingly like a faux-mance very much involving some bro-mances. And, the continued lack of resolution could mortally crush Stone’s wounded momentum as an ongoing concern. Some background: Wall Street darling Stone Energy, which posted consecutive performance improvements for most of its years, ran into production-decline and reserve-writedown issues last year that were exacerbated by hurricane damage to cash flow. For more on this, see the October issue of Oil and Gas Investor. For a subscription, call 713-260-6441.

Recommended Reading

Hirs: LNG Plan is a Global Fail

2024-03-13 - Only by expanding U.S. LNG output can we provide the certainty that customers require to build new gas power plants, says Ed Hirs.

CERAWeek: Energy Secretary Defends LNG Pause Amid Industry Outcry

2024-03-18 - U.S. Energy Secretary Jennifer Granholm said she expects the review of LNG exports to be in the “rearview mirror” by next year.

Exclusive: The Politics, Realities and Benefits of Natural Gas

2024-04-19 - Replacing just 5% of coal-fired power plants with U.S. LNG — even at average methane and greenhouse-gas emissions intensity — could reduce energy sector emissions by 30% globally, says Chris Treanor, PAGE Coalition executive director.

Belcher: Our Leaders Should Embrace, Not Vilify, Certified Natural Gas

2024-03-18 - Recognition gained through gas certification verified by third-party auditors has led natural gas producers and midstream companies to voluntarily comply and often exceed compliance with regulatory requirements, including the EPA methane rule.

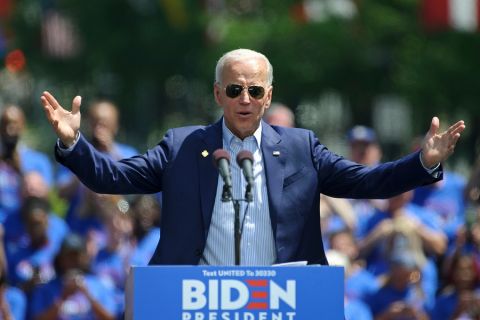

Pitts: Producers Ponder Ramifications of Biden’s LNG Strategy

2024-03-13 - While existing offtake agreements have been spared by the Biden administration's LNG permitting pause, the ramifications fall on supplying the Asian market post-2030, many analysts argue.