My children are competitive squash players. We travel around the country playing tournaments against the same 50 or so kids in each age group in this country wild enough to do the same. Each match (and even each game within a match) gets heavy scrutiny in our household. At times it seems like nothing is working in a game or one of them loses to a player they beat easily just a few weeks prior. Post-match debrief sessions devolve into hand wringing over regression despite weeks of practice and expensive lessons.

At those times, at least one parent has the responsibility to pull the lens out to a wider focus on progress that’s been made over a longer time horizon. Progress is not always linear, especially when the other players are trying just as hard to improve. It’s easy to get bogged down in day-to-day struggles, the short term, and extrapolate that into the future.

Similarly, in the stock market, intense focus on the scoreboard rarely extends beyond a single day or week, much less the multi-year horizon many investors purport to use when underwriting stock investments.

The good news for midstream stocks and MLPs is they are performing well over both short and long terms, essentially since the pandemic bottom. Midstream has not kept pace with the S&P 500 and its tech-fueled expansion, but midstream has outperformed energy stocks and income-oriented stocks like utilities, infrastructure stocks and REITs.

Following this analogy a bit further (if you’ll indulge me): there is a major difference between being a top 15 junior squash player in a given age division and being a top five junior squash player. The same could be said for many sports, of course. Through daily practice, one to two instructional lessons per week and some athletic ability, most 11-year-olds can go from starting at a ranking around 200 in the country down to 20 before they turn 13. Progress after that is slow, and you may start to bump up against a physical ceiling that comes down to genetics (or you just may lose interest).

In the same way, through reasonable dividend policy, focused leverage reduction and decently positioned assets, most every midstream company was able to post great stock price performance since the pandemic. But from here, the stock price performance will rely on being not only good, but better than other stocks starting at a higher baseline trying to do the same thing. Progress also could be limited by the quality or geography of the company’s assets.

What does my next level look like?

In recent squash history, the most successful and respected college and pro squash coach is a kindly older British man named Mike Way. He is the head coach of Harvard and is the primary coach of the top-ranked squash professional Ali Farag. He tends to focus on the mental side of the game.

Part of Mike Way’s philosophy centers around how players can visualize improvements in their game over time. He has players ask themselves, “What does my next level look like?” There’s always room for improvement: players will reach a level and plateau for a bit, and asking this question is designed to help players shorten that plateau period before they improve further, reach a new level.

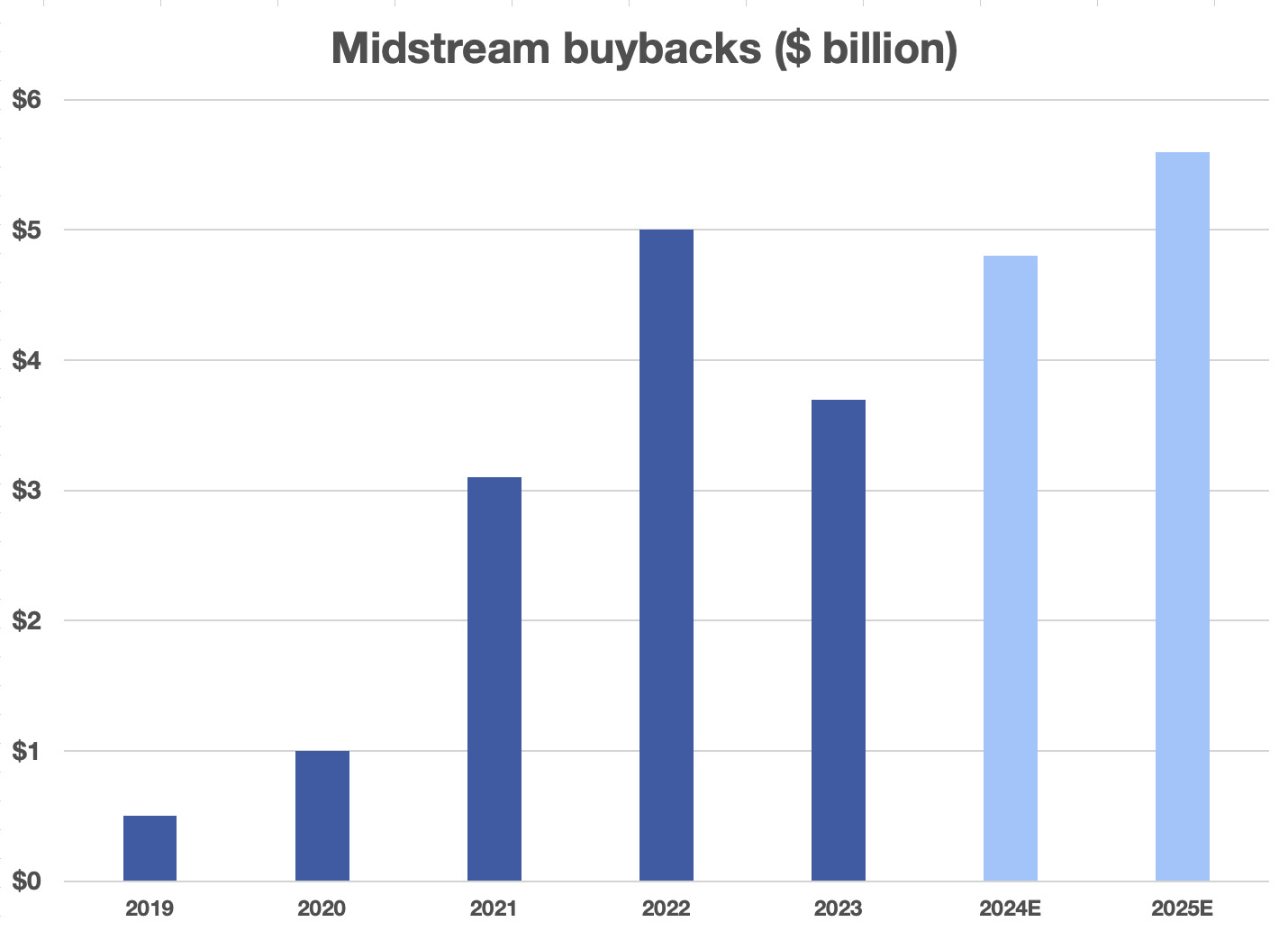

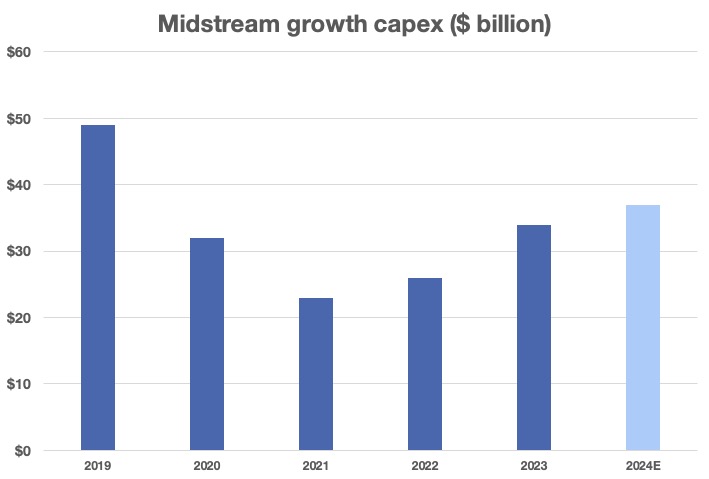

Last year, a big overarching theme was a slowing of new investment opportunities for midstream companies. The general activity deceleration manifested in two main ways: (1) M&A, both asset acquisitions and mergers; and (2) return of capital through higher dividends and buybacks.

In this new environment where fewer large producers exist, visibility into future bottlenecks and investment opportunities has never been higher. Savvy midstream management teams have keyed on the clarity and a new trend is emerging across the sector: multi-year guidance.

Medium term growth rates: I can see clearly now

Midstream companies recently have begun extending their forward guidance beyond just the current year. Multi-year guidance for EBITDA and capex and medium term growth rates are becoming more commonplace these days. Three midstream companies initiated three-year guidance for the first time: Enterprise Products Partners (EPD), Targa Resources and DT Midstream. EPD only provided capital expenditure guidance, but that’s more than we’ve had before.

One company that already had multi-year guidance is Enbridge, which recently held its analyst day and updated that guidance. Enbridge (ENB) expects three-year growth CAGR for 2024-2026 of 7%-9% for EBITDA, up from 4%-6% for its 2023-2025 prior guidance. ENB management attributed the uptick to the impact of utility acquisitions, various base business improvements and growth in its growth project backlogs.

The reasons midstream companies are now offering this extended view on the future include:

- More restrained activity from a more consolidated group of producers.

- Lower growth outlook in 2024 for most companies relative to 2025 when a known catalyst or project completion will drive better growth. Better to convince the market to look past 2024 as a transition year.

- Asset risk profile has improved with less exposure to commodity prices, and in some cases more regulated assets than before, e.g., ENB adding gas utilities.

- Better balance sheets, higher margin of safety related to dividend payments.

- Desire to compare to utilities that tend to provide guidance of three to five years for EPS growth.

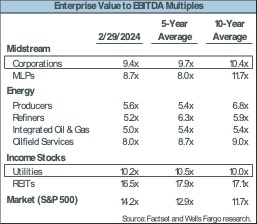

Midstream’s next level could be trading at a more utility-like EBITDA multiple if the sector can provide and execute on multi-year growth guidance. While midstream has performed well, there is still a valuation gap between midstream and utilities. If midstream can’t change perception all the way to utility levels of visibility, this multi-year outlook trend should help keep midstream valuations above other energy stocks.

Form breakdown

One final squash analogy to wrap up. Bad habits can be hard to break. Once a bad swing gets ingrained, it can be hard to change. Even when it does change, a player can revert to poor technique when under pressure or fatigued late in a match.

Above, I mentioned the slowing pace of new investment opportunities for midstream companies, but in 2023 growth capex was up 25% over 2022. That uptick in spending reflected to some degree the execution of capital projects announced in years prior. So, growth capital spending was up, but the growth “pipeline” got smaller as those projects were placed into service.

Early indications from initial 2024 guidance announcements point to a small uptick in growth capital spending in 2024 over 2023. There is a lag effect in midstream spending, but if capex continues to creep, midstream stocks will come under some pressure. The market will accept some level of growth spending, but in the face of slowing activity across onshore basins, more growth spending announcements from here would be met with skepticism. Eliminating bad habits like overspending has been a painful lesson that some midstream companies have learned better than others.

Recommended Reading

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.

New Fortress Energy Sells Two Power Plants to Puerto Rico

2024-03-18 - New Fortress Energy sold two power plants to the Puerto Rico Electric Power Authority to provide cleaner and lower cost energy to the island.

SilverBow Rejects Kimmeridge’s Latest Offer, ‘Sets the Record Straight’

2024-03-28 - In a letter to SilverBow shareholders, the E&P said Kimmeridge’s offer “substantially undervalues SilverBow” and that Kimmeridge’s own South Texas gas asset values are “overstated.”

Enerplus Increases Quarterly Cash Dividend

2024-02-23 - Enerplus Corp. increased its dividend 8% to US$0.065 (CA$0.088) per share.