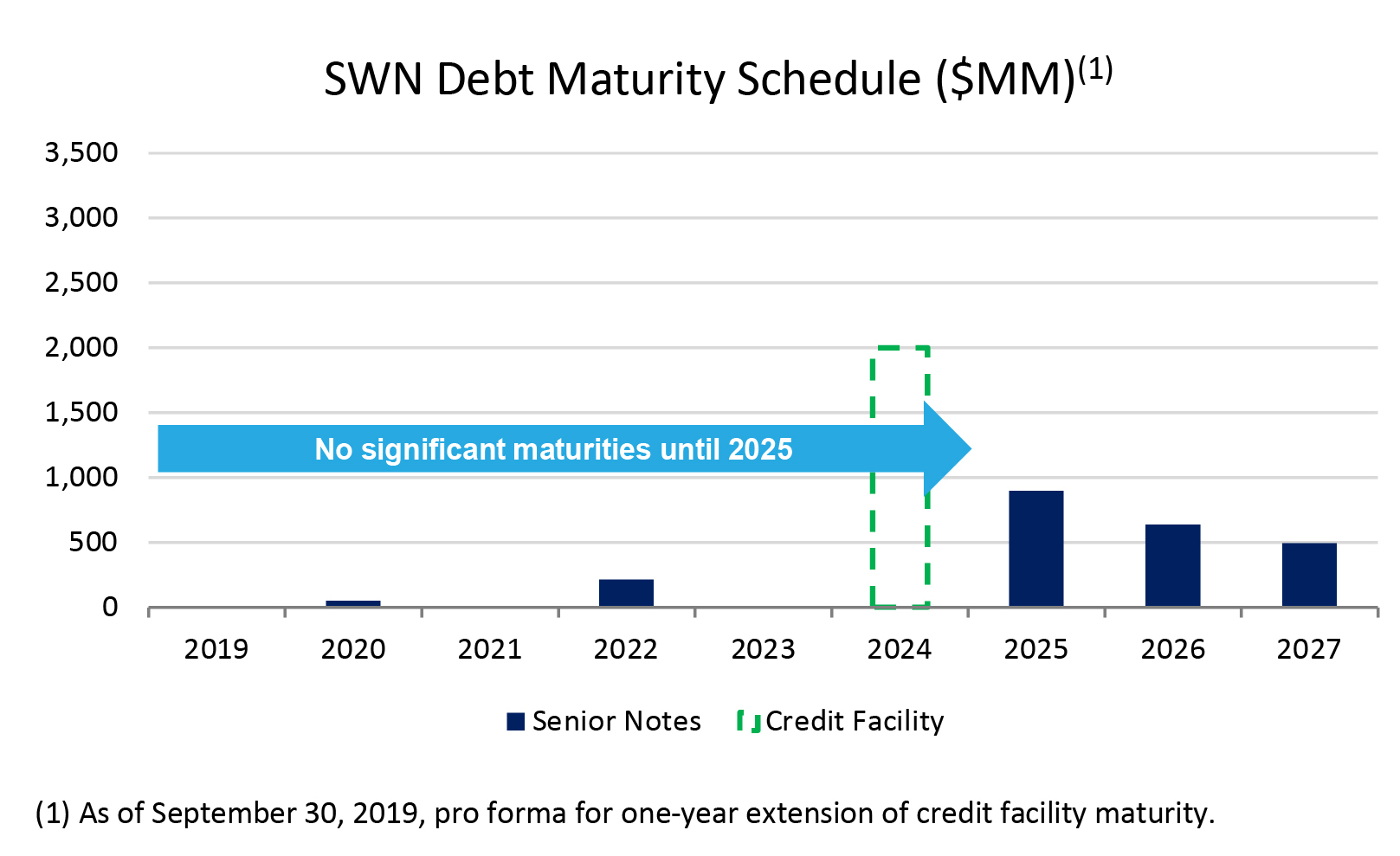

This fall’s redetermination gives Southwestern Energy a five-year window with no significant maturities. (Source: Hart Energy/Shutterstock.com)

Southwestern Energy Co. on Oct. 9 provided an update on several recent financial developments that analysts say brighten the Appalachia shale producer’s balance sheet outlook despite the current gas price environment.

Following this fall’s redetermination, Southwestern said its credit facility maturity date had been pushed out by one year to April 2024. Meanwhile, the committed borrowing base level remained unchanged at $2 billion and undrawn at the close of the third quarter. This gives Southwestern a five-year window with no significant maturities until 2025, according to the company release.

The company also said it executed a $50 million share buyback and reported that S&P reaffirmed its BB credit rating with a stable outlook.

The update follows ongoing efforts by shale producers to increase cash flow and investor returns by improving their capital efficiency. Driving these efforts has been negative market sentiment as investors continue to put the oil and gas industry under extreme pressure to start generating returns.

Southwestern is targeting a return to free cash flow by the end of 2020, according to an August press release. The company is principally focused on the development of natural gas and NGL in the Appalachian Basin in Pennsylvania and West Virginia.

Analysts with Capital One Securities Inc. noted that despite the “positive update” on Oct. 9, their model shows it will still take until 2022 for Southwestern to turn the corner to free cash flow generation. However, the new timetable of maturities grants the company enough to meet commitments.

“While the committed level is unchanged with the update, there is no mention in the release as to whether or not the prior ‘aggregate maximum revolving credit amount’ of $3.5 billion remains available as well,” the Capital One analysts wrote in an Oct. 10 research note. “No matter, really, as the $2 billion available easily covers the roughly $280 million of cash flow outspend that we model for [Southwestern] between now and the end of 2021 on a $2.40 [per thousand cubic foot] natural gas price deck.”

Capital One projects roughly $2.5 billion of free cash flow generation for Southwestern between 2023 and 2027, which the analysts said will substantially match the company’s current level of commitments.

According to Bill Way, president and CEO of Southwestern, financial strength is a core priority for the company.

“The company is strategically advantaged in this low price environment, given our strong balance sheet, liquidity position and debt maturity profile,” Way said in a statement on Oct. 9. “The recent actions by our bank group and S&P validate this view.”

Southwestern emerged this year as a pure-play operator in the Appalachian Basin after the divestiture of its Arkoma Basin position in 2018. Proceeds from the roughly $2.3 billion sale were used to pay down debt and fund share buybacks with the remainder earmarked for future investments.

The company was also one of several E&Ps to pull back on spending this year with the announcement in August that it planned to drop down to two rigs after averaging six in first-half 2019. Southwestern also noted spending for 2019 would not exceed $1.15 billion, which is below the high end of the company’s original capital guidance of between $1.08 billion and $1.18 billion.

“Financial resilience, coupled with a premier asset base, outstanding operational execution and lowered cost structure, sets [Southwestern] apart as a leading Appalachia producer,” Way added in his statement.

Recommended Reading

NOV Announces $1B Repurchase Program, Ups Dividend

2024-04-26 - NOV expects to increase its quarterly cash dividend on its common stock by 50% to $0.075 per share from $0.05 per share.

Repsol to Drop Marcellus Rig in June

2024-04-26 - Spain’s Repsol plans to drop its Marcellus Shale rig in June and reduce capex in the play due to the current U.S. gas price environment, CEO Josu Jon Imaz told analysts during a quarterly webcast.

US Drillers Cut Most Oil Rigs in a Week Since November

2024-04-26 - The number of oil rigs fell by five to 506 this week, while gas rigs fell by one to 105, their lowest since December 2021.

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.