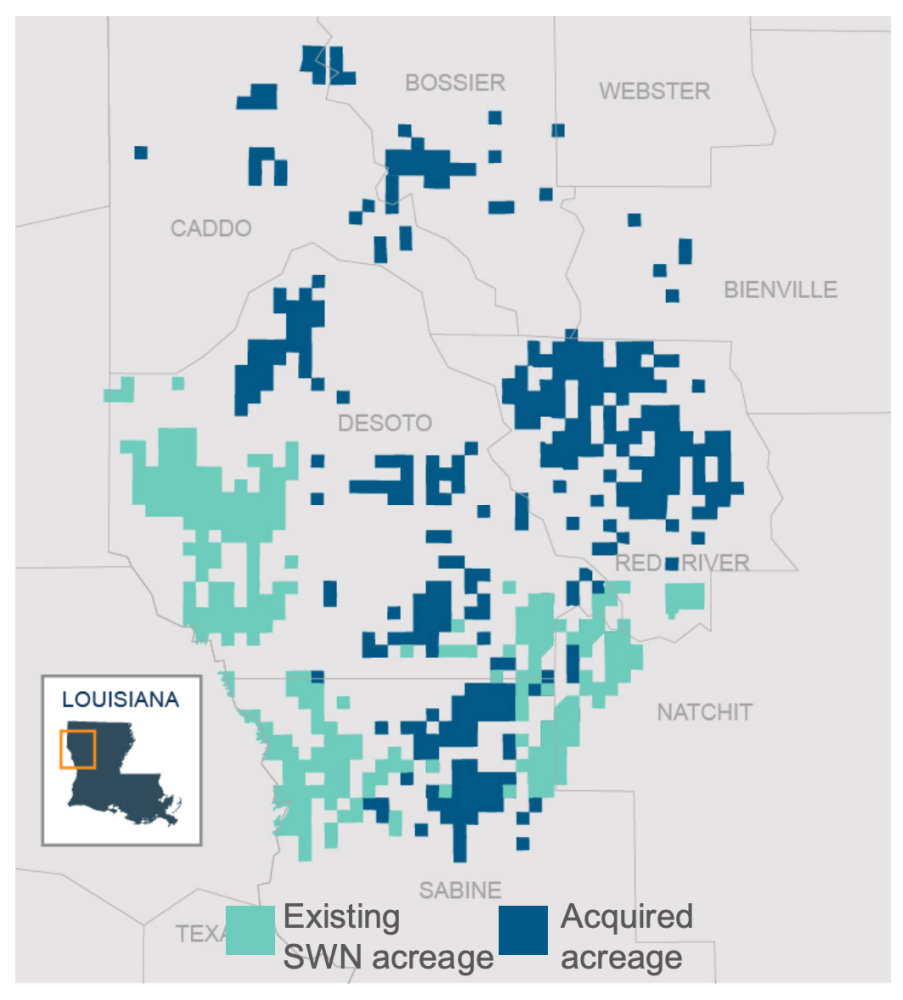

GEP adds roughly 226,000 net effective acres with estimated net resource potential of 6 Tcfe to Southwestern’s position in the Haynesville shale play. (Source: Hart Energy)

Southwestern Energy Co. snatched up another private Haynesville producer as the Spring, Texas-based company continues to grow its position in the shale gas play, further expanding exposure to the LNG corridor and growing demand centers along the U.S. Gulf Coast.

According to a company release on Nov. 4, Southwestern entered an agreement to acquire GEP Haynesville LLC in a cash-and-stock transaction valued at $1.85 billion. The third largest private Haynesville operator, GEP is a joint venture between GeoSouthern Energy—an E&P founded by billionaire oilman George Bishop—and Blackstone Inc.’s credit arm.

“This strategic move positions Southwestern as the largest producer in the Haynesville and enhances our leading presence in the top two premier natural gas basins in the U.S.,” Southwestern CEO Bill Way commented in the release.

The GEP deal follows Southwestern’s entrance into the Haynesville earlier this year with its $2.7 billion acquisition of privately held Indigo Natural Resources, which Way at the time described as a “logical move” for the formerly Appalachia pure-play.

GEP, which had acquired a bulk of its position through a 2015 acquisition from Ovintiv Inc. known as Encana at the time, adds roughly 226,000 net effective acres with estimated net resource potential of 6 Tcfe. With the addition of approximately 700 MMcf/d of production and 700 locations across stacked-pay Haynesville and Middle Bossier from GEP position, Southwestern projects total company production of approximately 4.7 Bcfe/d pro forma of the transaction.

“The company’s increased scale from both a reserves and production perspective is expected to deliver higher margins, enhanced economic returns and improved per-share cash flow metrics,” Way said.

Upon closing, Southwestern expects to realize at least $25 million in annual synergies, driven by G&A and other operational savings. Further, the company projects pro forma free cash flow of approximately $2.3 billion in 2022-23.

The total consideration of $1.85 billion will be comprised of $1.325 billion in cash and approximately $525 million in Southwestern common shares. Southwestern expects to finance the cash consideration “in a manner that affords near-term and efficient debt reduction, extends its maturity runway and lowers its cost of debt,” according to the company release.

Southwestern added that the acquisition valuation compares favorably to other recent natural gas transactions, with the $1.85 billion purchase price representing 2.9x estimated 2022 EBITDA using a $4 per Mcf Nymex Henry Hub price, which is below today’s strip prices, the company said.

“This transaction reflects the company’s strict adherence to our rigorous acquisition framework and will build on our leading execution in the integration and development of large-scale assets,” Way added. “The financing and hedging strategy for the deal aligns with our commitment to financial strength and disciplined enterprise risk management.”

The transaction was unanimously approved by each of Southwestern Energy’s and GEP Haynesville’s boards of directors and is expected to close by year-end 2021, subject to regulatory approvals and customary closing conditions.

Goldman Sachs & Co. LLC is exclusive strategic adviser to Southwestern for the transaction. JP Morgan, Bank of America, Citigroup, RBC and Wells Fargo served as financing advisers and provided $1.325 billion committed financing in connection with the transaction. Intrepid Partners LLC also provided a fairness opinion to Southwestern. Intrepid was advised by Gibson, Dunn & Crutcher LLP, led by partner Hillary Holmes.

Credit Suisse Securities (USA) LLC served exclusive strategic and financial adviser to GEP. Skadden, Arps, Slate, Meagher & Flom LLP is legal adviser to Southwestern, and Kirkland & Ellis LLP served as GEP’s legal adviser.

Recommended Reading

EIA Forecasts Larger Decline in US Natural Gas Output for 2024

2024-08-06 - U.S. natural gas output will average around 103.3 Bcf/d this year, the U.S. Energy Information Administration said in its August edition of the short-term energy outlook report.

EIA NatGas Storage Report Comes in at 10 Bcf Above Forecast

2024-08-22 - Most of the additional gas in storage came from the Appalachian Basin. The Midwest added 19 Bcf and the East added 12 Bcf, according to the EIA.

Analysts: ‘Rare’ Summer NatGas Drawdown May Occur

2024-08-15 - A natural gas storage withdrawal for the Lower 48 may be in the cards this summer, the first to occur since 2016.

Freeport LNG in Texas on Track to Take in NatGas Again After Hurricane Beryl

2024-07-15 - Since Freeport shut, U.S. gas futures have declined to a two-month low.

US NatGas Prices Rise More Than 2% on Hot-weather Forecasts

2024-07-12 - U.S. natural gas futures rose more than 2% on July 12 after touching their lowest in close to two-months earlier.