In plays such as the Marcellus Shale, as well as in association with oil production at the thousands of crude oil wells in North Dakota’s Bakken formation, contains NGL products such as ethane, propane and butane that can be stripped out and sold separately from methane, the primary constituent of natural gas.

But there are a number of problems with getting ethane, the second-largest component of natural gas, to market. One means of addressing this issue is through small-scale, gas-to-liquids (GTL) technologies, which can be used at midstream gas processing plants, as well as onsite at oilfields, to turn ethane into valuable liquid end products, such as gasoline, methanol or diluent.

We will be taking a detailed look at the economics of using small-scale GTL technologies to convert ethane into valuable end products, but first let’s address the ethane oversupply.

The ethane glut

Ethane is in demand to produce ethylene, an important feedstock in the plastics industry. But the current state of the domestic transport, storage and processing infrastructure for ethane is insufficient to handle the supply glut. While plans are in the works to build new ethane cracker plants on the Gulf Coast, as well as to build facilities to export ethane to petrochemical markets in India, East Asia and Europe, these are long-term solutions.

In the short term, the ethane supply continues to exceed demand, exerting downward pressure on prices.

Another issue is the expense of separating NGL from the gas stream. This isn’t a problem for NGL for which strong markets exist, such as propane, which can be sold into regional home heating markets, or butane, which can be delivered to refineries by truck or rail, but it is a problem for ethane, which can only be separated through an expensive deep refrigeration process. If the price of ethane drops too low, it becomes more economical to leave it in the natural gas stream to be burned for cooking, heating or electricity generation, which is known as ethane rejection.

While estimates of the amount of ethane that is being rejected vary widely, it’s clear that ethane rejection is rapidly increasing.

Flaring in the Bakken

Ethane rejection is a solution to the oversupply in regions where a natural gas pipeline infrastructure exists, such as the Marcellus. But what about in remote regions where there is limited natural gas pipeline infrastructure, such as the Bakken?

In remote regions, associated gas, including gas that is high in ethane, is typically flared. Currently, nearly one-third of North Dakota’s gas—or about 266 million cubic feet per day (MMcf/d)—is being flared, representing a value of more than $1 billion per year, or $3.6 million in lost revenue per day at market rates, according to a report by Ceres, a non-profit organization that is an advocate for sustainability. In 2012, natural gas flaring in North Dakota emitted 4.5 million metric tons of CO2, the equivalent of the annual emissions of about 1 million cars.

Because of the environmental threat posed by CO2, North Dakota has imposed tough restrictions on flaring, with penalties including restrictions on oil production. The need to comply with anti-flaring regulations, along with the waste of valuable fossil fuel resources, has prompted oil companies to find ways to monetize fl are gas, including by developing markets for ethane. While plans are underway to build ethane-specific pipelines and regional ethane cracker plants, the establishment of a substantial ethane infrastructure is years away.

Even in regions where ethane rejection is an option, however, it isn’t always feasible because pipeline operators impose strict limits on the amount of ethane that can be rejected. Because ethane has a higher heat content than methane, too much ethane in the natural gas stream can cause it to liquefy, which leads to pipeline transportation problems. Also, a high ethane content necessitates changes to burners in the homes and businesses that use natural gas for fuel, which isn’t practical. Finally, the “hotter” gas can ignite when it comes in contact with oxygen.

Faced with the dilemmas of being unable to a) separate ethane from the natural gas stream because of the expense or b) reject it into the natural gas stream because of pipeline restrictions or c) get it to market because of lack of ethane takeaway capacity, some producers have been forced to shut-in wells.

Monetizing ethane

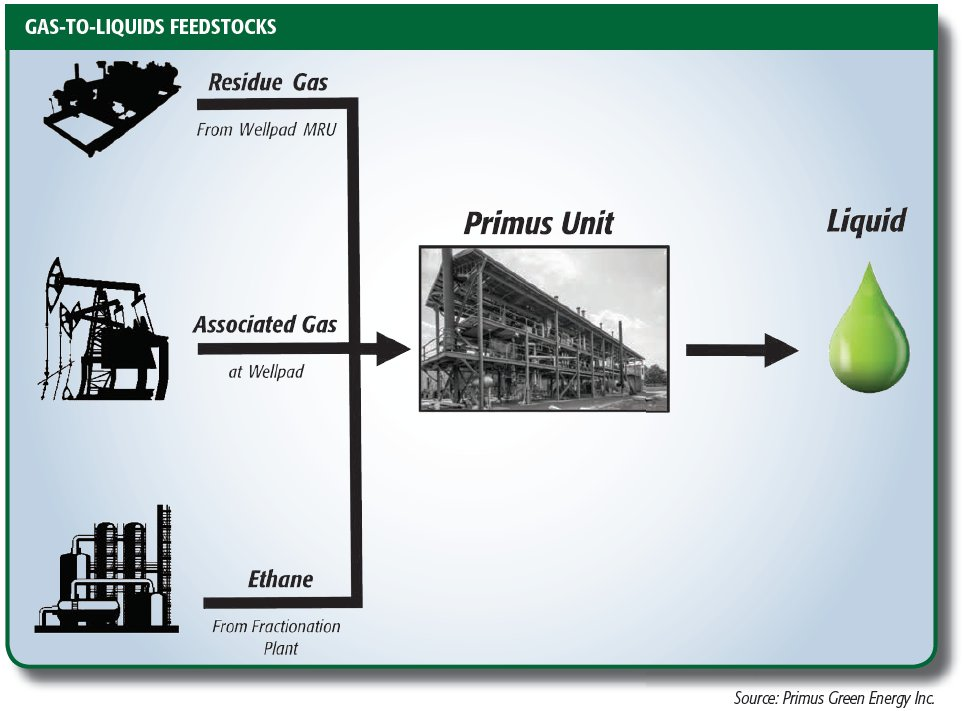

One option for monetizing ethane that is currently being rejected, flared or shut-in is employing GTL technology such as Primus Green Energy’s STG+, which converts ethane into valuable liquid end-products, such as gasoline, methanol or diluent. These end-products can be produced from ethane alone or from a range of natural gas feedstock types, including residue gas from a fractionation plant, wellhead gas with no limits on C2+ and up to 25% CO2 content.

As an example, let’s use an STG+ system that produces methanol using an ethane feedstock from the back end of a gas processing plant, with the presumption being that the ethane is stranded due to pipeline constraints or logistical issues. The STG+ natural gas-to-methanol system is ideal in such a situation because it is economical at small scales, requiring as little as 5,000 MMBtu/d of feed gas, which corresponds to 2.8 MMcf/d of ethane.

In this case, however, let’s propose that the gas processing plant is producing 21,000 MMBtu/d (12 MMcf/d) of excess ethane. If the ethane is used as a feedstock for the production of methanol through the STG+ process, the yield would be 640 metric tons per day of methanol, which translates to 214,000 (gal) per day. At a current spot price for methanol of $1.10 per gal, the company would gross $235,000 per day, with typical non-feedstock operating expenses of only 22 cents per gal.

The STG+ methanol system can be owned and operated by a midstream company on a tolling basis. By co-locating the STG+ unit at the gas processing plant, substantial capital savings are achieved on utilities and other outside battery limit items.

The STG+ natural gas-to-methanol process represents a significant opportunity to monetize a fossil fuel resource that had previously been considered a disposal problem, if not a financial liability.

Methanol demand

Methanol (CH3OH) is a chemical molecule that touches our lives in many ways—from serving as the basic chemical building block for paints, plastics and solvents to innovative applications in energy, transportation fuels (it is a biodiesel blending component) and fuel cells. By volume, it is one of the top five chemical commodities in the world. And demand is growing: global demand is expected to increase significantly—from 60.7 million metric tons in 2013 to more than 87 million metric tons in 2018, with an average annual growth rate of 8%, according to IHS.

Methanol (CH3OH) is a chemical molecule that touches our lives in many ways—from serving as the basic chemical building block for paints, plastics and solvents to innovative applications in energy, transportation fuels (it is a biodiesel blending component) and fuel cells. By volume, it is one of the top five chemical commodities in the world. And demand is growing: global demand is expected to increase significantly—from 60.7 million metric tons in 2013 to more than 87 million metric toMost U.S. methanol now comes from large plants in Louisiana and Texas. With the STG+ process, oil and gas companies can sell methanol into regional markets at a price that is typically lower than the price of methanol from the Gulf Coast. The STG+ process also satisfies the demand for methanol in hydraulic fracking operations, where it is used as a corrosion or scale inhibitor, a friction reducer, an inhibitor of hydrate formation and a fracking fluid flowback enhancer. The ability to produce methanol locally also saves oil and gas companies the trouble and expense of sourcing it from distant providers.ns in 2018, with an average annual growth rate of 8%, according to IHS.

While this case study is based on the production of methanol from stranded ethane at a gas processing plant, the STG+ process, as mentioned, can also be used to produce other end products from a range of feed gas composition types, including high-quality gasoline or diluent.

Historically, ethane has been considered a valuable gas liquid that has typically commanded a higher price than natural gas, rather than a stranded byproduct of oil and gas production as is now the case in many shale plays. With the STG+ gas-to-liquids technology, the oil and gas industry now has the opportunity to reclaim profit from low value stranded ethane, to create a valuable new ethane industry and to comply with anti-flaring mandates, while also making the best use of fossil fuel resources.

Recommended Reading

Analysts, SLB Execs See Stability in $7.7B ChampionX Deal

2024-04-04 - The acquisition of ChampionX vaults SLB’s chemical production business to No. 1 globally and orients SLB's business toward resource recovery that is less tied to price volatility.

Report: Devon Energy Targeting Bakken E&P Enerplus for Acquisition

2024-02-08 - The acquisition of Enerplus by Devon would more than double the company’s third-quarter 2023 Williston Basin production.

EIA: E&P Dealmaking Activity Soars to $234 Billion in ‘23

2024-03-19 - Oil and gas E&Ps spent a collective $234 billion on corporate M&A and asset acquisitions in 2023, the most in more than a decade, the U.S. Energy Information Administration reported.

Ohio Oil, Appalachia Gas Plays Ripe for Consolidation

2024-04-09 - With buyers “starved” for top-tier natural gas assets, Appalachia could become a dealmaking hotspot in the coming years. Operators, analysts and investors are also closely watching what comes out of the ground in the Ohio Utica oil fairway.

Deep Well Services, CNX Launch JV AutoSep Technologies

2024-04-25 - AutoSep Technologies, a joint venture between Deep Well Services and CNX Resources, will provide automated conventional flowback operations to the oil and gas industry.