Publicly held producers with small market capitalization joined their larger brethren to showcase 2002 and first-quarter 2003 results at the IPAA Oil & Gas Investment Symposium (OGIS) in New York. Meanwhile, in an effort to reach even more investors, the Independent Petroleum Association of America announced it will hold a second OGIS later this year, October 7-8 in San Francisco. What was apparent from several presentations is that many small-cap companies, which struggle to attract analyst coverage and investor interest, spent the past year strengthening their balance sheets and positioning themselves to drill more wells this year. Many are making significant changes to their management teams, boards and business models as well. Midland-based Parallel Petroleum (Nasdaq: PLLL) has changed its strategy, according to Larry Oldham, chief executive officer. "We are a new 24-year-old company. We have shifted our focus from historically being a speculative stock looking to drill a major discovery that would change the company overnight, to being an acquire-and-exploit, low-risk company. Why? The risk of exploration and the costs of finding oil and gas have gone up." Chief financial officer Don Tifton said a wildcat discovery has finding costs of $10 per BOE versus $6 on average for an acquisition. That's one reason why, in December 2002, the company acquired Permian Basin assets for $46 million, its largest deal yet. "We consider this the cornerstone of our new plan," Oldham said. Parallel also has assets in East Texas and onshore the Texas Gulf Coast. In the first quarter, the company's production averaged 3,100 barrel of oil equivalent per day, up 50% from the prior quarter. The $12-million drilling budget will be funded from cash flow, with any excess used to reduce debt. Equity Oil Co. of Salt Lake City (Nasdaq: EQTY) made its largest acquisition ever, for $30.7 million, in April 2002 and that has changed the company, said CEO Paul Dougan. The deal increased reserves 46% and added Sacramento Basin gas production. The focus is now in the Rockies and California. "We've gone from predominantly an oil company to a balance of oil and gas, sold our Canadian properties and generated about $2 of cash flow for every $1 invested during the last three years." Last year the company also repurchased 5.4% of shares outstanding and established a new, larger credit facility with Bank One. Gross profit return on investment (revenue less operating expenses and G&A cost per barrel of oil equivalent, divided by finding and development costs) was 204% during the past three years, Dougan said. -Leslie Haines

Recommended Reading

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.

OTC: E&Ps Improving Operational Safety with Digitization

2024-05-13 - Artificial intelligence and the digitization of the oilfield have allowed for several improvements in keeping operators out of harm’s way, panelists said during the 2024 Offshore Technology Conference.

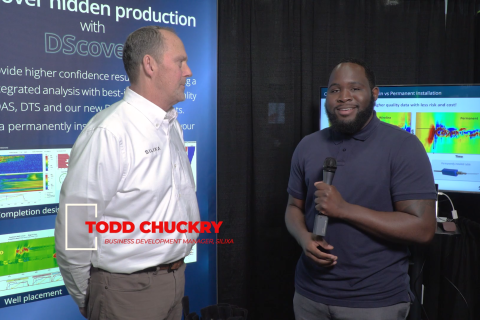

Exclusive: Silixa’s Distributed Fiber Optics Solutions for E&Ps

2024-03-19 - Todd Chuckry, business development manager for Silixa, highlights the company's DScover and Carina platforms to help oil and gas operators fully understand their fiber optics treatments from start to finish in this Hart Energy Exclusive.

Aramco Credits Adaptability, Collaboration for Driving Innovation

2024-05-15 - Aramco’s implementation of different approaches has led to the creation and commercialization of newer products, said Max Deffenbaugh, principal scientist for Aramco, at the 2024 Offshore Technology Conference in Houston.

Axis Energy Deploys Fully Electric Well Service Rig

2024-03-13 - Axis Energy Services’ EPIC RIG has the ability to run on grid power for reduced emissions and increased fuel flexibility.