SM Energy agreed to sell about 112,000 net acres in Wyoming for $500 million, which is expected to help fund development of the company’s Midland Basin and Eagle Ford assets. (Image: Hart Energy)

[Editor's note: This story was updated at 6:51 a.m. CST Jan. 11.]

Exceeding most valuations, SM Energy Co. (NYSE: SM) agreed to sell its Powder River Basin assets to private equity-backed Northwoods Energy LLC for $500 million—$300 million more than some analysts had valued the position.

However, some analysts said the deal may be a victory for the company’s immediate needs—funding SM Energy’s Midland Basin and Eagle Ford assets and reducing debt—that potentially sacrifices future gains in the Niobrara.

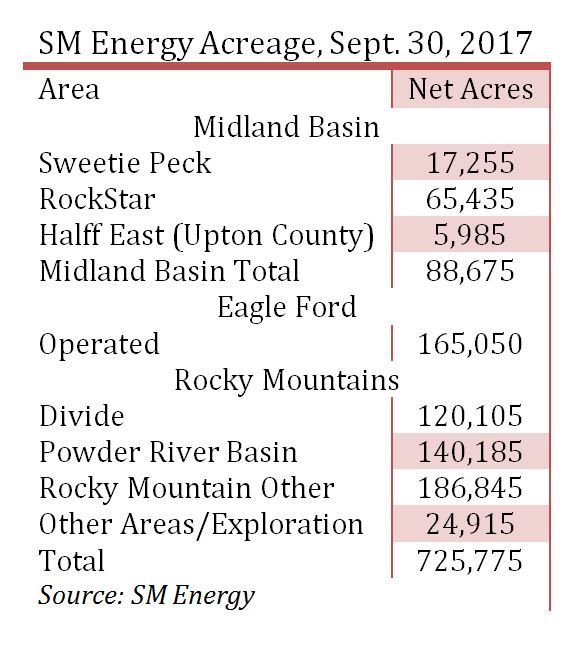

SM Energy agreed to deal about 112,200 largely contagious net acres in Converse, Johnson and Campbell counties, Wyo., or 80% of its Powder River acreage position, including the Frontier Formation. The company retains about 27,985 net acres, though the remaining leasehold is more scattered.

The sale includes net production, as of December, of about 2,200 barrels of oil equivalent per day (boe/d). Production is a mix of oil (51%), NGL (18%) and natural gas (31%). The assets’ proved reserves are an estimated 4.2 MMboe, 83% of which is proved developed producing.

“Divestiture of these assets is consistent with our strategy of focusing on development of our top tier Midland Basin and Eagle Ford assets and improving our balance sheet by reducing debt,” President and CEO Jay Ottoson said in a Jan. 9 news release. “Pro forma for this transaction, as of the end of the third-quarter 2017, net debt is reduced by approximately 20% and net debt: EBITDAX is reduced to less than 3x.”

At the end of the third quarter, SM Energy reported net debt of $2.5 billion. The company said it had liquidity of $1.4 billion, including $441 million cash on hand.

SM Energy secured a strong price for its undeveloped acreage, said Brian T. Velie, a Capital One Securities analyst.

The price equates to “about 9% of SM’s enterprise value. The volumes sold represent about 2% of SM’s total third-quarter 2017 production,” he said. Velie estimated the properties will generate about $16 million of EBITDA at $50 oil and $3 gas pricing during the next 12 months.

“We were only carrying $212 million for the entire Powder River Basin position,” he said. “The $500 million of proceeds represents roughly $3/share of NAV improvement. SM was planning to test the Niobrara potential on the position early this year. It seems that management chose to take advantage of oil pricing north of $60 per barrel rather than wait for more conclusive testing results later this year. Considering the price point, it is difficult to disagree with the approach.”

SM Energy appears to be headed for a strong year, though the sale price may have tacked toward a higher mark given interest in the basin, Tudor, Pickering, Holt & Co. (TPH) said in a Jan. 10 report.

“Some premium may already be baked into the equity” for the basin, TPH said.

Gordon Douthat, a senior analyst at Wells Fargo Securities, agreed that the asset hadn’t attracted significant capital from SM Energy, “though timing perhaps ahead of some expectations given upside potential in additional zones such as the Niobrara which had yet to be tested.”

Overall, TPH said the deal for “SM was a fantastic outcome as the company was able to extract value for the Frontier in our view but have also been paid for upside potential in formations like the Niobrara, where the company has yet to test well results” and has just one permit on its acreage, TPH said. “Early results on enhanced completions in the Frontier showed very promising results, but high well cost had yet to lend itself to highly commercial development.”

But private and public E&Ps have been aggressively permitting and likely testing Niobrara Shale results on overlapping acreage. “This, in our view, means core acreage trade value would see a big uplift from where the SM deal priced on an undeveloped value,” TPH said.

For A&D, the SM Energy transaction shows the market is keen to enter the basin and “we expect private equity and potentially smaller publics may look to consolidate acreage.”

Northwoods Energy is a portfolio company of Apollo Global Management LLC. The company was advised by Tudor, Pickering, Holt & Co. and Vinson & Elkins acted as Northwoods' legal adviser.

Darren Barbee can be reached at dbarbee@hartenergy.com

Recommended Reading

Oil, Gas Drilling Tech Transfer Boosts Fervo’s Geothermal Prowess

2024-02-14 - Geothermal company Fervo Energy is learning from oil and gas drilling and completion techniques to improve geothermal well costs and drill times.

Could Concentrated Solar Power Be an Energy Storage Gamechanger?

2024-03-27 - Vast Energy CEO Craig Wood shares insight on concentrated solar power and its role in energy storage and green fuels.

Amid ‘Battery Arms Race,’ Xerion CEO Talks Tech, Maturing Market, China

2024-04-10 - The late-stage battery startup is active in the military and electronics space, but is gaining attention for technology that extracts lithium from geothermal brine.

US Geothermal Sector Gears Up for Commercial Liftoff

2024-04-17 - Experts from the U.S. Department of Energy discuss geothermal energy’s potential following the release of the liftoff report.

Google Exec: More Collaboration Needed for Clean Power

2024-04-17 - Tech giant Google has partnered with its peers and several renewable energy companies, including startups, to ramp up the presence of renewables on the grid.