SM Energy has put a four-well pad in its new far northern Midland Basin stepout, targeting the 90%-plus oil-weighted Dean Formation overlying the similarly oily Wolfcamp A. (Source: Shutterstock)

SM Energy has put a four-well pad in its new far northern Midland Basin stepout, targeting the 90%-plus oil-weighted Dean Formation overlying the similarly oily Wolfcamp A.

KeyBanc Capital Markets reports SM’s wells in the stepout, in Dawson County, Texas, “measure up well to anything being drilled in the Midland Basin by anybody today.”

Herb Vogel, SM president and CEO, told investors on May 3 that the Dean Formation is the target. “There's prospectivity in the Wolfcamp A” in the new leasehold in southern Dawson County.

But “I would say we are not counting that.”

Among the four wells, the vertical in one was initially drilled below the Dean to take a look at underlying formations, such as the Wolfcamp. It was plugged back and a lateral was kicked off in Dean.

“If we're surprised that thermal maturity [in Wolfcamp A] is higher for some reason there than we expect it to be, that would be great news,” Vogel said.

“But we're really counting on this being more of a migrated-oil play.”

In that, laterals tap oil that has soaked into the Dean sandstone from other zones in the Midland Basin.

SM’s four wells were drilled earlier this year. Data remains in confidential status in Texas Railroad Commission (RRC) files for six months after completion unless released by the operator.

Dean, Spraberry

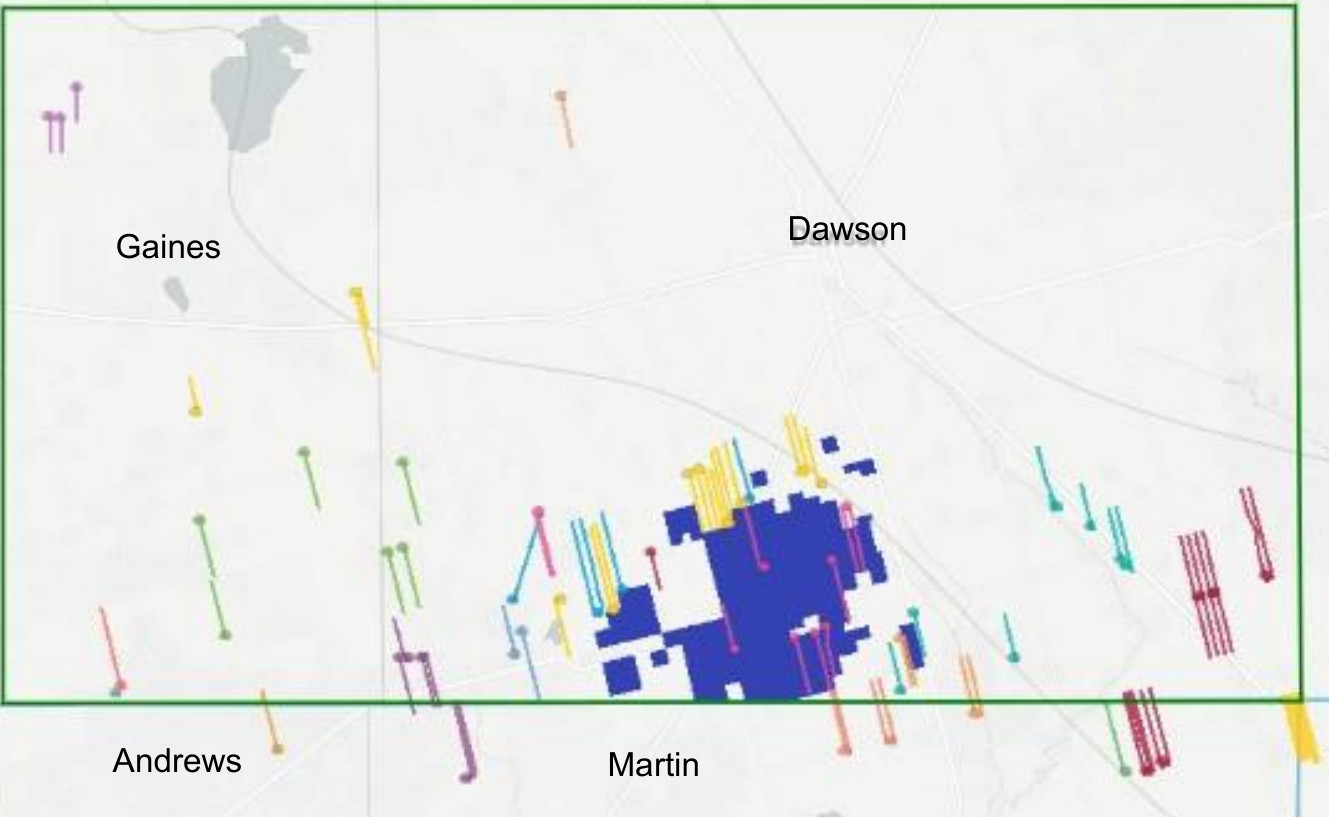

Hart Energy reported on new interest in Dawson County in February.

Since then, operators have completed 17 wells, but most are legacy operators’ recompletions of old verticals, according to the RRC.

Among the horizontals, prospectors are showing large wells in Dean, southeast of Lamesa, at the county’s center.

Among those southeast, Birch Operations reported 1,890 bbl of oil in a 24-hour IP from Ghost 35-26 B #4DN, landed in Dean with a 10,400-ft lateral, according to the RRC.

A companion well, Ghost #2DN, tested 1,785 bbl in Dean from a 10,200-ft lateral.

Also southeast of Lamesa, Ike Operating (formerly Pinion Operating) tested its Aquila 13-24 #6DN for 1,175 bbl from a 10,300-ft lateral in Dean.

Moving southwest, EOG Resources is looking to make a new play. Its Santorini Unit #1H made 216,000 bbl in its first 12 months from Middle Spraberry from an 11,000-ft lateral.

But EOG’s newly reported Santorini M #2H that’s a few paces from #1H tested 471 bbl from Dean from a 10,400-ft lateral.

EOG’s other newest horizontals in RRC data all landed in Spraberry. These tested 356 bbl (14,700-ft lateral), 783 bbl (12,000-ft), 801 bbl (15,700-ft) and 808 bbl (15,800-ft).

EOG still mum

SM picked up its Dawson leasehold—it calls it the Klondike area—last summer from Midland-based Reliance Energy, gaining 20,750 net acres for $93.5 million.

EOG hasn’t reported to investors yet on its work in Dawson.

Ezra Yacob, EOG chairman and CEO, said in a May 3 earnings call that, in one new area it’s looking at, it is drilling “what I would call ‘initial wells.’ I’d hate to call them wildcat wells because these aren’t frontier-type activities.”

Yacob did not identify the area.

He added, “We've still got another stealth play or two that are a bit more in, say, a delineation phase where we've drilled the initial well, we've been encouraged … and we're continuing to test and see if it's going to clear [our] hurdle rates.”

Hurdles include whether the new area is a portfolio-add. “We're not exploring for things that are simply just going to add inventory,” he said.

In any of the new areas, though, “there's so much data that we're not really drilling these initial wells to see if they'll actually produce oil and natural gas,” he added.

“It's not like we're testing whether or not the rock is productive [or] could we end up with a dry hole.”

Instead, it’s a matter of whether there’s enough oil and at a low enough D&C cost to be economic and “competes with the existing portfolio.”

The question, Yacob said, is, “have we found something that really commands investment and taking rigs off of another play?”

As good as Midland anything

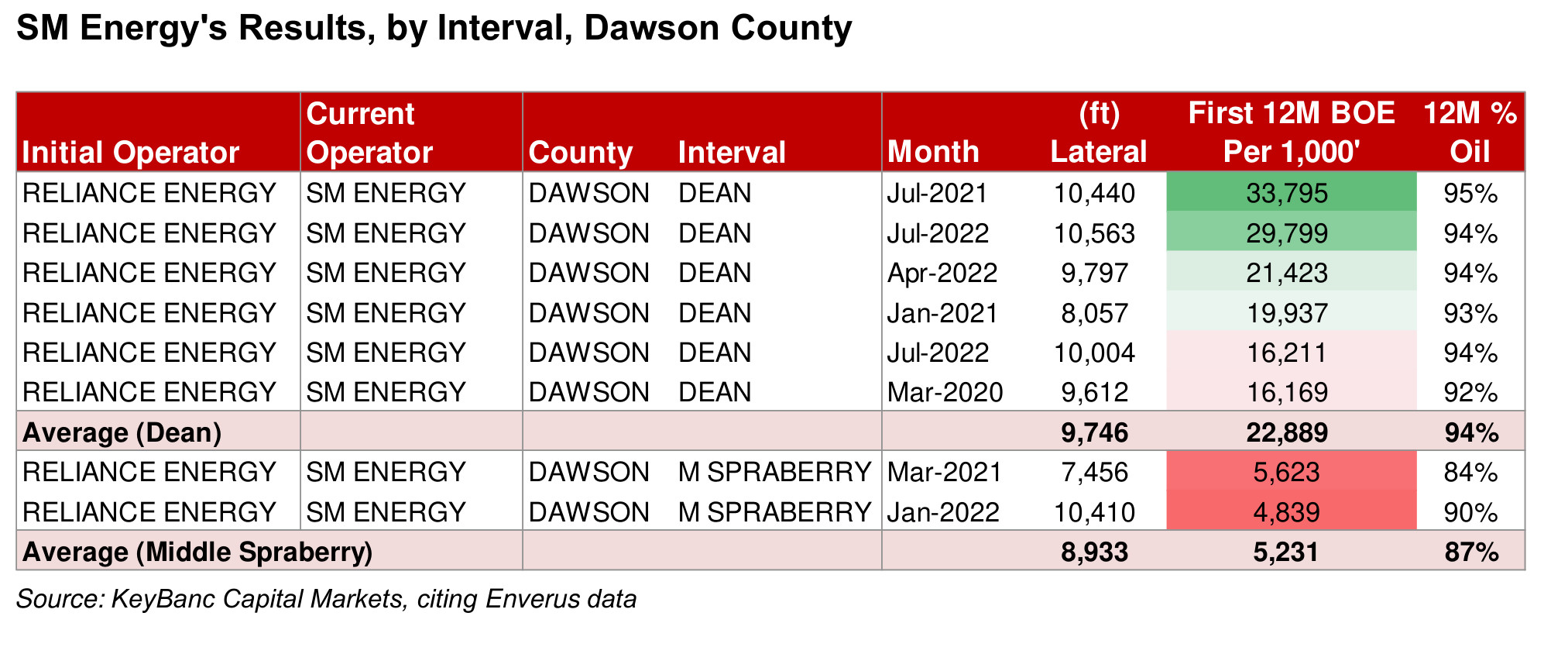

Tim Rezvan, an analyst with KeyBanc Capital Markets, took a look at Dawson County in April. He found that SM predecessor Reliance’s results in the Klondike “measure up well to anything being drilled in the Midland Basin by anybody today.”

Rezvan had found in a March look at Diamondback Energy’s Midland wells that its laterals in Dean were remarkable.

In the past two years, Diamondback has made 20 laterals in Dean in Martin County, which is south-adjacent to Dawson in 2022 and 2023.

Diamondback had landed only 15 wells in Dean between 2016 and 2021.

Among the new Dean wells, “results exceed those of any other interval, on a first-six- and first-12-month-per-1,000-lateral-foot basis,” Rezvan reported.

“In fact, the 2022 and 2023 Dean vintages are the most productive [12-month] interval cohorts that Diamondback has drilled anywhere in the Midland Basin since 2016.”

Turning to Dawson County and SM Energy’s new Klondike area in April, Rezvan found six Dean laterals in SM’s leasehold and a couple of dozen others in the area that were drilled since 2016.

“The Dean wells look strong,” he wrote.

In that timeframe, Birch made 11 in Dean; Reliance, six. First-12-month production for Birch’s averaged 20,600 boe per 1,000 lateral feet; for Reliance, 18,500 boe, Rezvan found.

Ike Operating (Pinion) landed in Dean in five wells, making “the highest first-12-month [results] … at 29,100 boe per 1,000 feet,” Rezvan wrote.

But EOG, with 12 wells in Rezvan’s study area, “focused exclusively on the Middle Spraberry interval.” The wells include those initially operated under an EOG pseudonym, CGS Operating.

For those, first-12-month production was 16,200 boe per 1,000 ft.

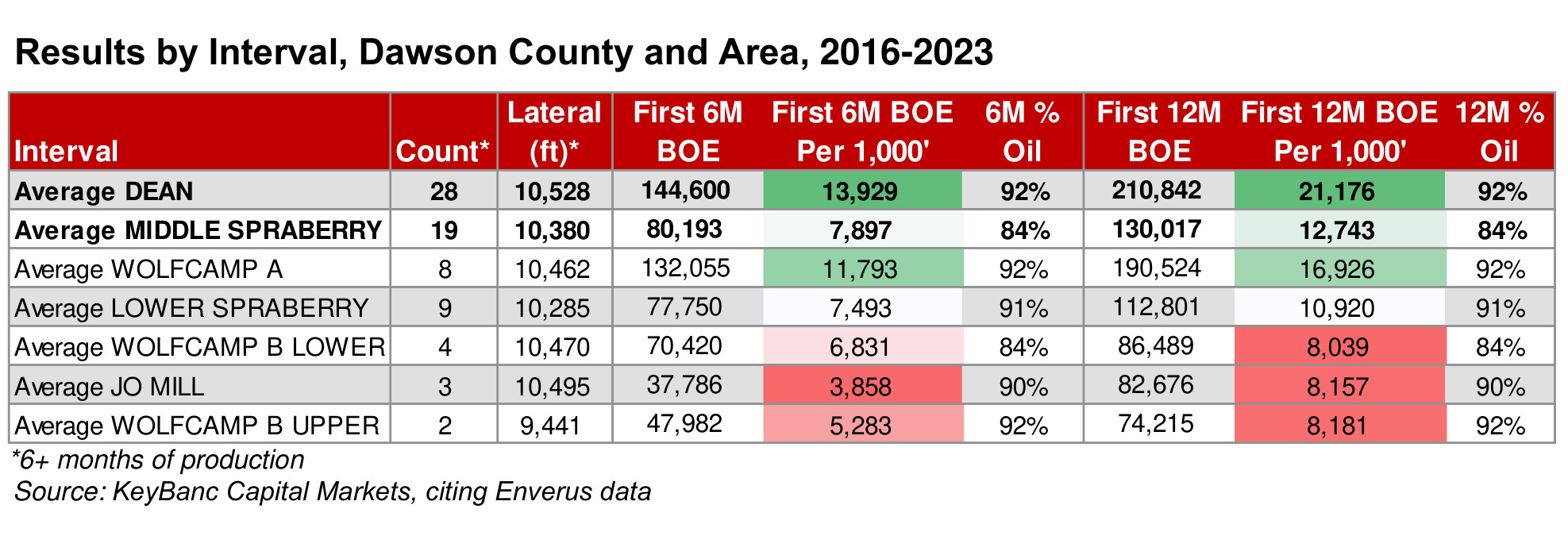

Rezvan also found that, while Dean wells are the best in Dawson, averaging 21,176 boe per 1,000 feet in their first 12 months, Wolfcamp A is second best at 16,926 boe.

Coming in third is Middle Spraberry (12,175 boe), followed by Lower Spraberry (10,920 boe), Upper Wolfcamp B (8,181 boe), Jo Mill (8,157 boe) and Lower Wolfcamp B (8,039 boe).

Recommended Reading

Energy Transfer to Buy Permian Midstream Player WTG for $3.25B

2024-05-28 - Energy Transfer has agreed to purchase WTG Midstream Holdings’ assets, including Midland Basin core infrastructure, from Diamondback Energy, Stonepeak and the Davis Estate in a cash and stock deal.

Baker Hughes to Supply Compression Trains for Algerian Field

2024-05-23 - Baker Hughes will supply 20 compression trains, which are expected to boost gas production at Alergia’s Hassi R’ Mel gas field.

Piñon Midstream Increases Delaware Basin Sour Gas Treating Capacity

2024-05-22 - Piñon Midstream plans to expand operations at Lea County, New Mexico, facility, the company said.

Developer Seeks Permit to Send US Gas to Mexico for LNG Exports

2024-05-22 - The project is the latest in a series of developments to convert U.S. gas into LNG and export it from Mexico's Atlantic and Pacific coasts to meet global demand.

Trans Mountain Pipeline Begins Work

2024-05-21 - The first oil cargo tanker, Suncor’s Dubai Angel, will load at the expanded Trans Mountain Pipeline’s crude terminus in Vancouver.