After failing to find any opportunities worth acquiring in the first quarter, Sitio Royalties bounced back in a major way in the second, reporting the closure of numerous acquisitions in the Permian Basin during second-quarter earnings. The closing of multiple acquisitions were valued, in the aggregate, at nearly $248 million, funded with 27% equity and 73% cash. (Source: Shutterstock.com)

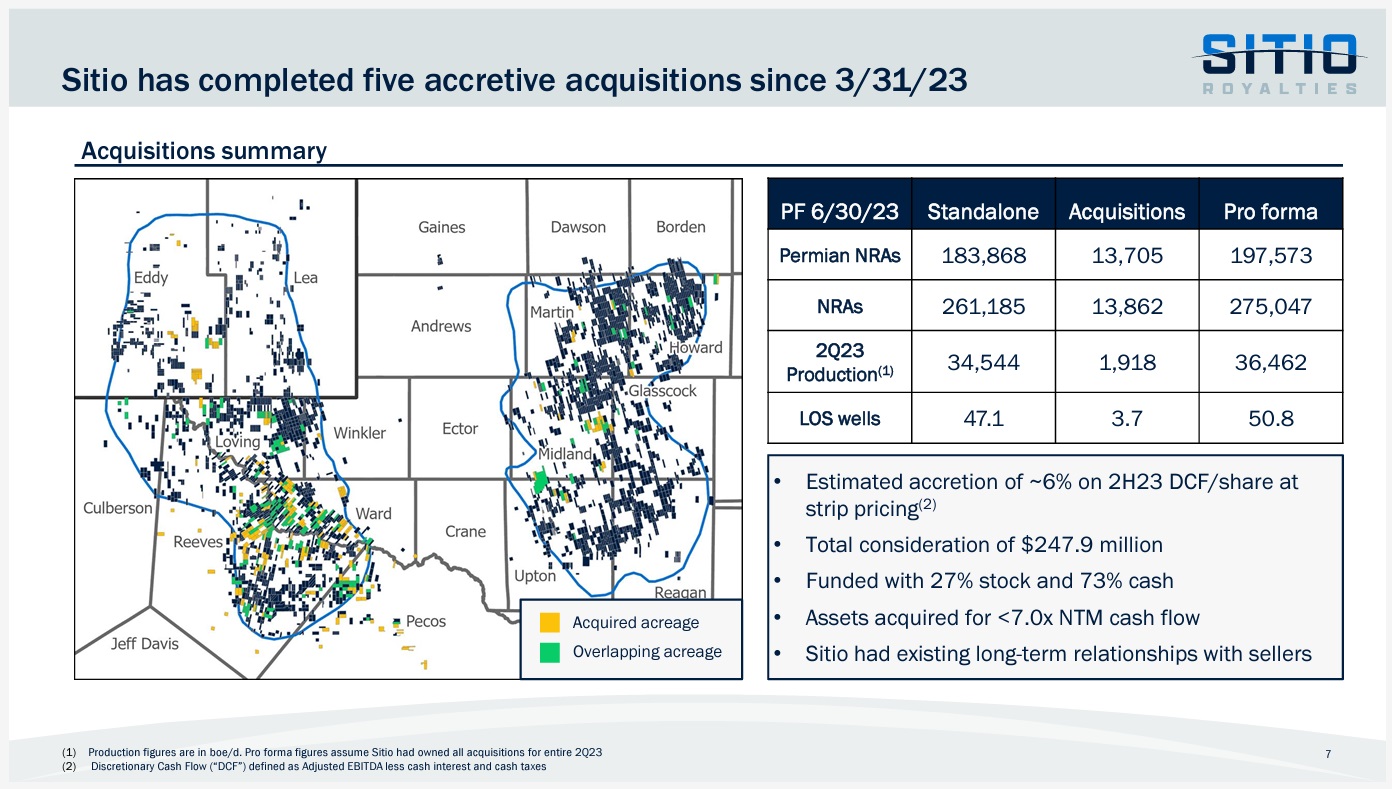

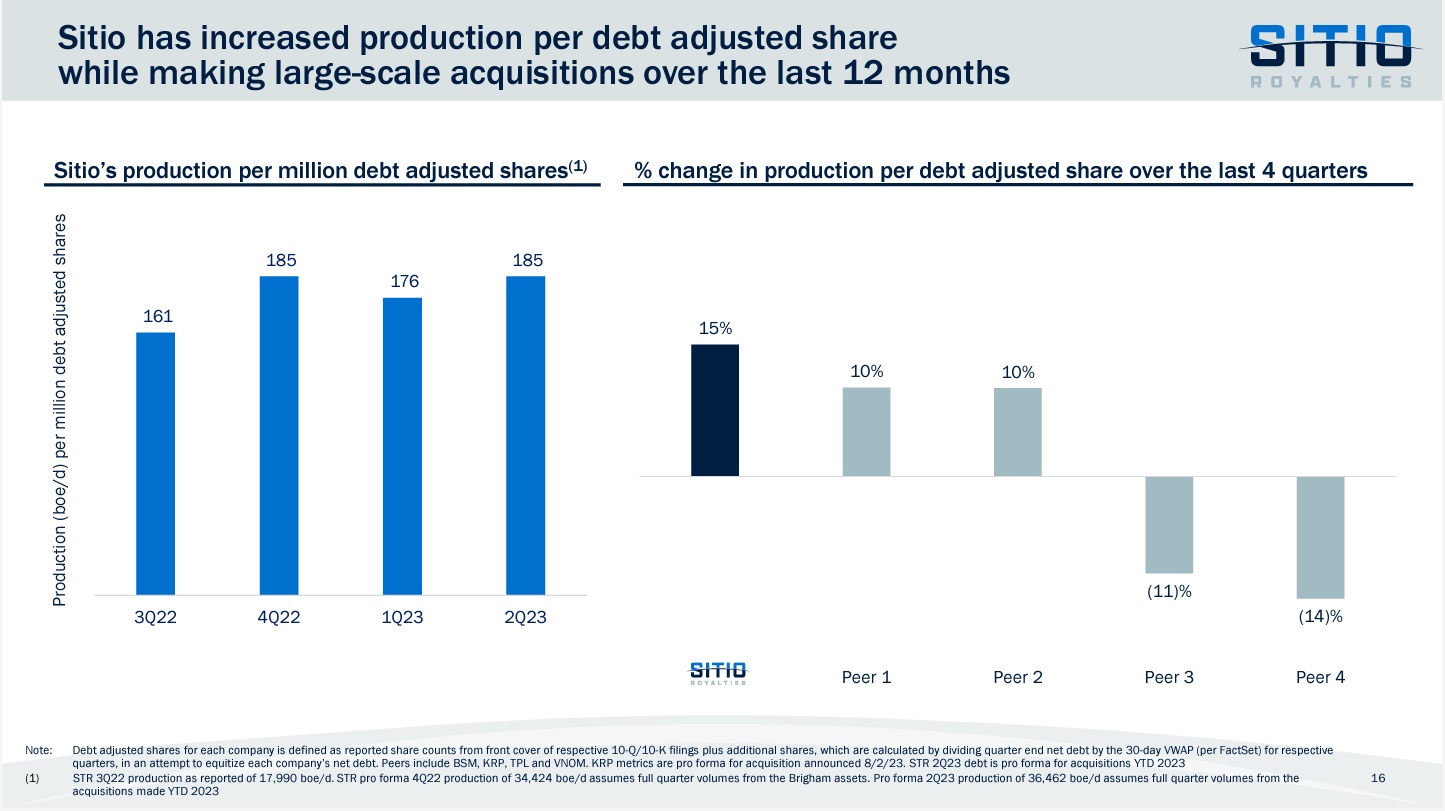

After failing to find any opportunities worth acquiring in the first quarter, Sitio Royalties bounced back in a major way in the second, reporting the closure of numerous acquisitions in the Permian Basin during second-quarter earnings. The closing of multiple acquisitions were valued, in the aggregate, at nearly $248 million, funded with 27% equity and 73% cash.

RELATED: Sitio Royalties Hits Unusual M&A Wall in Q1

During the earnings call, Chris Conoscenti, CEO of Sitio Royalties, said the assets were acquired for “no overhead” and credited Sitio’s massive rebound to the dealings they have developed over the years with their sellers.

“This relationship-based approach to generating and executing on minerals acquisitions is a true differentiator and has been a staple of our growth strategy for many years,” he said. “We acquired these assets for less than seven times next 12 months’ cash flow and, in aggregate, expect them to be approximately 6% accretive to our second half 2023 discretionary cash flow per share at current strip pricing and a payout ratio of 65%.”

Sitio’s second-quarter acquisitions added 13,705 net royalty acres (NRAs) to their position in the Permian, which the company sees as a key focus area. The 13,705 NRAs are equal to 7% of their Permian Basin position. About 82% of the interests were picked up in the Delaware Basin and 18% in the Midland Basin. The acquired assets also yielded a total of 3.7 net line-of-sight (LOS) wells.

As of June 30, Sitio’s LOS wells reached a record high of 50.8 pro forma net wells, an increase of 19% from the end of the first quarter. Pro forma net LOS wells comprised of 27.1 net spuds and 23.7 net permits, of which 2.6 net spuds and 1.1 net permits were from the recent Permian acquisitions.

“From a geographic perspective, our pro forma net line-of-sight well increase came from 61% in the Delaware Basin, 16% in the Midland Basin and 23% in the Eagle Ford, with the rest of our basins relatively flat on a combined basis,” Conoscenti said.

The acquisitions, on a pro forma basis, include production averaging 36,462 boe/d, representing a 5% increase relative to second-quarter production of 34,681 boe/d.

“Compared to our previous guidance for the full year of 2023, we are increasing our production guidance for the second half to $35,000 to $37,000 boes per day and reducing our gathering and transportation guidance range,” Conoscenti said.

Impairment charge hits income

While Sitio achieved some record highs last quarter, they did not do so without sustaining some losses.

Sitio reported a second quarter adjusted EBITDA of $127 million and discretionary cash flow of $95 million, down 9% and 21%, respectively, from the first quarter. The declines were driven by pricing as the average hedged price-per-barrel of oil equivalent was $44.45, a 9% decrease from the previous quarter, the company said.

Sitio also endured a net loss of $3 million, down $50.7 million relative to first-quarter 2023 net income. This loss was caused by a $25.6 million non-cash impairment charge related to Appalachian Basin proved properties and lower realized commodity prices.

As of June 30, the company had $902.3 million principal value of total debt outstanding and liquidity of $264.3 million. In June 2023, Sitio made its third consecutive quarterly amortization payment of $11.3 million, reducing the principal from $427.5 million to $416.3 million. As of Aug. 7—post-closing of the stock and cash acquisitions—Sitio had about $1.02 billion total debt outstanding.

While a share buyback program has not yet been authorized by Sitio’s board, they have made some progress on paying back some of their prepayable debt balances.

“We've made several payments at par on our unsecured notes,” Conoscenti said. “Prior to these cash acquisitions in the last two months, we were paying down our RBL balance and we'd like to continue doing that and working towards our long-term goal of one times or less leverage, which will give us not the optimal balance sheet, but adequate liquidity to capitalize opportunistically on cash acquisitions.”

Despite seeing some losses this quarter, Sitio’s various acquisitions have Conoscenti optimistic for the rest of the year

“If you look at the response that the gas market has had to infrastructure build-out it's encouraging… with the Whistler [pipeline] expansion, Permian Highway with Matterhorn getting FID [final investment decision] and another project, you have upwards of 3.6 Bcf per day of new capacity coming on over the next year, year and a half. And so that sends a strong signal to the gas market that there's egress coming out of the Permian Basin in a volume that you just can't see in other basins.”