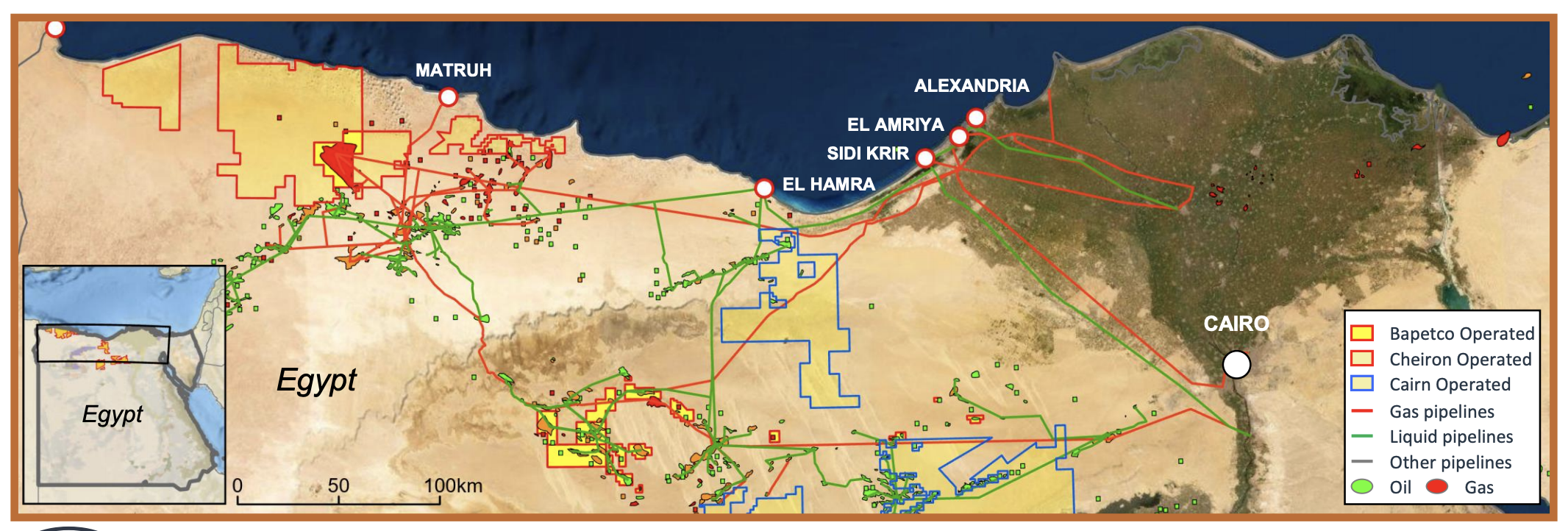

Royal Dutch Shell Plc entered into an agreement to sell upstream assets in Egypt’s Western Desert to Cheiron Petroleum Corp. and Cairn Energy Plc for up to $926 million, the company said on March 9.

The deal includes Shell Egypt’s stake in 13 onshore concessions and its share in the Badr El-Din Petroleum Co. (BAPETCO). It is subject to government and regulatory approvals and is expected to be completed in the second half of 2021, the statement said.

It sets a base price of $646 million, with additional payments of up to $280 million between 2021 and 2024, subject to the oil price and exploration results.

“It will enable Shell to concentrate on its offshore exploration and integrated value chain in Egypt, including seven new blocks in the Nile Delta, West Mediterranean and Red Sea,” the company said.

Recommended Reading

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

Endeavor Integration Brings Capital Efficiency, Durability to Diamondback

2024-02-22 - The combined Diamondback-Endeavor deal is expected to realize $3 billion in synergies and have 12 years of sub-$40/bbl breakeven inventory.

Exxon, Chevron Tapping Permian for Output Growth in ‘24

2024-02-02 - Exxon Mobil and Chevron plan to tap West Texas and New Mexico for oil and gas production growth in 2024, the U.S. majors reported in their latest earnings.

Patterson-UTI Braces for Activity ‘Pause’ After E&P Consolidations

2024-02-19 - Patterson-UTI saw net income rebound from 2022 and CEO Andy Hendricks says the company is well positioned following a wave of E&P consolidations that may slow activity.

CEO: Magnolia Hunting Giddings Bolt-ons that ‘Pack a Punch’ in ‘24

2024-02-16 - Magnolia Oil & Gas plans to boost production volumes in the single digits this year, with the majority of the growth coming from the Giddings Field.