The company noted that it is “aggressively pursuing scale through accretive M&A, especially outside of California, in all cases to enhance our ability to generate sustainable free cash flow.” (Source: Shutterstock)

After recently closing a $70 million acquisition in California, Berry Corp. is hunting for more scale through M&A—and it’s eyeing deals outside of the Golden State, in particular.

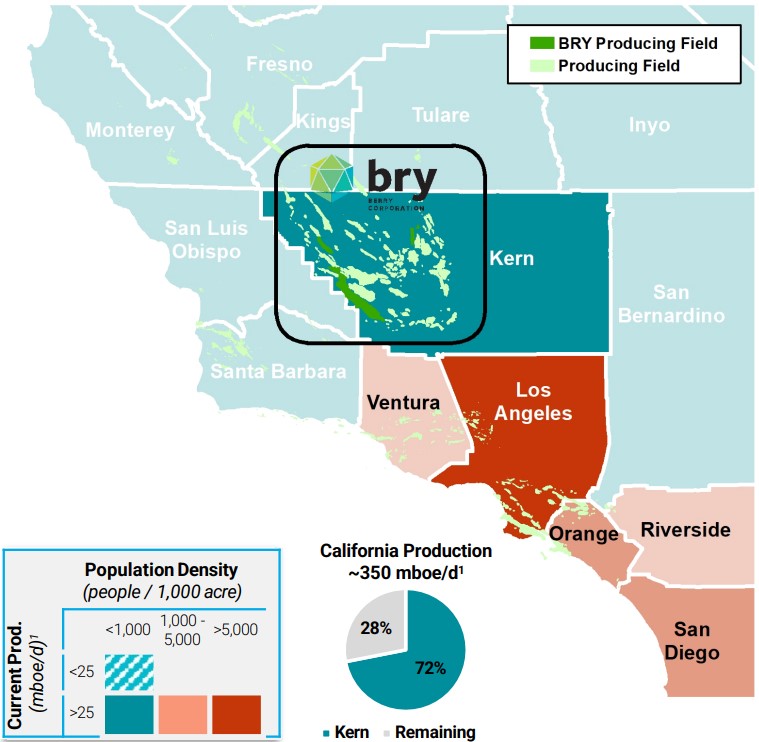

Dallas-based Berry Corp. closed its acquisition of Macpherson Energy Corp., a privately held E&P in Kern County, California, in mid-September.

Berry agreed to pay $70 million in cash to acquire Macpherson—$50 million of which was paid upon closing. The remaining $20 million will be paid out in July 2024, per the terms of the deal.

Berry CEO Fernando Araujo reported in the company’s third-quarter earnings that Macpherson’s business has successfully integrated, and that the combined company began implementing efforts to reduce costs and boost free cash flows.

“When we announced this acquisition, we said that we expected these assets to enhance Berry's free cash flow by 15% to 25% in 2024,” Araujo said during the company’s third-quarter earnings call. “Based on our cost savings opportunities implemented so far, we now expect to exceed these free cash flow estimates.”

Berry’s third-quarter daily production averaged 25,300 boe/d; oil volumes averaged 23,200 bbl/d over the quarter, accounting for 92% of total companywide production.

RELATED

Berry Corp. Raises Production Outlook After Acquiring California E&P

Bolting on scale

After closing the Macpherson deal, Berry is searching for more opportunities to grow through acquisition.

The company noted that it is “aggressively pursuing scale through accretive M&A, especially outside of California, in all cases to enhance our ability to generate sustainable free cash flow.”

“We’re looking for scale,” Araujo said.

Berry is still scrutinizing California for opportunistic bolt-ons—similar to the Macpherson deal in its own backyard in Kern County.

But Berry is also focusing on accretive assets outside of California where the E&P can maintain a flat production profile and deliver sustainable free cash flow for years to come, Araujo said.

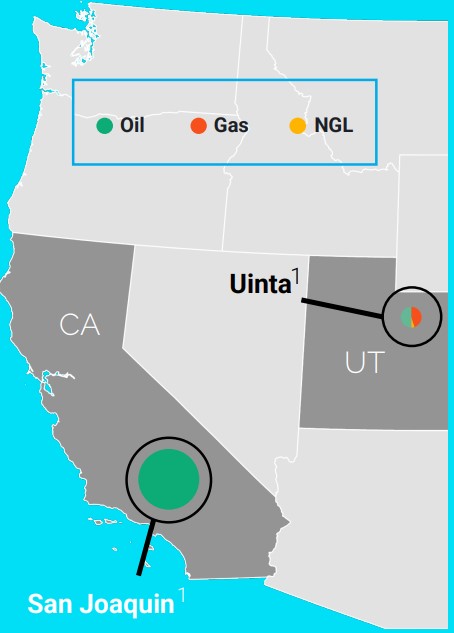

“In terms of basins, initially, we're focusing in the Western Rockies — basins like the Uinta, Piceance, Powder River,” he said. “But in reality, we're basin agnostic.”

The vast majority of Berry’s total production comes from the Golden State: California production contributed an average 20,500 boe/d, or 81% of Berry’s total quarterly output.

But the company also has upstream assets in the Uinta Basin in Utah, according to regulatory filings.

Mike Helm, Berry’s CFO and chief accounting officer , said bolt-on acquisitions like the Macpherson deal are typically financed using its reserve-based lending facility.

The company is eyeing multiple ways to finance larger acquisitions, including issuing equity or potentially raising debt.

“In that regard, it would have to make sense from all of our financial metrics, including leverage,” Helm said. “We don’t have the appetite to increase our leverage on a long-term basis.”

RELATED

Haynes Boone: RBLs Continue to Cool as Source of Oil, Gas Capital

Recommended Reading

Supply Disruptions Ahead as Canadian Rail Workers Vote for Strike

2024-05-01 - The union, representing more than 9,000 employees at Canadian National Railway and Canadian Pacific Kansas City, announced that 95% of its members approved of a strike, which could happen as early as May 22.

Vision RNG Expands Leadership Team

2024-05-01 - Vision RNG named Adam Beck as vice president of project execution, Doug Prechter as vice president of finance and Beckie Dille as HR manager.

OGInterview: Building EIV Capital’s Midstream Investment Strategy

2024-05-01 - Midstream-focused EIV Capital has added non-operated assets and transition projects to its portfolio as a sign of the times.

NOG Lenders Expand Revolving Credit Facility to $1.5B

2024-04-30 - Northern Oil and Gas’ semi-annual borrowing-base redetermination left its reserved-based lending unchanged at $1.8 billion.

Imperial Oil Names Exxon’s Gomez-Smith as Upstream Senior VP

2024-04-30 - Cheryl Gomez-Smith, currently director of safety and risk at Exxon Mobil’s global operations and sustainability business, will join Imperial Oil in May.