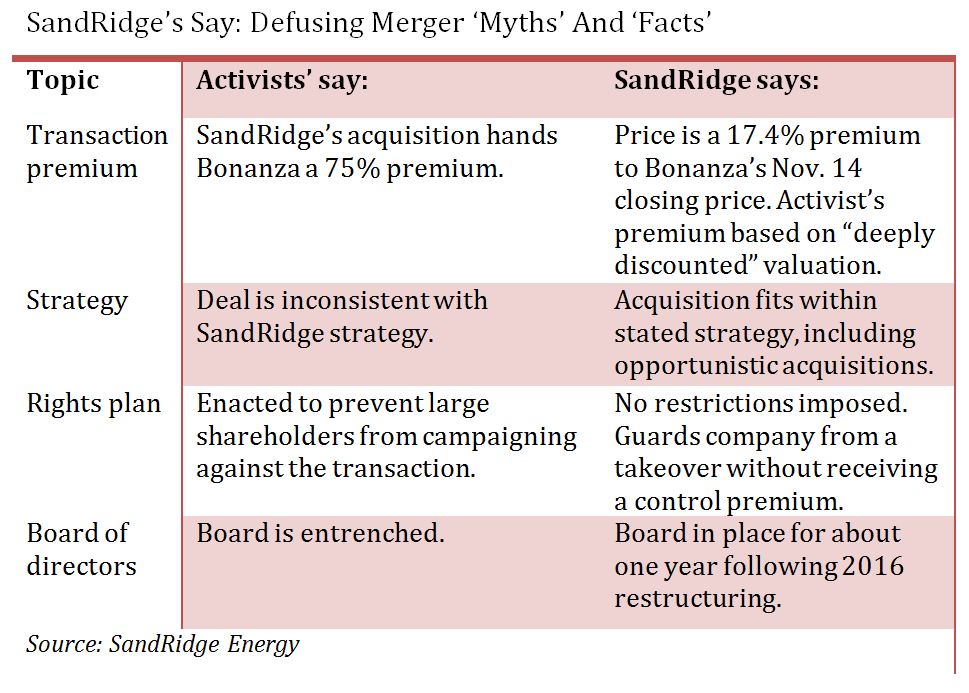

Activist investors controlling roughly 28% of SandRidge stock have said the deal pays too much for Bonanza, an assertion SandRidge rejects.

SandRidge Energy Inc. (NYSE: SD) clapped back strongly against activist investors opposed to its $746 million merger with Bonanza Creek Energy Inc. (NYSE: BCEI)—launching an effort to debunk what it called distorted facts and “myths” about the deal.

“A vocal minority of shareholders have attempted to criticize the acquisition by distorting the facts and misleading the investing public,” SandRidge said in a letter to shareholders made public Dec. 11. “Their assertions are false and reckless and we believe it is imperative to set the record straight for our investors.”

Though SandRidge’s policy is not to comment on specific discussions with shareholders, heated criticism directed at the Denver-Julesburg (D-J) Basin combination apparently reached a tipping point for the company.

Some analysts have already written off the merger because of opposition by four shareholders “controlling 27.6% of SandRidge shares.”

Investors lined up against the deal include frequent pot-stirrer Carl Icahn, who amassed $50 million worth of shares after the transaction was announced on Nov. 15. Investor Fir Tree Partners initially opposed the merger.

SandRidge said that Icahn and other opponents of the deal have their facts wrong. The company noted that its $36 per share offer for Bonanza is “well within the per share valuation ranges implied by Bonanza Creek’s net asset value.”

The company also specifically addressed several areas of contention, including the transaction premium criticized by activists and the assertion that an entrenched board is making decisions.

After the deal was announced, some analysts saw the deal as a step in the right direction for SandRidge.

Mike Kelly, senior analyst at Seaport Global Securities, said that at $50 oil prices “we think it’s a savvy and fitting move” that could propel its stock from proved developed producing value to a name that receives “3P credit for the future potential of a promising asset,” such as Bonanaza’s 67,000 net acres in the D-J Basin.

SandRidge also did not put a value on Bonanza’s midstream assets, “which we think could make the deal screen even cheaper,” Kelly said. However, he noted that at Seaport’s forecast of $40 oil prices, the deal’s economics begin to degrade.

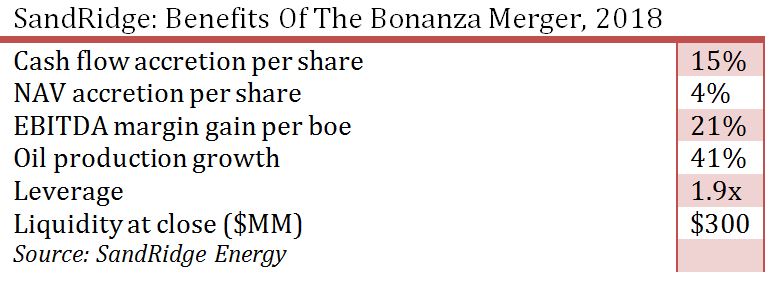

SandRidge’s letter to shareholders outlines a deal the company says will provide immediate cash flow and high-return development opportunities.

The deal would reshape the company’s production sources, increasing Niobrara volumes to 25% of total production from 4%. Additionally, its Mississippi Lime production would fall below 60% of total volumes from 80%.

Additionally, SandRidge the deal providing:

- Rates of return of 30%-50%;

- 970 new drilling locations close to existing infrastructure; and

- A 92% increase in estimated proved undeveloped locations to 230.

SandRidge also touted the economic benefits of the merger, including an increase in its reserve-based loan to $700 million on more favorable terms.

Activists have also attacked the company’s enactment of a rights plan on Nov. 27 to large pieces of SandRidge’s stock.

“The rights plan is designed to deter the acquisition of actual, de facto or negative control of the company by any person or group without appropriately compensating its shareholders for such control,” Sandridge said in a news release.

Ichan excoriated the company’s board for adopting the plan, saying in a letter “you adopted a poison pill that is a complete travesty and represents a new low in corporate governance.”

Under the terms of the rights plan, the company caps a person or group from acquiring 10% or more of the company’s common stock. Shareholders who already have a 10% or greater interest are grandfathered by the plan. The plan requires shareholder approval in 2018.

The company has said the plan prevents a possible takeover of the company without paying shareholders a premium.

SandRidge closed its letter to shareholders by saying, “We urge you to make this decision only after careful analysis of all of the facts.”

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Sempra Targets Summer 2025 for Commercial Start of ECA LNG Phase 1

2024-03-06 - Sempra is targeting the summer of 2025 as the commercial operations date for its 3.25 mtpa (0.43 Bcf/d) nameplate capacity Energía Costa Azul LNG Phase 1 project, located in Ensenada in Baja California, Mexico.

Permian Gas Finds Another Way to Asia

2024-04-30 - A crop of Mexican LNG facilities in development will connect U.S. producers to high-demand markets while avoiding the Panama Canal.

Heard from the Field: US Needs More Gas Storage

2024-03-21 - The current gas working capacity fits a 60 Bcf/d market — but today, the market exceeds 100 Bcf/d, gas executives said at CERAWeek by S&P Global.

Darbonne: Brownsville, We Have LNG Liftoff

2024-04-02 - The world’s attention is on the far south Texas Gulf Coast, watching Starship liftoffs while waiting for new and secure LNG supply.

API Gulf Coast Head Touts Global Emissions Benefits of US LNG

2024-04-01 - The U.S. and Louisiana have the ability to change global emissions through the export of LNG, although new applications have been frozen by the Biden administration.