Sabine Oil & Gas Corp. is looking to expand beyond East Texas, considering the Eagle Ford, Oklahoma’s Woodford and the Utica as well, said Sabine president and CEO Doug Krenek at Hart Energy's DUG Haynesville conference in Shreveport, Louisiana. (Source: Hart Energy)

East Texas Haynesville and Cotton Valley gas pureplay Sabine Oil & Gas Corp. is expanding its hunt for more leasehold beyond East Texas, looking at the Eagle Ford, Oklahoma’s Woodford and the Utica.

“Of course, our No. 1 play we like the most is East Texas and that's where we prefer to grow,” Doug Krenek, Sabine president and CEO, told Hart Energy’s DUG Haynesville 2023 attendees in Shreveport.

The company’s budget is between $100 million and $150 million, he added. “Y'all may say, ‘Well, that's not a lot of money.' But again, we're trying to grow organically. We don't want to buy a bunch of PDP [proved developed producing].

“So if you have any ideas that fit our bill, [contact us].”

East Texas pureplay Rockcliff Energy might be for sale, after a rumored deal with TG Natural Resources didn’t manifest earlier this year amid collapsing natural gas prices.

Might Sabine try adding that to its portfolio? “You saw the number [we have], though: $100 [million]- to $150 million,” he laughed. TG Natural Resources was rumored to be negotiating a $4.6 billion deal with Rockcliff.

Rockcliff is producing 1.2 billion cubic feet per day. “I think there's a disconnect. That bid/ask spread is too big, probably.”

In the Eagle Ford, which phase window?

The oil window is likely shut to Sabine, a subsidiary of Osaka Gas USA.

“Osaka is committed to ESG, so we really don't want to enter oil plays, just because of the carbon intensity associated with them,” Krenek said. “We're mainly looking for a gas window and maybe with some liquids, but not a big portion.”

Chesapeake Energy Corp. has its rich-gas Austin Chalk play for sale in the Eagle Ford in the southern Dimmit and northern Webb counties, Texas.

“That would be something we'd probably look at. Again, remember the number I'm working with,” he laughed. “Maybe I could be a buy a piece of it; I don't know. Or we could do a JV [joint venture] for part of it; I don't know.”

The gassy window of the Eagle Ford and the gas-weighted window of the Woodford are interesting to Sabine because Texas and Oklahoma have a friendly regulatory environment, he added.

As for the Utica, “we just think it has a lot of untapped potential, [although] it may have tougher regulatory and takeaway issues.”

In East Texas, Sabine is producing 450 million cubic feet equivalent per day (MMcfe/d), 93% gas, from 1,016 wells on 237,382 net acres (306,323 gross) of leasehold. The well count is 31% horizontal; the balance is legacy vertical wells that the company has been divesting. Plans are to put another package on the market later this year.

Year-end 2022 reserves were 1 billion cubic feet equivalent (Bcfe)PDP; 2.8 trillion cubic feet equivalent (Tcfe) proved; and 6.6 Tcfe 3P.

In the past three years, the $950 million it’s invested in its property has been with only $30 million in outside capital infusion.

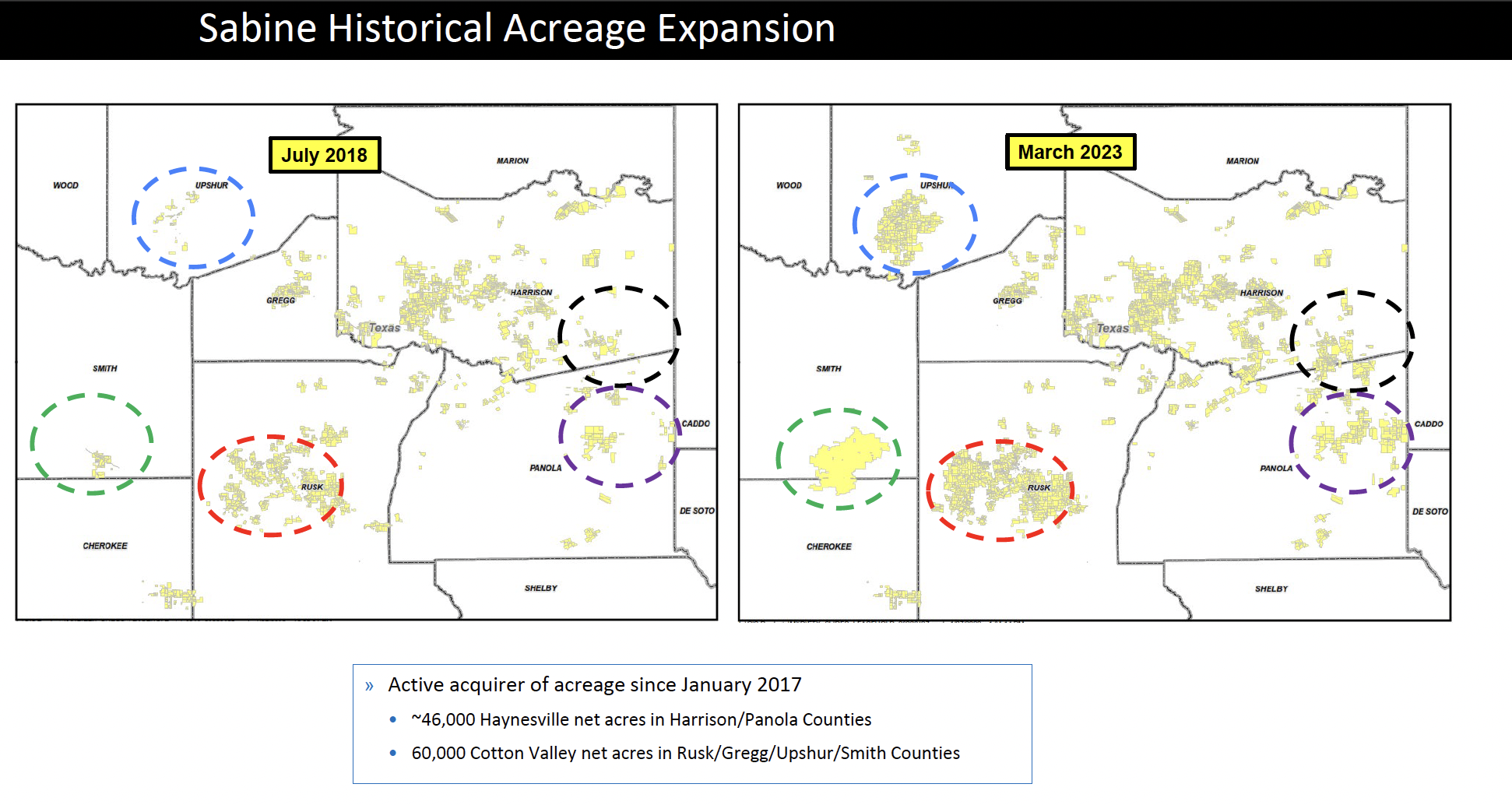

Sabine currently has two rigs drilling its 46,000 net Haynesville acres along the Texas-Louisiana border. In Texas, that includes in Harrison and Panola counties, and one making hole in its 60,000 net Cotton Valley acres west of that in Rusk, Gregg, Upshur and Smith counties.

At the current rig count, it has 10-plus years of inventory—157 Haynesville wells; 165 Cotton Valley.

Execution in the Haynesville has improved, but the Cotton Valley is “a tough one to crack when it comes to drilling the lateral,” Krenek said. “We're going to be working on that one real hard now too.”

For acquisitions, “we budget money every year. We like to grow organically through the drillbit,” he said. “There are PDP players out there. We're not one of them. So when it comes to deals, we like to get acreage we can drill.

“If it's got low-impact, marginal wells on it, we really don't want those in our portfolio. So we'll take them, but we'll flip them out after we get them.”

Recommended Reading

Baytex Energy Joins Eagle Ford Shale’s Refrac Rally

2024-07-26 - Canadian operator Baytex Energy joins a growing number of E&Ps touting refrac projects in the Eagle Ford Shale.

US Rig Count Makes Biggest Monthly Jump Since November 2022

2024-07-26 - The oil and gas rig count, an early indicator of future output, rose by three to 589 in the week to July 26.

Private Equity Looks for Minerals Exit

2024-07-26 - Private equity firms have become adroit at finding the best mineral and royalties acreage; the trick is to get public markets to pay more attention.

BP and NGC Sign E&P Deal for Offshore Venezuelan Cocuina Field

2024-07-26 - BP and NGC signed a 20-year agreement to develop Venezuela’s Cocuina offshore gas field, part of the Manakin-Cocuina cross border maritime field between Venezuela and Trinidad and Tobago.

Nabors’ High-spec Rigs Help Keep Lower 48 Revenue Stable in 2Q

2024-07-25 - Nabors’ second quarter EBITDA was down 1% quarter-over-quarter but the company sees signs of increased drilling activity in international markets the second half of the year.