Source: Hart Energy

[Editor’s note: This is a developing story. Check back for updates.]

RSP Permian Inc. (NYSE: RSPP) said Oct. 13 it will acquire Delaware Basin’s Silver Hill Energy Partners LLC in a deal valued at about $2.4 billion.

The Dallas-based company said it entered definitive agreements to acquire Silver Hill for $1.25 billion in cash and 31 million shares. Silver Hill controls about 68,000 gross (41,000 net) acres within the Delaware and produces about 15 thousand net barrels of oil equivalent per day (Mboe/d).

The acquisition adds another core in the Permian to RSP's portfolio. The company already operates large, contiguous acreage blocks within the Midland Basin totaling about 63,000 net surface acres. Excluding adjustments, RSP will pay roughly $40,000 per acre for Silver Hill.

Silver Hill’s acreage is located in Loving and Winkler counties in West Texas and includes 58 producing wells, 49 of which are horizontal. The deal also gives RSP Permian about 3,200 gross (1,950 net) total undeveloped locations in the Delaware.

Steve Gray, CEO of RSP, said the returns of Silver Hill’s horizontal wells compare favorably with the company’s Midland Basin assets.

“We have been patient in our M&A efforts to ensure that we pursue accretive opportunities for our shareholders that enhance our already deep inventory of high-return horizontal locations,” Gray said in a statement. “We believe the assets of Silver Hill are located in the best part of the Delaware Basin and will be a perfect complement to our existing asset base.”

The transaction adds 50% more production to RSPP, which averaged 29,761 Mboe/d in the third quarter, Securities and Exchange Commission filings show.

RSP Permian plans to fund the acquisition through capital market transactions, which may include equity or debt offerings.

Silver Hill is comprised of two privately held entities controlled by affiliates of Kayne Anderson Capital Advisors and Ridgemont Equity Partners. Diamondback Energy Inc. (NASDAQ: FANG) was rumored to be in discussions to buy Silver Hill for $2.5 billion, but said Oct. 10 that they were no longer actively pursuing the acquisition.

RSP Permian’s acquisition of both Silver Hill entities will have an effective date of Nov. 1. However, the two transactions will close separately—one in fourth-quarter 2016 and the other in first-quarter 2017.

Upon closing, Kayne Anderson, Ridgemont and other Silver Hill shareholders are expected to collectively own about 20% of RSP's outstanding shares. In addition, RSP expects to add Kyle D. Miller, CEO of Silver Hill, to its board of directors.

RBC Capital Markets was lead M&A adviser to RSP and provided fairness opinions to RSP’s board of directors. Barclays Capital Inc. was a co-M&A adviser. Vinson & Elkins LLP was the company’s legal counsel.

Jefferies LLC was financial adviser to Silver Hill. Thompson & Knight LLP and DLA Piper LLP served as its legal counsel.

Emily Moser can be reached at emoser@hartenergy.com.

Recommended Reading

Despite LNG Permitting Risks, Cheniere Expansions Continue

2024-02-28 - U.S.-based Cheniere Energy expects the U.S. market, which exported 86 million tonnes per annum (mtpa) of LNG in 2023, will be the first to surpass the 200 mtpa mark—even taking into account a recent pause on approvals related to new U.S. LNG projects.

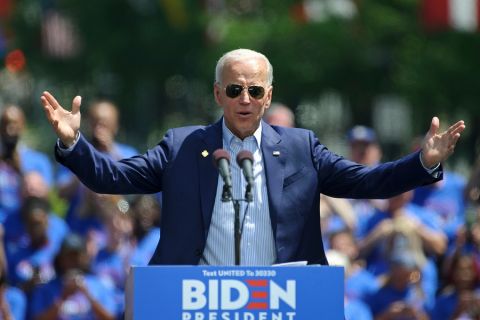

Pitts: Producers Ponder Ramifications of Biden’s LNG Strategy

2024-03-13 - While existing offtake agreements have been spared by the Biden administration's LNG permitting pause, the ramifications fall on supplying the Asian market post-2030, many analysts argue.

EQT’s Toby Rice: US NatGas is a Global ‘Decarbonizing Force’

2024-03-21 - The shale revolution has unlocked an amazing resource but it is far from reaching full potential as a lot more opportunities exist, EQT Corp. President and CEO Toby Rice said in a plenary session during CERAWeek by S&P Global.

Everywhere All at Once: Woodside CEO Touts Current Global Portfolio

2024-03-05 - Meg O’Neill, the CEO of Australian energy giant Woodside Energy, is overseeing the “next wave” of growth projects around the globe, including developments in the Gulf of Mexico, offshore Senegal and further LNG expansion.

US Asks Venture Global LNG to Justify Filing of Confidential Documents

2024-03-13 - The FERC request comes days after Venture Global LNG customers had challenged the company's request for a one-year extension of its startup and urged the regulator to make Venture Global release the confidential commissioning documents.