The royalty trust business structure is poised to offer unique options to North American oil and gas producers in their pursuit of growth. Due to its tax-efficient characteristics, it has the potential to accomplish what the master limited partnership (MLP) has done for U.S. midstream natural gas companies-that is, provide capital to launch consolidation of a defined segment of the energy value chain. Canadian oil and gas royalty trusts have acted far different than their U.S. counterparts, frequently acquiring producing properties and returning to the public markets to raise capital to fund that growth, while U.S trusts have mostly distributed income from existing cash flow without growth. By year-end 1996, royalty trusts had more than C$3 billion in market capitalization. In a manner previously uncharacteristic of royalty trusts, many of these pursued an aggressive acquisition and development strategy resulting in an aggregate market cap of C$12 billion today. "In the past five years, Canadian royalty trusts have completed nearly C$7 billion of acquisitions and development, adding more than 900 million barrels of oil equivalent (BOE) of reserves," says Dirk M. Lever, who is with National Bank Financial, Calgary, and widely regarded as the premier analyst covering Canadian royalty trusts. What about south of the border? U.S. operators created eight new royalty trusts during the 1990s. All but one have a market capitalization of about $100 million, the exception being Hugoton Royalty Trust with a market cap of $600 million. Unlike their Canadian cousins, U.S. trusts have not added reserves in any significant amount, nor have they issued new units during this period. New U.S. trusts law Prior to 1997, U.S. tax law prevented royalty trusts from issuing new units or growing their asset base. To qualify for tax exemption they were expected to liquidate their asset base. To deviate from this would result in reclassification as a corporation and they would be subject to taxation at the entity level, resulting in two tiers of taxation (at the trust level and to unit-holders). But, this constraint was changed in 1997 by the IRS, making it possible for a royalty trust to make an election of the type of tax treatment it would receive. The result was that new royalty trusts could grow their asset base and offer additional units to the public to fund growth. At least two companies recognized this opportunity. In July 1999, Ocean Energy Inc. filed to form Ocean Energy Royalty Trust, intending to offer 75% of the units to the public. Ocean would have conveyed to the trust a 45% net profits interest in properties in the Arkoma Basin in Oklahoma and Arkansas and in the Bear Paw Basin in Montana. Partnership treatment would have meant no federal income tax on the entity. Ocean withdrew the offering, however, because the assets were sold in a private transaction. In 2002, Treasure Island Royalty Trust was formed by Newfield Exploration Co. as part of its merger with EEX Corp. Steve Campbell, investor relations officer with Newfield, says Treasure Island offered a "way to bridge a valuation gap" relating to a deep exploration concept in the Gulf of Mexico. EEX shareholders could elect a portion of EEX shares being exchanged for Newfield shares to be exchanged instead for Treasure Island units. Those who made this election, which was oversubscribed by three times and had to be allocated, had a means to participate in any future success from this concept. At this time there are no reserves or production associated with Treasure Island. Absent these two events, there have been no other serious efforts in the U.S. to use existing royalty trusts in an acquisition and development strategy. "The check-the-box regulations that became effective January 1, 1997, would allow an entity to look like a royalty trust but act like an MLP [grow and offer more units]. This seems to be a little-known fact," says Barry R. Miller, an attorney with Vinson & Elkins LLP, Houston, who has extensive experience in structuring MLPs and royalty trusts. In spite of the differences in application of the royalty trust structure between the U.S. and Canada, the performance in both markets has been remarkably similar. Unit-holders have enjoyed excellent results in both Canada and the U.S. Benefits vs. challenges A low cost of capital is a motivation for an existing or new trust in its pursuit of growth through development and acquisitions. Not paying federal income taxes at the trust level creates incremental cash. This incremental cash is an undisputed competitive advantage for the trust in funding operations, servicing debt and paying distributions to unit-holders. This is true in Canada, with royalty trusts paying premiums that have been 25% higher than other buyers can pay. Canadian federal income tax rates are much higher than in the U.S., suggesting that some of the competitive advantage could be eroded in attempts to apply the model in the U.S. Producers considering a royalty trust to monetize existing assets don't have to face the loss-of-control issue inherent in a normal divestiture. By retaining the working interest in the properties, the sponsor retains a high level of control and maintains a presence in the region, giving rise to potential strategic benefits such as knowledge-sharing. The sponsor can also retain ownership in some of the trust units. These two forms of retained interest provide the added benefit of creating alignment between the sponsor and the unit-holders, a great feature when marketing units to the public. This is precisely the structure contemplated in Ocean's proposed royalty trust, where initially they would have retained a 55% working interest in the conveyed properties and ownership of 25% of the units. Unlike the treatment received by MLPs in the U.S., where conveyance of property into the partnership and the subsequent sale of partnership units do not create a taxable event, U.S. royalty trusts are tax-challenged. Asset conveyance to a royalty trust is not a taxable event, but the proceeds from the sale of trust units to the public are taxable. Greg Pipkin, head of global upstream for Lehman Brothers, suggests this makes royalty trusts "tax inefficient, as the asset tax basis is usually low." There is a significant reporting and investor relations obligation associated with the formation and ongoing operation of a royalty trust. It is registered with the SEC and makes periodic filings and reports much like a corporation and must provide tax information to unit-holders. As the market matures, more royalty trusts will compete for fewer assets that will meet the stringent quality requirements. Deals will become more difficult to find and execute and the potential will exist for buyers to either lower their standards or pay too much. Already, some Canadian trusts are eyeing U.S. assets to buy. The future for royalty trusts The excellent performance royalty trusts have displayed, from the unit-holder standpoint, has been influenced by low interest rates and high oil and gas prices. Investors need to recognize the impact these factors have had as they contemplate future investment decisions. Lever says he sees inherent beauty in the structure. "Recent market conditions have made them a safe haven for investors. They are extremely transparent and their operations are predictable." Longer-term, under normal commodity-price and interest-rate scenarios, royalty trust performance will likely fade from current stellar levels. But with the right assets, conservative capitalization practices and a quality management team, a royalty trust should offer long-term returns above the cost of money. Producers have many alternatives available to raise capital; the royalty-trust structure should be considered one. For a producer with mature, long-life reserves with relatively low levels of reinvestment capital required, a royalty trust can offer a low-cost source of money to fund strategic growth options elsewhere. Royalty trust competition and a lack of quality target acquisitions will challenge operators to continue growth without eroding unit-level performance. For those that do find the right opportunity, the retail investor market appears able to absorb still more units. Garry Tanner, chief operating officer at Enerplus Resources Fund, Canada's largest conventional oil and gas trust, says, "At C$12 billion, the Canadian market has shown tremendous growth and the current market indicates this growth will continue. Potential liability issues for unit-holders are being addressed and will open the door for institutional investors." The business model is sustainable because of tax efficiencies, risk mitigation (asset quality, low debt and quality management teams) and value creation. The business has evolved from more of a financial engineering-driven model to one where technical and operating excellence is driving value creation within the sector, he says. In the U.S., the wounds of the 1980s appear to have been healed, as Canadian royalty trusts that have sold units on the NYSE have met eager buyers. The market for U.S. royalty trusts has not been sufficiently tested since the check-the-box rules were adopted. U.S. royalty trust market capitalization is currently one third of that in Canada. Given the size of the U.S. equity market it should not be a major challenge to sell any reasonably constructed royalty trust offering. There is clearly an early mover opportunity on a least two fronts: tap into the pool of investors looking for high-yield investments with tax-deferment features, and leveraged competitive access to quality investments. In an immature royalty trust M&A arena, the first company to choose this route can pick and choose from a large pool of opportunities. Steve McDaniel, managing director in Merrill Lynch's global energy and power group, who has followed the evolution of the Canadian royalty trust sector, thinks the relative maturity of many basins in the U.S. creates an argument for the growth of a U.S. royalty trust market. Notwithstanding their history, McDaniel sees the potential for a win-win solution for both investor and oil and gas company issuer, considering the current weakness in public oil and gas valuation levels and a yield-starved investment environment. Key drivers of success will be understanding and minimizing uncertainty, risk management, tax basis suitability, and proper "yield-based" pricing, with consideration of the asset's depletion characteristics, he adds. David Roussel is a project manager for Carnrite Consulting Group Ltd., a management consulting firm based in The Woodlands, Texas.

Recommended Reading

TGS Starts Up Multiclient Wind, Metaocean North Sea Campaign

2024-05-07 - TGS is utilizing two laser imaging and ranging buoys to receive detailed wind measurements and metaocean data, with the goal of supporting decision-making in wind lease rounds in the German Bright.

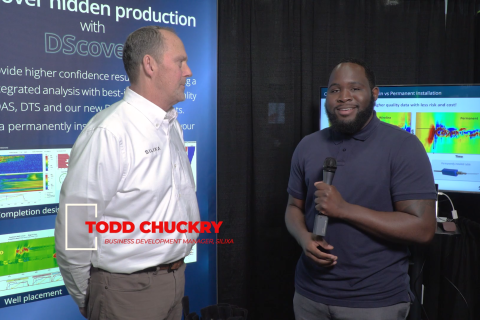

Exclusive: Silixa’s Distributed Fiber Optics Solutions for E&Ps

2024-03-19 - Todd Chuckry, business development manager for Silixa, highlights the company's DScover and Carina platforms to help oil and gas operators fully understand their fiber optics treatments from start to finish in this Hart Energy Exclusive.

CERAWeek: AI, Energy Industry Meet at Scary but Exciting Crossroads

2024-03-19 - From optimizing assets to enabling interoperability, digital technology works best through collaboration.

Cyber-informed Engineering Can Fortify OT Security

2024-03-12 - Ransomware is still a top threat in cybersecurity even as hacktivist attacks trend up, and the oil and gas sector must address both to maintain operational security.

Forum Energy Signs MOU to Develop Electric ROV Thrusters

2024-03-13 - The electric thrusters for ROV systems will undergo extensive tests by Forum Energy Technologies and SAFEEN Survey & Subsea Services.