Riviera Resources also signed an agreement on Aug. 6 for the sale of its interest in certain Anadarko Basin properties located throughout central and northwest Oklahoma. (Source: Hart Energy; Shutterstock.com)

After completing over $500 million worth of asset sales since its spin off from Linn Energy, Riviera Resources Inc. is now looking to exit the upstream space altogether.

In an Aug. 6 release, the Houston-based oil and gas company said it had started to shop its remaining upstream assets despite already narrowing its multibasin portfolio to focus only in Oklahoma following a steady stream of asset sales.

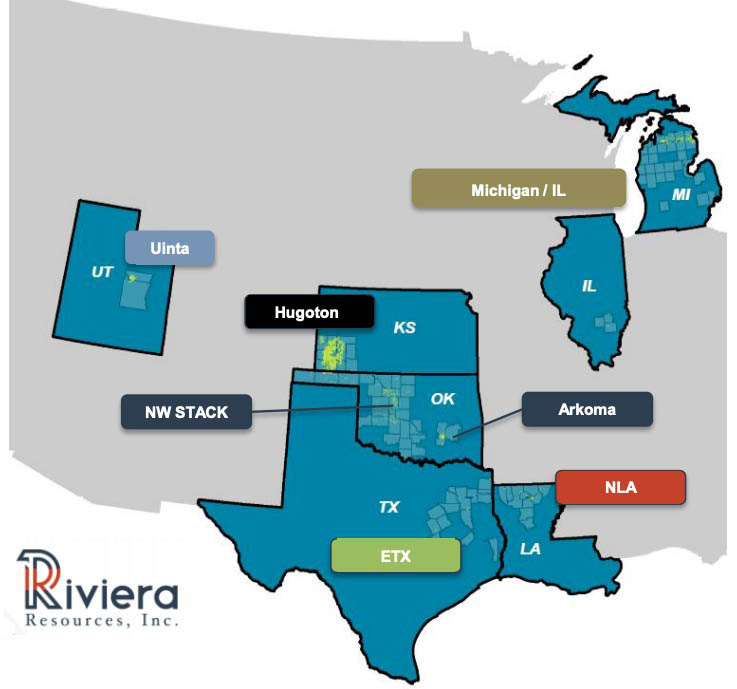

Riviera formed in 2018 through the spin off of Linn Energy’s portfolio of mature, low-decline assets located throughout the U.S. The company also owns Blue Mountain Midstream LLC, a gathering and processing business focused in the Merge, SCOOP and STACK plays of Oklahoma.

Since the spinoff, though, Riviera has gradually been monetizing assets from the multibasin portfolio it inherited from Linn. Last year, the company generated over $500 million in proceeds through strategic monetizations, returning more than $400 million of capital to its shareholders, according to a release from late 2019.

Divestitures have continued into 2020 with the company closing four transactions so far this year, generating aggregate proceeds of approximately $69 million. Assets sold in 2020 include properties located in the Uinta Basin (closed January), the Overton Field in East Texas (closed January), the Personville Field also in East Texas (closed February), and its Oklahoma City office building (closed February).

The company also has two pending transactions comprised of a recent deal for its North Louisiana properties plus a definitive agreement, which Riviera said it signed on Aug. 6, to sell interest in certain Anadarko Basin properties for $16 million. The Anadarko sale includes approximately 2,100 wells located in 14 counties throughout central and northwest Oklahoma averaging about 28 MMcfe/d of production.

As for the company’s remaining upstream portfolio, all located in Oklahoma, CEO David Rottino said Riviera had engaged EnergyNet to market those assets. Plans are for the transactions to close by fourth-quarter 2020.

“Once we close these remaining transactions, it will result in a complete exit from the upstream business,” Rottino said in a statement on Aug. 6. “In addition, we continue to work closely with Tudor, Pickering, Holt & Co. to explore a potential sale or merger for Blue Mountain.”

The North Louisiana asset sale is expected to close third-quarter 2020, while closing of the Anadarko sale announced Aug. 6 is expected for the fourth quarter.

Recommended Reading

Oil and Gas Chain Reaction: E&P M&A Begets OFS Consolidation

2024-04-26 - Record-breaking E&P consolidation is rippling into oilfield services, with much more M&A on the way.

Exxon Mobil, Chevron See Profits Fall in 1Q Earnings

2024-04-26 - Chevron and Exxon Mobil are feeling the pinch of weak energy prices, particularly natural gas, and fuels margins that have cooled in the last year.

Marathon Oil Declares 1Q Dividend

2024-04-26 - Marathon Oil’s first quarter 2024 dividend is payable on June 10.

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.

Energy Transfer Ups Quarterly Cash Distribution

2024-04-25 - Energy Transfer will increase its dividend by about 3%.