Enbridge Inc. is increasing apportionment on its Mainline pipeline system, which ships the bulk of Canadian crude exports to the U.S., as demand to transport barrels climbs due to rising production and colder weather.

Enbridge will apportion December deliveries on its heavy crude system by 11% and ration space on the light oil system by 13%. The rationing is the highest it has been since last winter and comes after a period of very low or zero apportionment in 2022.

Higher apportionment, or rationing of pipeline space, on the 3.1 million-bbl/d Mainline system could lead to crude getting backed up in Alberta and weigh on prices at the Hardisty storage hub, where benchmark Canadian heavy oil is already trading at a steep discount to U.S. grades.

“If this is the beginning of real additional tightness it’s going to really hurt,” said Rory Johnston, founder of the Commodity Context newsletter. “Having a transportation backlog on top of the quality discount would be a double whammy that the patch does not want to see right now.”

Apportionment typically picks up over the winter when production in Canada is usually at its highest, Johnston said. Canadian oil producers also have to add a higher proportion of diluent, an ultra-light oil, to viscous bitumen so it can flow through pipelines in cold weather, increasing volumes.

Signs of increased congestion on Canadian export pipelines come on top of a prolonged period of weak demand for Western Canada Select (WCS), the benchmark Canadian heavy grade, in the U.S. Midwest and Gulf Coast.

Still, apportionment on Canadian export pipelines remains well below historical levels, which until as recently as last summer hit over 50% of some parts of the system.

Congestion dropped dramatically after Enbridge completed its Line 3 replacement project last October, adding 370,000 barrels per day of capacity to the export network.

There was no apportionment at all on the Mainline from March to July this year, according to Enbridge data. In November and October apportionment was 2% on light and heavy oil pipelines.

Recommended Reading

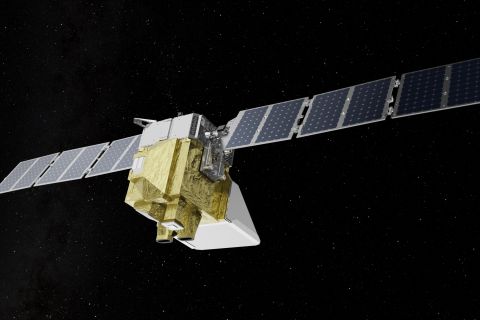

Markman: Is MethaneSAT Watching You? Yes.

2024-04-05 - EDF’s MethaneSAT is the first satellite devoted exclusively to methane and it is targeting the oil and gas space.

US Finalizes Big Reforms to Federal Oil, Gas Drilling

2024-04-12 - Under the new policy, drilling is limited in wildlife and cultural areas and oil and gas companies will pay higher bonding rates to cover the cost of plugging abandoned oil and gas wells, among other higher rates and costs.

US EPA Expected to Drop Hydrogen from Power Plant Rule, Sources Say

2024-04-22 - The move reflects skepticism within the U.S. government that the technology will develop quickly enough to become a significant tool to decarbonize the electricity industry.

Exclusive: Dan Romito Urges Methane Mitigation Game Plan

2024-04-08 - Dan Romito, the consulting partner at Pickering Energy Partners, says evading mitigation responsibility is "naive" as methane detection technology and regulation are focusing on oil and gas companies, in this Hart Energy Exclusive interview.

New US Rules Seek to Curb Leaks From Drilling on Public Lands

2024-03-27 - The U.S. Interior Department finalized rules aimed at limiting methane leaks from oil and gas drilling on public lands.