Good reporting should no longer be seen as an overhead but an opportunity to become a real differentiator, says IsoMetrix COO Dr. Giles Nelson. (Source: Shutterstock.com)

ESG reporting standards have significantly changed in the last year alone, with more developments expected on the horizon for 2022 and beyond.

In a historic move, the Securities and Exchange Commission said that companies would be required to disclose their greenhouse gas emissions and be held to account for their climate promises under a proposal published on March 21.

Digitalization can play a key role in streamlining the ESG reporting process, making it more efficient and auditable for investors and regulators, while reducing many of the manual tasks.

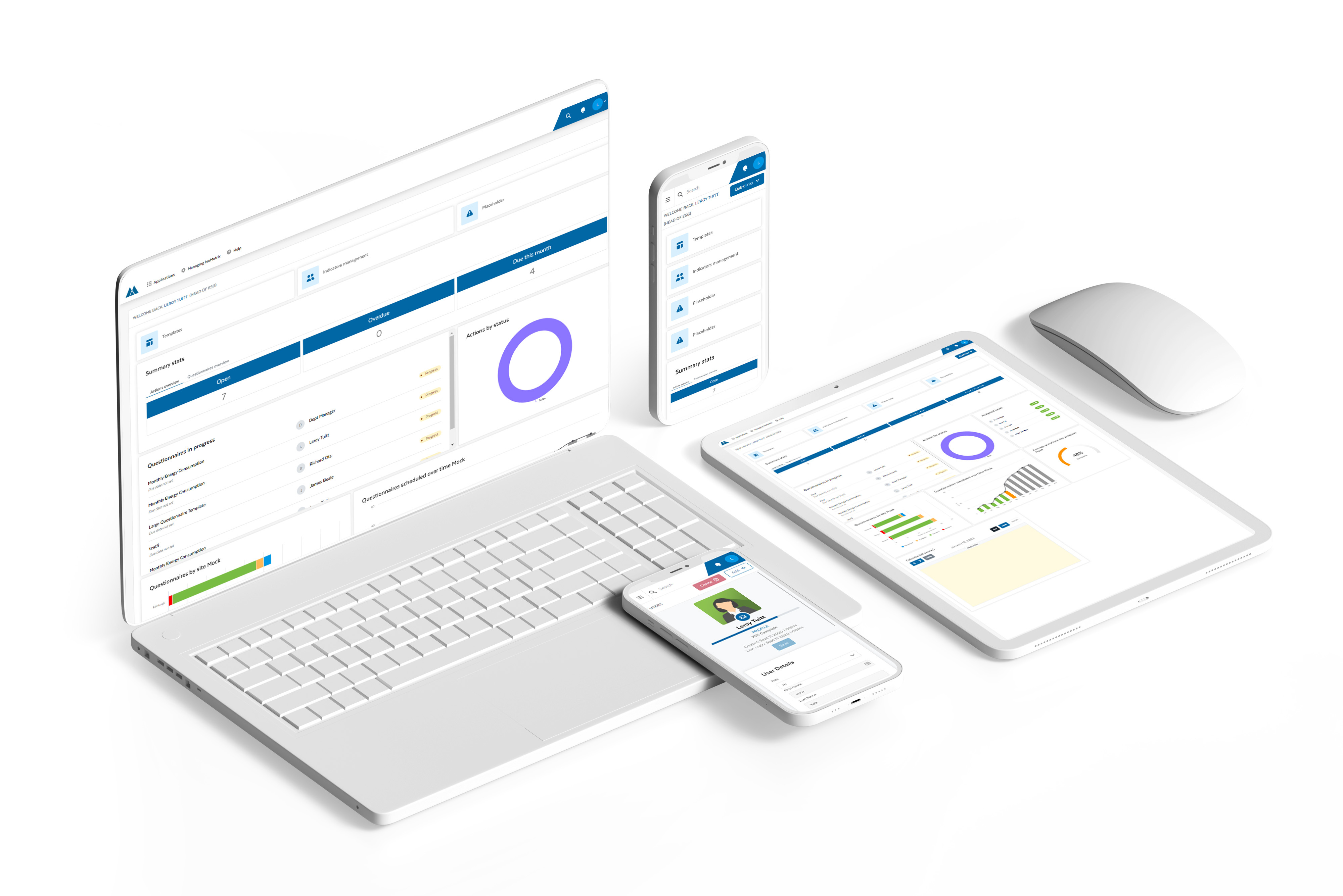

Risk management software developer IsoMetrix recently launched an ESG management tool to help organizations comprehensively manage and report on their ESG and sustainability performance. Dr. Giles Nelson, COO of IsoMetrix, talks more about the new tool and why this is a critical time for companies to put a stake in the ground for ESG reporting.

Hart Energy: IsoMetrix’s new system is designed to help companies in collecting key data necessary to report ESG metrics efficiently and accurately. Tell us more about it.

Nelson: At IsoMetrix we’ve always helped organizations develop efficient, centralized systems to capture and report progress in EHS and ESG. With the ESG landscape evolving, we knew organizations were going to face new challenges. We did extensive research with current and prospective customers to drill down on their specific pain points. We discovered, for example, a lot of companies depend on spreadsheets to compile and analyze information, have difficulty using emerging ESG standards due to a lack of expertise and experience, and don’t have good methods to facilitate collaboration between departments.

This was the reason we built IsoMetrix Lumina and this is the reason we’re offering first a state-of-the-art, all-in-one ESG application. It enables companies to efficiently collect data and report ESG metrics accurately and in alignment with industry standards and frameworks. We’ve also prioritized ease of use for set-up and implementation of reporting processes.

Some of the features we’re excited to share include the ability to gather data directly from team members using data requests, inspections, and surveys; a powerful calculation engine to measure carbon footprint; built-in ESG reporting standards that are updated in real-time; and a powerful analytical layer that allows organizations to interrogate and visualize data. We also make available specialized advisory partners to support ESG initiatives.

Hart Energy: Can you comment on the need for energy companies to commit to ESG reporting?

Nelson: There has never been a more critical time for companies to put a stake in the ground when it comes to ESG reporting.

First, it’s becoming harder to ignore the benefits of good ESG reporting and ESG best practices. A growing number of investors have gone on record committing to put significantly more capital into companies with a good ESG record. Good reporting should no longer be seen as an overhead but an opportunity to become a real differentiator.

On the flip side, companies will soon no longer be able to bypass reporting requirements or get by with fake or lightweight reports. The SEC's proposed regulations— in addition to a commitment to a more scrutinous review of ESG compliance—for both ESG investors and the companies in which they invest.

Hart Energy: What are your thoughts on the current reporting standards and their complexities for energy companies?

Nelson: ESG reporting is typically done quarterly or annually. But, increasingly, investors can ask for ESG reports in a more ad hoc fashion. In addition, the inception of the new International Sustainability Board could bring about new standards on a global level. For companies in the U.S., the SECs proposed regulations will only add to these requirements.

Having a 360-degree view of all of the relevant information is the only way to effectively make operational, management and product decisions. It will also make it easier to prioritize resources, reduce risk and accurately respond to both regular and ad-hoc reporting requests and requirements. Having a comprehensive ESG management system with multiple functionalities in place is also the best way to prepare for future regulations.

Hart Energy: With calls for more transparency and rigor, how, according to you, will ESG reporting evolve and how can oil and gas prepare for it?

Nelson: Companies in the oil and gas industry are already accustomed to a higher degree of scrutiny than many other industries, but it’s not enough to simply put together an ESG report that looks good each time a request comes in.

For oil and gas companies, it’s time to weave ESG reporting and practices into the fabric of your company.

To prepare for the new world of more frequent and more stringent ESG reporting, foster a culture that places the utmost importance on the EHS and ESG. Communicate this priority through the organization regularly and consistently. It’s also beneficial to appoint and empower an internal Head of Sustainability. This person can provide guidance and oversight and maintain accountability to both internal and external stakeholders. ESG is fast becoming an everyday concept for every oil and gas project, and companies will have to adapt. The smart ones will welcome this louder cry for transparency as a way to stand out amongst their peers.

Recommended Reading

Marathon Oil Declares 1Q Dividend

2024-04-26 - Marathon Oil’s first quarter 2024 dividend is payable on June 10.

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.

Energy Transfer Ups Quarterly Cash Distribution

2024-04-25 - Energy Transfer will increase its dividend by about 3%.

ProPetro Ups Share Repurchases by $100MM

2024-04-25 - ProPetro Holding Corp. is increasing its share repurchase program to a total of $200 million of common shares.

Baker Hughes Hikes Quarterly Dividend

2024-04-25 - Baker Hughes Co. increased its quarterly dividend by 11% year-over-year.