Seeking to shore up environmental support during an election year, President Joe Biden’s administration is weighing a tougher test for LNG export facilities. (Source: Shutterstock.com)

U.S. LNG export terminal projects may be facing an election-year test.

The Biden administration wants to tighten regulations on the LNG export terminals planned or under construction in the U.S. for environmental concerns, according to two recent reports.

The move could place an obstacle in front of many companies that have spent both years and billions of dollars developing plans to export LNG and take advantage of robust foreign demand.

Politico and Bloomberg, both citing anonymous sources, have reported that the U.S. Department of Energy (DOE) is reviewing whether the government should consider climate change as a national interest when judging the viability of a proposed LNG export facility during the permitting process.

Analysts see the move as the way for President Biden to signal his administration’s seriousness towards curbing greenhouse gases during an election year. If implemented, the review would update an existing process. All U.S. LNG export projects have to complete a public interest review by the DOE.

Such a policy could be applauded by environmentalists but would likely anger many entities the federal government is allied with—hindering the Biden administration’s ultimate goal of curbing emissions, said Tom Sharp, director of permitting intelligence at Arbo.

“Export authorizations for countries with which the United States has Free Trade Agreements in place are essentially automatically deemed in the public interest by statute,” Sharp said. “Given that, any attempt to chill the authorization process puts DOE in the crosshairs of two critical policy goals—energy security, support for our allies and displacement of overseas coal—which conflicts with the administration’s desire to move away from fossil fuels domestically.”

Natural gas emits less carbon when burning. Natural gas produces about 117 lb of CO2 per MMBtu, while coal produces 200 lb of CO2 per MMBtu. In the last decade, the U.S. has become the world’s leading LNG exporter, with a capacity of 11.4 Bcf/d.

Exporters have invested billions with the expectation that the export market will continue its rapid growth. NextDecade expects the first phase of the Rio Grande LNG Export Terminal expansion project, for example, to cost about $18.4 billion. Export capacity is expected to more than double to 24.3 Bcf/d by the end of 2027.

An analyst for the Institute for Energy Economics and Financial Analysis (IEEFA), an organization dedicated to accelerating the transition away from fossil fuels, said updating the current process would reflect new realities of gas markets to the American consumer’s benefit.

“To IEEFA, an update to the public interest review seems absolutely reasonable,” said Clark Williams-Derry, an energy finance analyst for the organization. The IEEFA predicts the current export growth for U.S. natural gas may cause domestic prices to rapidly increase and hurt consumers.

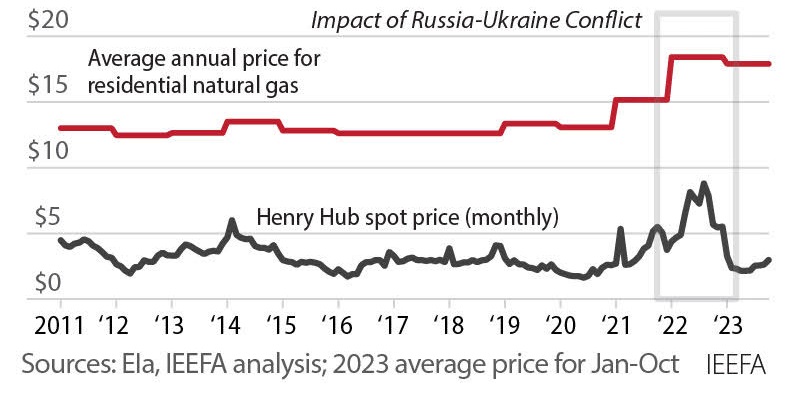

According to the organization’s data, after hitting record high prices in the winter of 2022, the commodity price for natural gas has since dropped more than $5 to about $3/MMBtu today. Residential gas customers have not experienced the same drop in their utility bills, with most households still paying prices comparable to 2022 at the end of 2023.

The organization said the growing LNG export market is to blame.

“This raises critical questions about whether boosting gas exports is in the public interest and whether the existing public interest test has fully and fairly assessed the consumer and environmental impacts of the industry,” Williams-Derry said.

Some analysts note that the relationship between residential gas prices and rising LNG exports is more complicated. In a report by the Center for Strategic and International Studies, said that the overall increased production of U.S. natural gas in the past decade has meant an abundant supply for both utilities and exports. Natural gas inventories as reported by the U.S. Energy Information Administration are well above the 5-year average.

Regardless of the administration’s ultimate decision, Sharp said it would most likely not have an effect on the current level of LNG exports, as most agreements in the industry are made on a 20-year basis.

“It remains to be seen how big an issue U.S. gas exports will be on campaign trail, if at all, but there aren’t a lot of actions available to Biden to stop what is already flowing,” he said.

Recommended Reading

Shipping Traffic Freezes Up in Port Waters After Baltimore Bridge Collapse

2024-03-26 - U.S. port of Baltimore traffic was suspended until further notice following a bridge collapse. At least 13 vessels expected to load coal were anchored near the port at the time of the incident.

Segrist: The LNG Pause and a Big, Dumb Question

2024-04-25 - In trying to understand the White House’s decision to pause LNG export permits and wondering if it’s just a red herring, one big, dumb question must be asked.

US NatGas Flows to Freeport LNG Export Plant Drop Near Zero

2024-04-11 - The startup and shutdown of Freeport has in the past had a major impact on U.S. and European gas prices.

US Natgas Prices Hit 5-week High on Rising Feedgas to Freeport LNG, Output Drop

2024-04-10 - U.S. natural gas futures climbed to a five-week high on April 10 on an increase in feedgas to the Freeport LNG export plant and a drop in output as pipeline maintenance trapped gas in Texas.

Exclusive: Chevron Balancing Low Carbon Intensity, Global Oil, Gas Needs

2024-03-28 - Colin Parfitt, president of midstream at Chevron, discusses how the company continues to grow its traditional oil and gas business while focusing on growing its new energies production, in this Hart Energy Exclusive interview.