Capital efficiency, leverage and the effects of shareholder-friendly activity all pose risks after a brighter environment in 2018, according to recent reports by Moody’s. (Source: Hart Energy/Shutterstock.com)

E&Ps shaved development and production costs substantially after the commodity price downturn in 2014, but those gains may now be hobbled.

Recent reports from Moody’s examined how credit conditions are changing for the North American E&P sector in a time of more modest and range-bound commodity prices. The analysts determined capital efficiency, leverage and the effects of shareholder-friendly activity all pose risks after a brighter environment in 2018.

Moody’s review of 40 independent oil and gas companies indicated that “range-bound commodity prices today, cost inflation and geological issues will all limit further gains in capital efficiency during 2019-20.” Companies included in the reports consisted of several large E&Ps such as ConocoPhillips Co., Occidental Petroleum Corp. and EOG Resources Inc.

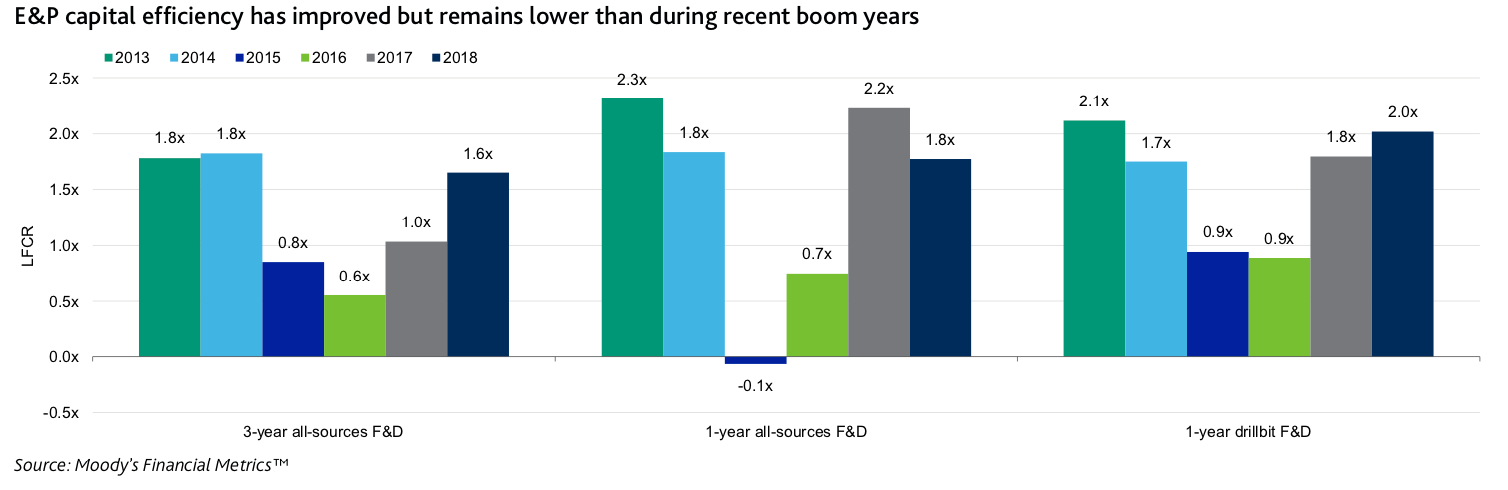

The research firm’s study of capital efficiency showed that drilling costs are moving higher based on the three-year all-source leveraged full cycle ratio (LFCR).

The Moody’s analysts calculate LFCR by dividing a company’s leveraged cash margin by its three-year average all-sources finding and development cost. Moody’s said that investment–grade E&Ps typically have LFCRs of at least two times, with a one-times LFCR indicating a company’s ability to replace reserves at breakeven costs.

Largely underpinning LFCR results for E&Ps are commodity prices. According to Moody’s assessment, West Texas Intermediate (WTI) oil prices averaged $66 per barrel (bbl) in 2018, compared to $51/bbl in 2017 and $43/bbl in 2016.

“While operating and capital cost optimization is one component of improvement in the LFCR, the other significant component of the LFCR is the commodity price itself,” Moody’s analysts said.

In fact, for E&Ps to maintain a consistent LFCR of 1.5 times or more, WTI oil prices need to average $60/bbl or higher—“especially with drilling costs increasing and natural gas prices still weak, at less than $3 [per million British thermal unit],” the analysts said.

Moody’s outlook is for oil prices to remain between $50 and $70 through 2020, and natural gas at between $2.50 and $3.50. The analysts noted that E&Ps need $60 oil or above to improve LFCR.

Higher commodity prices are also similarly the fulcrum in companies’ attempts to reduce debt.

“Despite boosting financial flexibility, very few E&P companies will be able to reduce debt in 2019 after sufficiently covering reinvestment needs and shareholder distribution,” Moody’s analysts said. “Higher prices are needed for the sector to further delever since companies can do little to further reduce costs or repay debt in today’s price environment.”

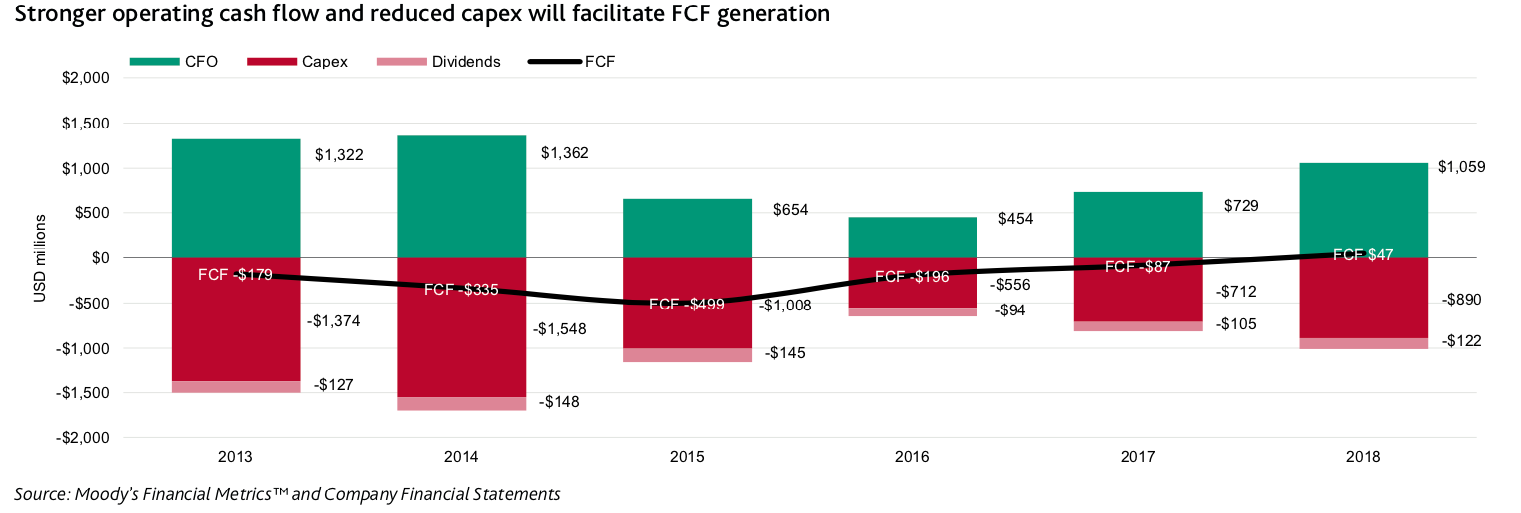

With companies pressured to live within cash flow and return money to shareholders, the ability to reduce leverage is bleak. Though, Moody’s analysts said E&Ps have indeed made gains in their efforts to satisfy investors on this front. Last year, 15 of the 40 E&Ps produced free cash flow, vs. just four in 2014.

“In 2018, 50% of the 14 investment-grade E&Ps and 31% of the 26 speculative-grade companies delivered free cash flow,” the analysts said. “Even more importantly, they achieved this level of operating cash flow in 2018 with far less capital investments and lower commodity prices, spending 42% less capital than in 2014, and with commodity prices roughly 30% lower.”

Additionally, Moody’s analysts noted that aggregate operating cash flow for the group was much stronger in 2018 than during 2015-17, and was only 22% lower than in 2014.

“Moreover, these 40 companies as a group generated free cash flow for the first time in 2018, indicating an enhanced ability to tolerate lower commodity prices,” the analysts said.

Moody’s found that average drilling and completion costs declined significantly during 2015-18, but the analysts believe drillbit finding and development (F&D) costs unlikely to decline any further, with rising service costs offsetting any drilling efficiencies. In particular, they said a scarcity of new equipment will prompt a rise in drilling costs this year and next.

As for those who might look to buy rather than drill, the analysts noted that “unit costs for acquisitions in 2018 were 70% higher than in 2017.” Moody’s believes acquisition costs will only become more punitive this year and going forward. The analysts see acquisition F&D increasing “as valuations get richer and acquisitions get pricier.”

“Gaining scale in prolific basins is going to become increasingly important as companies compete for good drilling inventory and to secure infrastructure resources such as pipeline capacity and water handling,” the analysts said.

Another sign of coming challenges: “Negative reserve revisions returned in 2018 as companies tempered their five-year growth outlooks.”

Lastly, Moody’s weighed in on the dangers of “aggressive share buybacks” that could offset rising cash flow going forward, making it harder for E&Ps to grow and weakening their credit quality as they fail to reduce debt.

“Higher cash flow and efficiencies should ultimately enhance shareholder returns, but only when investors feel assured that any fall in commodity prices will be temporary, and that rising prices will persist for longer,” the analysts said.

Recommended Reading

Imperial Expects TMX to Tighten Differentials, Raise Heavy Crude Prices

2024-02-06 - Imperial Oil expects the completion of the Trans Mountain Pipeline expansion to tighten WCS and WTI light and heavy oil differentials and boost its access to more lucrative markets in 2024.

ARC Resources Adds Ex-Chevron Gas Chief to Board, Tallies Divestments

2024-02-11 - Montney Shale producer ARC Resources aims to sign up to 25% of its 1.38 Bcf/d of gas output to long-term LNG contracts for higher-priced sales overseas.

ConocoPhillips CEO Ryan Lance Calls LNG Pause ‘Shortsighted’

2024-02-14 - ConocoPhillips chairman and CEO Ryan Lance called U.S. President Joe Biden’s recent decision to pause new applications for the export of American LNG “shortsighted in the short-term.”

Association: Monthly Texas Upstream Jobs Show Most Growth in Decade

2024-04-22 - Since the COVID-19 pandemic, the oil and gas industry has added 39,500 upstream jobs in Texas, with take home pay averaging $124,000 in 2023.

EIA: Oil Prices Could Move Up as Global Tensions Threaten Crude Supply

2024-02-07 - Geopolitical tensions in the Middle East and ongoing risks that threaten global supply have experts questioning where oil prices will move next.