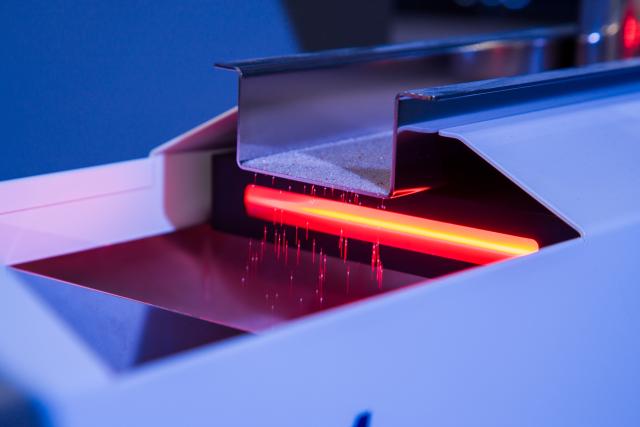

Particle analyzers have the ability to quality-test a batch of sand within five minutes and can determine whether or not the sand meets or exceeds API and customer standards. (Source: Shale Support)

Even as the oil and gas industry begins to rebound, budget constraints push energy producers to keep rig counts low and completion schedules light. Operators need to maximize every completion program in hopes of achieving steady producing wells. Now more than ever, quality, accuracy and efficiency can make or break a well. There is little margin for error. A key to the completion stage of an oil and gas well is hydraulic fracturing, which requires large quantities of sand (proppant) and water. With a depressed oil market, something as simple as fracture sand can have a significant impact on field development economics.

Proppant’s role

There are various types of proppants used across the industry, from sand that is mined and then chemically treated to engineered products made from ceramics and other materials. Proppant solutions directly impact completion economics, treatment size and the well performance. Fracture sand is the most widely used option in the industry. An average shale well requires up to 5 million pounds of fracture sand during the completion phase depending on its location and formation characteristics. Energy producers spend about $300,000 on fracture sand per well.

Without proper quality control (QC) and logistics management, proppant solutions can cause major problems for oil and gas operations. One mistake and an entire order of fracture sand is rendered useless.

To better understand this, it’s important to look at fracture sand quality on a granular level. The physical aspects of the proppant are key: size, shape, weight and chemical application. Fracture sand does not go from the mine to downhole directly. Once mined, the sand is processed through a series of dryers, screeners and coatings to achieve optimum physical attributes for well performance.

Performance factors include conductivity throughout the life of the well, crush resistance and acid solubility. In addition, rock formations vary by basin and require different proppant solutions to enhance well performance.

Logistics are important as well. Once fracture sand is mined and processed, it is loaded into rail cars for transport to the basin, where it is stored in large silos before a truck delivers it to the well site. Strict QC standards must be maintained to prevent contamination during transport and while stored.

If proppant quality is compromised at any point, the product cannot be pumped down the well. The $300,000 loss is only the beginning for energy producers. They become entangled with the supplier of bad sand, often entering into legal disputes to recoup their initial investment. In addition, no fracture sand means no fracture, and well operations must shut down. The associated costs are considerable as many service companies and suppliers penalize operators for downtime. Energy producers are forced to identify a new vendor and procure another load of proppant on the fly. To top it off, they face the environmental challenge of responsibly disposing of 5 million pounds of tainted fracture sand, another costly outcome. Finally, the operator or drilling contractor runs the risk of a public relations nightmare in communities where fracturing already is seen as an environmentally risky business.

On numerous occasions, Shale Support—a vertically integrated supplier of proppant—has been called in to provide fresh fracture sand following contamination by other suppliers. It strategically integrates quality and logistics to avoid downtime and excessive costs with a QC program.

QC is essential

As the industry enters a new era in efficiency, oilfield service companies and operators are looking to fracture sand providers to maintain quality, accuracy and efficiency. Proppant providers use traditional analysis methods approved and mandated by the International Organization for Standardization (ISO) to determine the quality of the proppant. These methods are time-consuming—a single test can take up to 30 minutes to complete—and the results often are subjective and vulnerable to human error. Traditional methods also lack necessary safeguards to ensure that the proppant arriving at the well site has not been contaminated during the logistics process.

Shale Support mines fracture sand from its properties in Picayune, Miss. With the latest QC technology, the company maximizes the effectiveness of wet mining and drying processes to ensure accuracy and performance of its product.

After fracture sand is treated, the company uses its particle analyzer to quality-test sand from each batch. With the particle analyzer, facility operators know within five minutes whether or not the sand meets American Petroleum Institute (API) and customer standards. Because of the efficiency and superiority in analyzing each sand particle, the particle analyzer provides customers the assurance that the sand they’re ordering is the sand they’ll receive. Additionally, the company maintains samples from every batch of sand ordered in case there are any concerns about quality once the sand leaves its facility.

Once proppant has been tested and is approved to send to a customer, Shale Support moves into its second phase of QC, the Rail Tag System. The particle analyzer uploads results into the system and assigns a unique code that will not allow a rail car to be built or unloaded out of spec. The system mitigates human error and maintains QC safeguards throughout the logistical process by scanning the unique code at various checkpoints throughout the transport process. The Rail Tag System allows real-time tracking of the product as it travels to the well site.

Once the proppant arrives to its delivery location, logistical teams confirm the Rail Tag hasn’t been tampered with (if the seal is broken, there’s the potential a load of sand has been contaminated) and that, once scanned, the details on the sand delivered match the original request.

Logistical efficiency

Shale Support transports its proppants via rail and road to all major U.S. shale plays. The company owns and operates terminals in the heart of the Eagle Ford Shale and Permian Basin. These facilities allow the company to store large quantities of proppant in locations that are strategically located near high amounts of hydraulic fracturing activity. It also means the company maintains control of the proppant from the mine to the well site. If there is a problem with the proppant, the operator and Shale Support can identify it immediately and know exactly when contamination occurred, offering its customers peace of mind.

While the onshore industry looks to 2017 with cautious optimism on production, the pressure to meet quick demands with quality and accuracy is everpresent. Reducing or eliminating the risk of downtime for any well is key to saving operators significant sums of money. Shale Support follows current ISO regulations and uses traditional analysis methods while preparing for industrywide acceptance of particle analyzer data. Embracing new technology and driving innovation to strategically integrate QC and logistics is vital to maintaining efficiency and well productivity.

Recommended Reading

Remotely Controlled Well Completion Carried Out at SNEPCo’s Bonga Field

2024-02-27 - Optime Subsea, which supplied the operation’s remotely operated controls system, says its technology reduces equipment from transportation lists and reduces operation time.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

E&P Highlights: March 15, 2024

2024-03-15 - Here’s a roundup of the latest E&P headlines, including a new discovery and offshore contract awards.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.