Morrison, co-author of the PwC report, spoke with Hart Energy this week about the funding gap in global clean energy finacing and what is needed to increase investment. (Source: Shutterstock)

As the energy industry works to reduce emissions while keeping the world supplied with affordable energy, there are several gaps to bridge on the road to a lower-carbon economy.

In a report released earlier this summer, PwC identified disconnects between existing technologies, infrastructure and investment. Despite progress, including technology lowering costs and improving efficiency, combined with moves by governments to incentivize investment in clean energy, there is still work to be done.

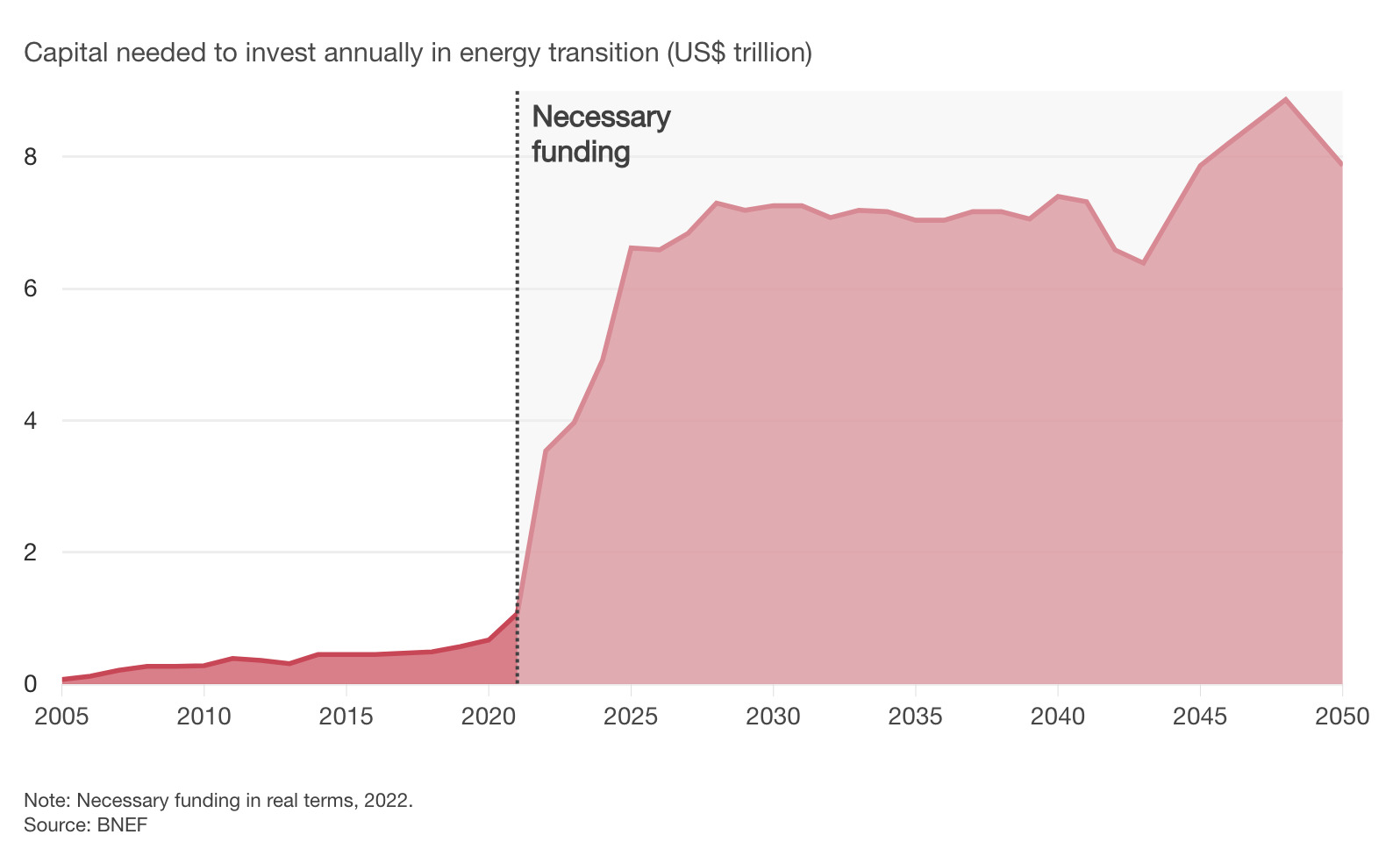

Global clean energy investment has grown, hitting a record high of $358 billion in the first half 2023 and matching that of hydrocarbon investments in 2022 at about $1.1 trillion by BloombergNEF’s estimates. Still, investments are falling short of what experts say is needed to limit global warming to no more than 1.5 C by 2050. Though estimates vary, numbers may run into the trillions of dollars to accomplish energy transition-related targets.

Annual spending must jump to $2.4 trillion annually to achieve net-zero targets, according to Wood Mackenzie’s Energy Transition Outlook. Estimates by the International Energy Agency and the Intergovernmental Panel on Climate Change range from $4 trillion to $6 trillion, PwC said.

“We need more renewables to hit some of these long-term goals,” said Reid Morrison, global energy advisory leader for PwC. However, there also is a need to protect the base, he added, referring to hydrocarbons and nuclear. “The gap is significant in both.”

Morrison, co-author of the PwC report, spoke with Hart Energy this week about the funding gap and what is needed to increase energy investment.

This interview has been edited for clarity, length and style.

Velda Addison (VA): What are some of the leading drivers, in your opinion, for this gap? What is holding potential investors back?

Reid Morrison (RM): Returns. The IRA [Inflation Reduction Act] is one of the smartest pieces of legislation I’ve seen, and it really is doing a good job of incubating and accelerating different industries. When you look at the levelized cost of energy, and then you remove the subsidies, you find that the return rate doesn’t compete with other investment opportunities. And that’s where you start to see the reluctance from investors. I was over in Australia talking to a big infrastructure fund, and they think differently than we do. Infrastructure funds think in 30- and 50-year timeframes. We’re all excited about the IRA, but it has an end date of 2035. So, they ask me a question: if we invest in hydrogen or carbon capture, and it’s a 50-year economic model, is it profitable from 2036 going forward? I was like, don’t know. So, they’re not saying no, but they’re going to be patient because there is no proof that the returns will be there after the subsidies expire.

VA: Is that the case for all forms of renewable energy? Costs have come down for solar, for example, on improving technology. Are some investments more attractive to investors?

RM: I would think so. Solar is probably at the top of the list. Wind, I think, is starting to get some serious questions around its viability. Then, you’ve got technology that I wish would get more focus, like geothermal. To me, it’s the sleeper candidate of the renewable energies. When we get serious about it, I think there’s more geothermal opportunity with a good investment profile than any of the other renewable sources.

VA: Why hasn’t there been much attention to geothermal projects?

RM: I think it has to do with the cost of the well itself and, historically, the locations were in areas that weren’t close to their energy demand centers. So, you’ve got what is called the Ring of Fire in the Pacific, but it’s got a lot of industry there. When you look at the advancement of geothermal and how they’re able now to drill cheaper, they don’t have to go as deep. And there’s a good study by the University of Texas that looks at all the potential geothermal sites, and essentially the tagline is, if we could drill 2 million geothermal wells, we’d satisfy the world’s energy appetite. The Department of Energy has done a similar study, and this makes me think, that technology has not gotten the focus that it needs. But now you can see capital starting to flow to it because now they’re able to drill these and repurpose existing orphaned wells. The technology and the cost curve are starting to come down. Figuring out how to use that energy source closer to the demand centers is going to be what gives it momentum.

VA: What steps can be taken to increase the amount of funding for energy transition-related projects?

RM: I’m going to be a little bit contrarian, but having respect for the traditional energy players and welcoming them to the table. To make this energy transition, it’s going to take deep engineering and science capabilities, and that’s what these companies are great in. To think we’re going to have some startup in a garage that’s going to replace an energy system that took us 150 years to create is just not going to happen. And these engineers geek out on problems like this. Respect for the hydrocarbon industry to be a serious leader in this is one of the key steps.

The second would be the role of the government in this. I think it needs to evolve, just like we have a Federal Reserve for the monetary system. Those leaders are appointed, so they’re not elected, and they can think longer term. We need something similar for energy system oversight that isn’t people trading hopes for votes and putting the energy system at risk because it gets people elected. We’ve seen it in Texas; we had to eat crow. Our energy system, which should be the world’s best, is not as a resilient when it gets really cold. And why? Because we had some policy decisions made by people that didn’t factor in the resiliency of an energy system when you have extreme temperatures.

VA: What makes a project or a company attractive to investors?

RM: Returns.

VA: Returns. It all comes back to returns.

RM: I’m not trying to be trite because I understand the gravity of the question. The industry is no longer viewed as a growth industry, and it’s now going to be measured on its ability to safeguard capital and generate a reliable return. So, it’s no longer, how many more barrels can you produce in the next five years? Because the narrative is not sure if the world is going to need those barrels. So, if you want to attract capital, it’s a matter of appreciating you’re competing with the entire S&P 500. The dividend aristocrats are delivering dividends north of 6%, steady Eddie. If you want to attract investors, you need to be in that 7% to 10% range in the low cycle. And that’s been the conundrum for the industry; they can say we can deliver that 10% dividend when oil prices are at $80/bbl. Okay. The investor is going to ask, well, what about when you’re at $40/bbl? And if you say, well, you know, we’ll break even, then they’re out. But if you say, ‘yeah, we can guarantee a dividend of 6% at $40, $60 that’s 8%’ and you have that model, there’ll be a lot more investors lining up than you would have expected.

VA: Are there any parts of the finance community that are more heavily invested in clean energy, or are there any segments that are specifically targeting clean energy projects and development?

RM: Those that have the luxury of spending a portion of their portfolio on things that don’t have guaranteed returns. They are really wealthy sovereign wealth funds; they are really well-managed infrastructure funds. And they’re looking at this as a 50-year play, not a 10-year play. That shorter-term investor, I think, is the one that’s still sitting on the sidelines waiting for a proven returns model.

VA: Your report touched on gaps in power generation, distribution and storage—areas that are deeply intertwined. It pointed out that is where some of the major gaps are. What does the finance community need to see from developers and regulators in these areas to encourage development, besides returns?

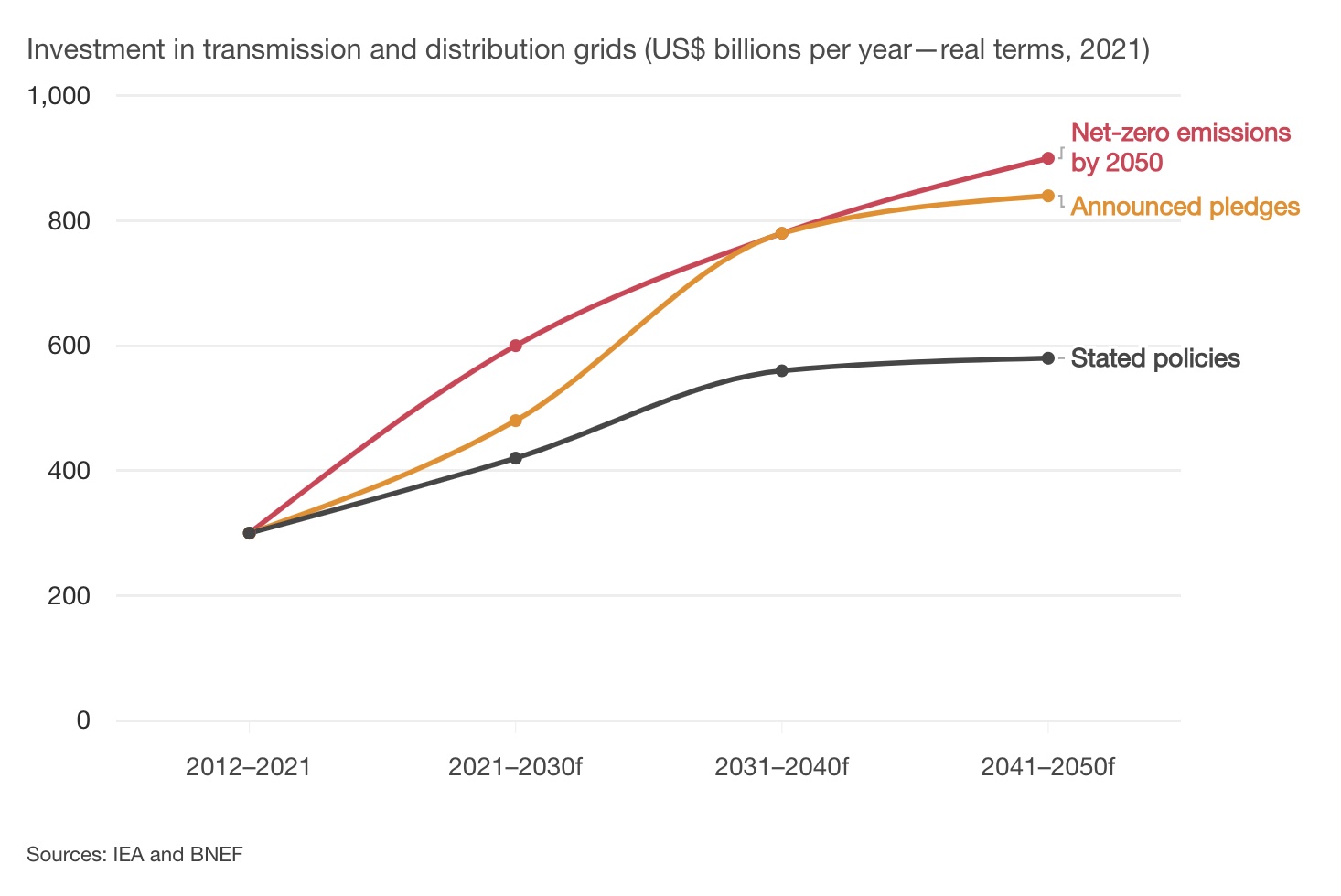

RM: When you look at the transmission and distribution side of things, there are some good projects to invest in. You just want to have certainty that it’s going to get permitting and it’s going to come online. So, I don’t think anybody disputes that the more that we electrify things, the more copper we’re going to need for the transmission distribution. There are investors that want to support those projects. But when you look at the permitting cycle, it sort of becomes a question of, ‘Will it ever get permitted?’ We want to be greener, we want to be reliable and affordable. Well, the permitting process is suffocating a lot of these initiatives that investors would put money into.

VA: Are there certain things that companies seeking investment can do to improve their chances of getting more funding?

RM: Work closer with the government. [The] Department of Energy has done some amazing analysis of the reservoirs for carbon capture and storage, for geothermal, for hydrogen. That stuff’s available for the industry to leverage and use. From a policy standpoint in Europe, the relationship between the companies and the government is a lot more cordial and collaborative. They work together. In the U.S., it’s adversarial and it’s antagonistic. We’re on the same side. We’re on the same planet. We’re not going to find another place that we can live. So, we’ve got to solve this stuff.

When you look at the level of expertise in the government around these new technologies and the capabilities in the energy companies, you can almost see they’re like close cousins, but they don’t work together. If they can start to collaborate in a way that’s respectful, inquisitive and aligned around these moonshot ideas—hydrogen hubs, the scale up of geothermal—I think we get there a lot faster than people expect. But we have to drop the sort of stereotypes that both sides are coming [in] … already on the offensive.

Recommended Reading

ChampionX to Acquire RMSpumptools, Expanding International Reach

2024-03-25 - ChampionX said it expects the deal to extend its reach in international markets including the Middle East, Latin America and other global offshore developments.

Turnco Buys Drill Spec Services to Enhance OCTG Capabilities

2024-04-09 - Turnco said the integration of Drill Spec’s assets will expand its service offerings in West and South Texas.

Beacon Offshore Divests Non-op Gulf of Mexico Interests

2024-04-05 - Beacon Offshore Energy said that with its non-op assets divested, it would turn all of its focus to its Shenandoah and Winterfell assets in the Gulf of Mexico.

Energy Systems Group, PacificWest Solutions to Merge

2024-04-17 - Energy Systems Group and PacificWest Solutions are expanding their infrastructure and energy services offerings with the merger of the two companies.

The JF Petroleum Group Acquires General Contractor GE Goodson Service

2024-04-15 - Following the transaction, GE Goodson will operate as The JF Petroleum Group’s Midland branch on a go-forward basis.