(Source: Shutterstock.com)

Midland, Texas-based ProPetro Holding Corp. acquired cementing company Par Five Energy Services’ assets and business operations, according to a Dec. 4 press release.

The Par Five will be integrated within ProPetro’s existing cementing and operating team and brand, the release stated.

“The transaction is also highly complementary to our current cementing operations, led by Beau Tenney, our vice president of cementing operations, and will allow us to serve both the Midland and Delaware Basin areas of the Permian,” said Sam Sledge, CEO of ProPetro.

RELATED: ProPetro CEO: Next-gen Equipment Demand High Despite Market Headwinds

ProPetro anticipates the acquisition will increase their 2024 adjusted EBITIDA by approximately $10 million and convert approximately 80% to 90% of that into free cash flow, the release said.

Recommended Reading

Chesapeake, Awaiting FTC's OK, Plots Southwestern Integration

2024-04-01 - While the Federal Trade Commission reviews Chesapeake Energy's $7.4 billion deal for Southwestern Energy, the two companies are already aligning organizational design, work practices and processes and data infrastructure while waiting for federal approvals, COO Josh Viets told Hart Energy.

Exclusive: Liberty CEO Says World Needs to Get 'Energy Sober'

2024-04-02 - More money for the energy transition isn’t meaningfully moving how energy is being produced and fossile fuels will continue to dominate, Liberty Energy Chairman and CEO Christ Wright said.

Exclusive: Sabine CEO says 'Anything's Possible' on Haynesville M&A

2024-04-09 - Sabine Oil & Gas CEO Carl Isaac said it will be interesting to see what transpires with Chevron’s 72,000-net-acre Haynesville property that the company may sell.

Exclusive: Chevron New Energies' Bayou Bend Strengthens CCUS Growth

2024-02-21 - In this Hart Energy LIVE Exclusive interview, Chris Powers, Chevron New Energies' vice president of CCUS, gives an overview of the company's CCS/CCUS activity and talks about the potential and challenges of it onshore-offshore Bayou Bend project.

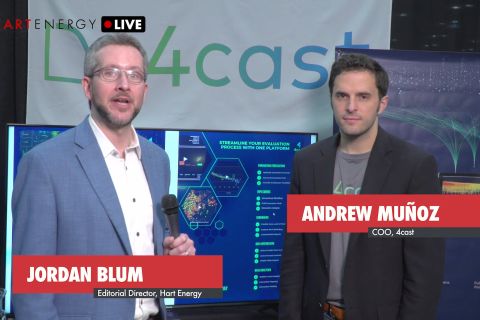

Exclusive: As AI Evolves, Energy Evolving With It

2024-02-22 - In this Hart Energy LIVE Exclusive interview, Hart Energy's Jordan Blum asks 4cast's COO Andrew Muñoz about how AI is changing the energy industry—especially in the oilfield.