NGL prices improved in early September as several ethane crackers returned to service after undergoing unexpected turnarounds. Surprisingly, the biggest price turnarounds were at the Conway, Kan., hub while improvements at the Mont Belvieu, Texas, hub were marginal with ethane prices decreasing despite the increased cracking available.

Both Westlake Chemical Corp.’s Petro 1 Unit in Lake Charles, La., and Dow Chemical Co.’s LHC-8 plant in Freeport, Texas, restarted after undergoing unplanned maintenance. Dow’s planned turnaround at the LHC-8 facility is likely to occur in late fall. According to reports, the planned turnaround at Chevron Phillips Chemical Co.’s Cedar Bayou cracker in Baytown, Texas, is also expected to be pushed back to 2015. In addition, Formosa Plastics Corp. delayed the planned five-week turnaround at its Point Comfort, Texas, Olefins 1 cracker as a result of steady ethylene spot prices caused by tightening supplies. The turnaround has been moved to late October.

While these schedule changes will increase ethane cracking capacity, ExxonMobil Corp.’s Baytown, Texas, Olefins Plant No. 2 was taken offline for a planned 44-day turnaround. Chevron Phillips Chemical’s Port Arthur, Texas, and The Williams Cos. Inc.’s Geismar, La., plants remain offline while expansions are completed. Both facilities are expected to return to service by the end of October.

Ethane’s challenge

Given these turnarounds, ethane prices are likely to remain challenged at least through the rest of the year as supplies are very high. This has caused prices to remain under 30 cents per gallon for the past few months.

This marks three consecutive weak summers for ethane, largely due to turnarounds. It will take some time for the storage overhang to be worked off, but there is hope that low prices, ample supplies and cracking capacity will entice a petrochemical industry-led run on these excess volumes.

Should this increased capacity bring a price turn, it would be similar to what occurred in the propane market for much of the past year as export terminals opened a new market for the product.

Propane prices were nearly identical at both hubs as export demand increases ahead of Sunoco Logistics Partners LP’s Mariner South project in Nederland, Texas, where operations will begin in early 2015. The U.S. Energy Information Administration reported that propane storage levels increased at a slower rate than anticipated, with a 73 million barrel build the week of Sept. 5. Propane stocks remained at their highest levels in the past 10 years.

Frank Nieto can be reached at fnieto@hartenergy.com or 703-891-4807.

Recommended Reading

Fracturing’s Geometry Test

2024-02-12 - During SPE’s Hydraulic Fracturing Technical Conference, industry experts looked for answers to their biggest test – fracture geometry.

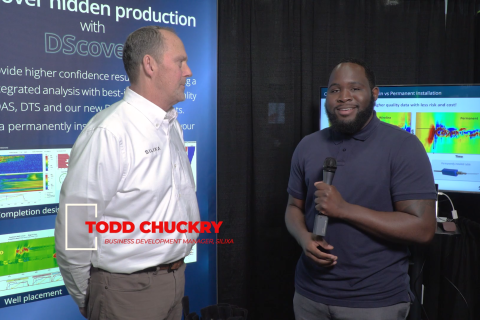

Exclusive: Silixa’s Distributed Fiber Optics Solutions for E&Ps

2024-03-19 - Todd Chuckry, business development manager for Silixa, highlights the company's DScover and Carina platforms to help oil and gas operators fully understand their fiber optics treatments from start to finish in this Hart Energy Exclusive.

Axis Energy Deploys Fully Electric Well Service Rig

2024-03-13 - Axis Energy Services’ EPIC RIG has the ability to run on grid power for reduced emissions and increased fuel flexibility.

Going with the Flow: Universities, Operators Team on Flow Assurance Research

2024-03-05 - From Icy Waterfloods to Gas Lift Slugs, operators and researchers at Texas Tech University and the Colorado School of Mines are finding ways to optimize flow assurance, reduce costs and improve wells.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.