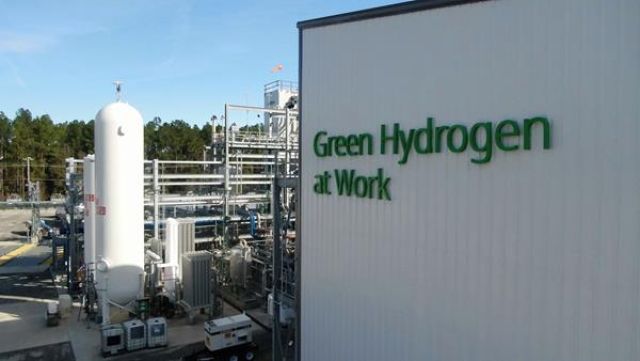

Plug Power has started producing liquid green hydrogen at its Georgia plant. (Source: Plug Power Inc.)

Plug Power said on Jan. 23 that it has secured over $1 billion in government funding and started producing liquid green hydrogen at its Georgia plant, sending the company's shares up about 20% in morning trade.

The hydrogen fuel cell firm said it has finalized a term sheet negotiation with the U.S. Department of Energy (DoE) for a $1.6 billion loan facility.

The company has been facing liquidity issues amid supply challenges in the liquid hydrogen market in North America, and had raised going concern doubts in November. It also planned a $1 billion equity raise earlier this month.

"This funding, when received, will support the development construction and ownership of up to six hydrogen production facilities, significantly advancing green hydrogen deployment in the United States," CEO Andrew Marsh said during an investor call.

"With our Georgia plant operational, and the Tennessee plant coming online, we expect a significant reduction in costs," he added.

Talking about the Georgia plant, Marsh said while "the construction took slightly longer than expected," the facility will bolster Plug's supply of liquid hydrogen deliveries to its customers for material handling operations, fuel cell electric vehicle fleets and stationary power applications.

The plant, which the company said is the largest liquid green hydrogen plant in the U.S. market, is designed to produce 15 tons per day of liquid electrolytic hydrogen.

"The DoE loan facility seems well baked, but we have to wait until the second half of 2024. Seems they are getting the finance options they need and wiggling out of a very tight spot," said Craig Irwin, an analyst at Roth Capital Partners.

As companies are moving towards their net-zero emission targets, hydrogen, a zero-emission gas at point-of-use, serves as both a fuel and as energy storage, helping them reduce their carbon footprint.

The company said the production is expected to positively impact its bottom line and provide an additional step change in fuel margin expansion.

Recommended Reading

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.

NAPE: Chevron’s Chris Powers Talks Traditional Oil, Gas Role in CCUS

2024-02-12 - Policy, innovation and partnership are among the areas needed to help grow the emerging CCUS sector, a Chevron executive said.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Exxon Ups Mammoth Offshore Guyana Production by Another 100,000 bbl/d

2024-04-15 - Exxon Mobil, which took a final investment decision on its Whiptail development on April 12, now estimates its six offshore Guyana projects will average gross production of 1.3 MMbbl/d by 2027.

Rystad: More Deepwater Wells to be Drilled in 2024

2024-02-29 - Upstream majors dive into deeper and frontier waters while exploration budgets for 2024 remain flat.