The next wave of LNG supply from the Haynesville Shale is coming and Clearfork Midstream LLC is positioned to ride it along with the E&Ps the company serves.

That was the plan all along: acquire Clearfork CEO Kipper Overstreet’s former company, launch an expansion and revamp underutilized infrastructure to reach the core of Haynesville and Bossier’s production areas.

Backed by EnCap Flatrock Midstream, Clearfork bought Azure Midstream Energy LLC in February 2022. Overstreet knew the ends and outs of Azure. He’d worked for a decade heading up M&A and commercial services; overseeing engineering, pipeline services; and serving as director of operations.

(Source: Photography by Gustav Schmiege III)

Overstreet left Azure with the idea of putting a team together and acquiring it, Clearfork CFO Will Page told Hart Energy. Overstreet’s thesis was straightforward: Azure’s assets were underutilized and in the next several years, a lot more natural gas will be leaving the Gulf Coast as LNG. And that demand will be met in Louisiana.

Beyond the immediate need to debottleneck certain areas in the play, the opportunities for gas demand on a macro level were obvious to Clearfork.

“When you take the growing natural demand from our residential commercial, industrial natural gas and then add in the LNG [demand] around the world, we thought that’s a long-term growth trend for supply,” Page said. “And the Haynesville is a great way to play it.

“We saw the LNG wave coming here as these projects were getting announced and we’re looking ahead … to ‘24 or ‘25, ‘26 and thinking, ‘okay, well we can get in here and acquire these assets that at the time we felt were underutilized,” he said, “and we can do some things to optimize them, to debottleneck—to do some quick projects to bring some gas back on.”

Clearfork’s rapid expansion

And quick they were. Clearfork announced in October that the company planned to expand. Less than a year later, the company finished a massive expansion with growth capex of $150 million over the past year.

The results: Clearfork increased treating capacity by 65% to 1.65 Bcf/d from 1 Bcf/d. The company’s average daily throughput volumes nearly doubled, hitting 1 Bcf/d in July. The company also upgraded its SCADA systems and liquids handling capacity—while expanding to the east and west.

“We’ve added new interconnects with intra-basin gathering systems and added downstream connectivity to expand takeaway capacity and market options for our customers to maximize netbacks,” Page said.

The company is also able to provide solutions to producers looking for optionality to increase their netbacks and “work to support those needs and make new interconnects and be responsive to … our customers.”

With the recent completion of its expansion projects, Clearfork is projecting a material reduction in growth capex and strong free cash flow generation going forward.

“We’re also pursuing several commercial opportunities around our systems to bring new volumes to us utilizing our expanded capacity,” he said.

The company picked up speed from political and foreign events—the Ukraine war, for one—in 2022, that pushed “us ahead of where we thought we’d be by now,” Page said.

Overstreet’s knowledge of Azure included his awareness of where concerns might crop up in due diligence, which helped mitigate risks.

“Shortly after closing, we started full speed ahead on the commercial side,” Page said.

First, the company looked at where the Haynesville’s activity was headed.

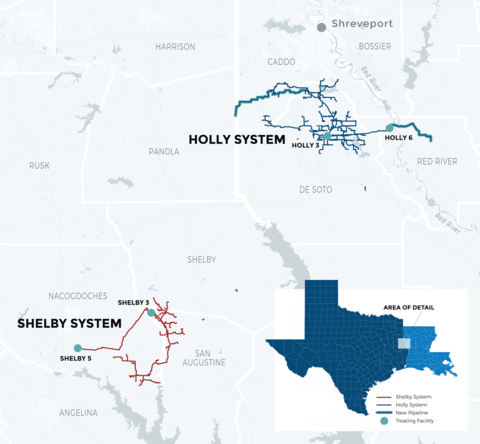

“We’re seeing right over the core today expanding to the east, which taps us into the new area and some nice potential middle Bossier upside in the future,” Page said. “And then to the west, closer to the Texas line, [Clearfork] picked up some activity on some existing customers.”

The company also expanded toward the Shelby Trough, an area less developed than North Louisiana.

“We’ve got a lot of pipe in the ground and see a lot of upside there as we … fill capacity as production and drilling continues to move and advance in the Shelby area,” he said.

The company added some long-term acreage dedications, boosted treating capacity and then expanded geographically, which was underpinned by its contracts.

Once Clearfork crossed the Red River, it found other commercial opportunities to participate in “and to try to win some of that business, as well.”

“So, we checked all the boxes on the expansions,” Page said. “We saw the wave of gas coming and were able to de-risk it with contractual support.”

E&Ps Haynesville showing discipline

This year’s plummeting natural gas prices and a reduction in Haynesville production hasn’t been a concern, Page said. Nor has the Haynesville’s fall in rigs been too worrisome. The play’s rig count has dropped to 41 compared to 70 a year ago, according to Baker Hughes’ Aug. 25 data.

Haynesville producers have approached the pullback in natural gas prices this year by dropping some rigs and deferring completions, which has provided recent support for natural gas spot prices, he said.

Looking ahead to 2024, Clearfork sees the forward curve signaling a recognition in the market that higher natural gas prices will be necessary to spur production growth to meet the step change in demand from LNG exports.

“I think what we’re seeing from customers is the disciplined approach where they want to maintain production in ‘23 to a reasonable level, with an eye on flexibility,” he said.

With the next wave of LNG expansions coming online in 2025 and 2026, Page said he sees built-in support for a sustained rig count and frac activity. Producers have indicated they’ll be adding rigs again in 2024 if prices continue to firm up along the forward curve, he said.

“Nobody wants to fall too far behind and have to be catching up when that comes along. So, I think there’s this one approach,” he said. “Obviously the rig count has come down in Haynesville. We’ve seen frac crews come down and then come back up a little bit. We’ve seen more DUCs over the past year come online.”

But overall, the prospects of LNG remain enticing.

“We’re solidly bullish on the outlook for natural gas and the Haynesville, in particular, and see the disciplined response of producers to natural gas prices this year as an opportunity for midstream providers to catch up and prepare for the inevitable rebound in activity as demand continues to grow and new LNG facilities come online,” Page said.

Recommended Reading

BKV CEO Chris Kalnin says ‘Forgotten’ Barnett Ripe for Refracs

2024-04-02 - The Barnett Shale is “ripe for fracs” and offers opportunities to boost natural gas production to historic levels, BKV Corp. CEO and Founder Chris Kalnin said at the DUG GAS+ Conference and Expo.