Conflict in the Middle East has enabled Brazil’s state-owned Petrobras to change the flow of its oil exports, with China being the primary beneficiary, followed by Europe. (Source: Shutterstock.com)

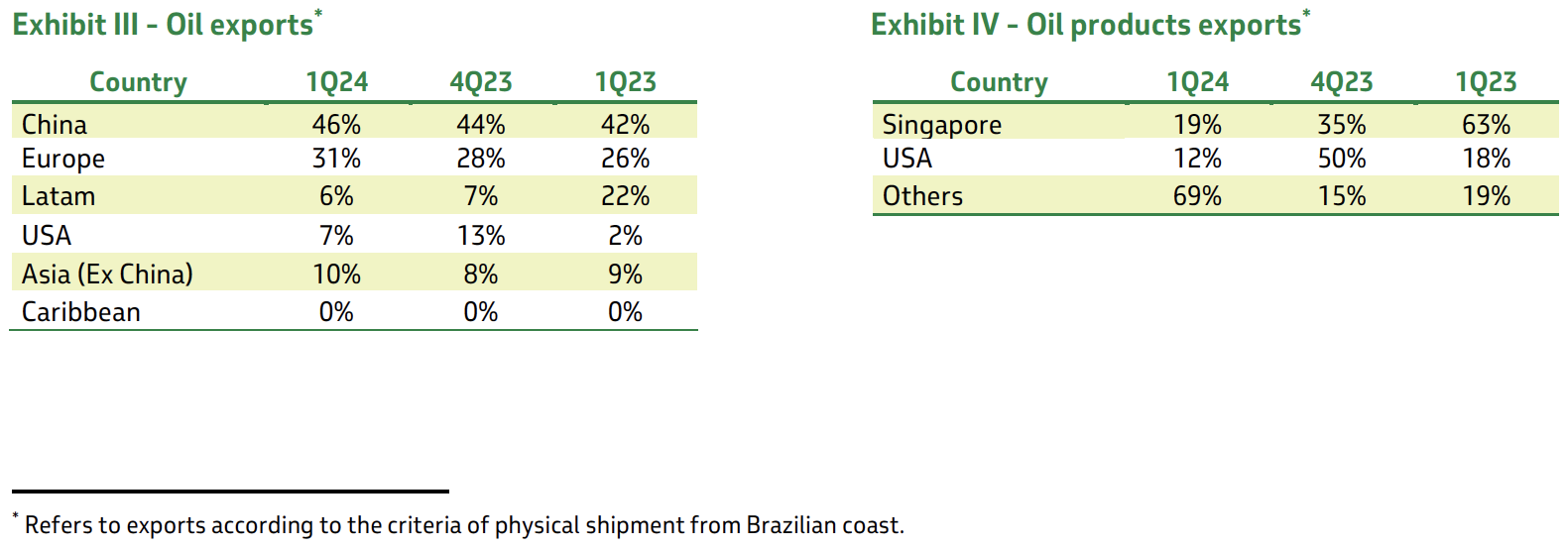

Brazil’s state-owned Petrobras continues to boost the percentage of oil it exports to Asian markets, especially China, which was the final destination of 46% of the company’s exports in first-quarter 2024.

In fourth-quarter 2023, 44% of Petrobras’ oil exports went to China. A year ago, in first-quarter 2023, the company sent 42% of its exports there, the company reported in its quarterly earnings report on April 29.

“The conflict in the Middle East has caused instability in maritime freight rates and, as a result, a change in the flow of our oil exports,” Petrobras said in its earnings release. “Markets that are naturally served by larger ships became more attractive. We were able to exploit this arbitrage by increasing the volume of oil exported to Asian markets, especially China, and we optimized shipments on large vessels to markets such as Europe and the United States.”

Petrobras’ rising export trend to China has continued despite lower actual export volumes.

The Rio de Janeiro-based company’s oil exports averaged 848,000 bbl/d in the first quarter, down 4.2% compared to the previous quarter and a year-over-year decrease of 4.4% compared to first-quarter 2023.

The sequential decline in oil exports was primarily related “to lower oil products exports, especially gasoline, mainly attributed to quality exchange operations in the fourth quarter 2023, as well as maintenance stoppages in the first quarter 2024,” Petrobras said in the report. “This was partially offset by an increase in oil exports, reflecting the lower need to process oil in the refineries.”

RELATED

Deepwater Roundup 2024: Americas

Petrobras to Step Up Exploration with $7.5B in Capex, CEO Says

Production swings

Petrobras reported average production of oil, NGL and gas of 2.77 MMboe/d in the first quarter, down 5.4% compared to fourth-quarter 2023. Pre-salt formation production of 1.85 MMboe/d in the first quarter represented 67% of Petrobras’ total production.

Lower quarter-over-quarter production can be attributed to stoppages, maintenance and natural declines at mature fields, which were partially offset by production from FPSOs Almirante Barroso (Búzios Field), P-71 (Itapu Field), Sepetiba (Mero Field) and Anita Garibaldi (Marlim, Voador and Espadim fields).

Year-over-year, Petrobras’ production was up 3.7% due to the ramp-up of some of those same FPSOs: Almirante Barroso, P-71, Anna Nery, Anita Garibaldi and Sepetiba, as well as the start-up of 19 new wells from complementary projects in the Campos (11 wells) and Santos (eight wells) basins.

Recommended Reading

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Barnett & Beyond: Marathon, Oxy, Peers Testing Deeper Permian Zones

2024-04-29 - Marathon Oil, Occidental, Continental Resources and others are reaching under the Permian’s popular benches for new drilling locations. Analysts think there are areas of the basin where the Permian’s deeper zones can compete for capital.

Exxon Versus Chevron: The Fight for Hess’ 30% Guyana Interest

2024-03-04 - Chevron's plan to buy Hess Corp. and assume a 30% foothold in Guyana has been complicated by Exxon Mobil and CNOOC's claims that they have the right of first refusal for the interest.

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

Pitts: Heavyweight Battle Brewing Between US Supermajors in South America

2024-04-09 - Exxon Mobil took the first swing in defense of its right of first refusal for Hess' interest in Guyana's Stabroek Block, but Chevron isn't backing down.