Petro-Hunt plans to commence an active development drilling program on the Delaware Basin assets acquired from Admiral Permian Resources later this year, the company said. (Source: Hart Energy)

Petro-Hunt LLC recently picked up Delaware Basin assets from Admiral Permian Resources, Dallas-based Petro-Hunt said in a company release on March 9.

According to the release, Petro-Hunt Permian LLC, a fully owned subsidiary of the company, completed the acquisition of the Delaware Basin assets from APR Operating LLC (dba Admiral Permian Resources). Terms of the transaction weren’t disclosed.

Admiral Permian Resources is a privately held E&P company focused on the acquisition and development of oil and gas properties in the Permian Basin. The company, headquartered in Midland, Texas, is majority owned by funds managed by the private equity group of Ares Management LP and is also backed by Pine Brook and members of management.

The acquired APR assets consist of predominantly operated oil and gas production and 21,430 net acres of leasehold in northwest Reeves and northeast Culberson counties, Texas, in the Delaware Basin. Current gross operated production is approximately 7,000 bbl/d of oil and 100 MMcf/d of gas.

“Petro-Hunt plans to commence an active development drilling program on these assets later this year,” the company said in the release.

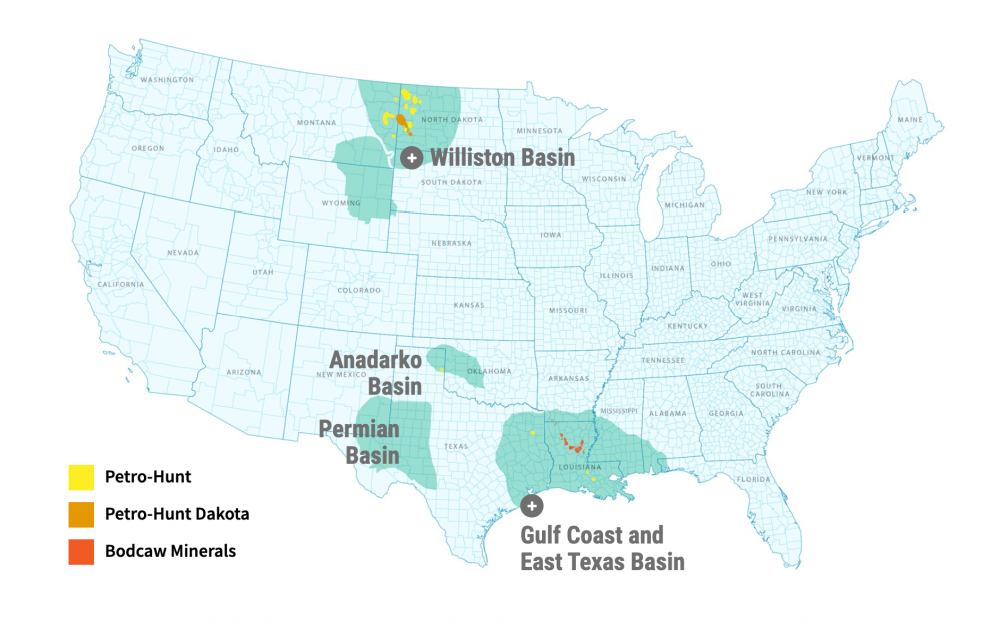

Petro-Hunt is a privately owned E&P company whose origins trace back to the first quarter of the 20th century. The company, ranked among the nation’s top 10 private liquids (oil) producers according to its website, operates 775 wells and participates in over 8,100 nonoperated wells located throughout the U.S.

Including the acquired APR assets, Petro-Hunt said on March 9 that the company, its subsidiaries and affiliates had current gross operated production capacity of approximately 57,000 bbl/d of oil and 220 MMcf/d of gas.

Recommended Reading

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.

Energy Transfer Ups Quarterly Cash Distribution

2024-04-25 - Energy Transfer will increase its dividend by about 3%.

ProPetro Ups Share Repurchases by $100MM

2024-04-25 - ProPetro Holding Corp. is increasing its share repurchase program to a total of $200 million of common shares.

Baker Hughes Hikes Quarterly Dividend

2024-04-25 - Baker Hughes Co. increased its quarterly dividend by 11% year-over-year.

Weatherford M&A Efforts Focused on Integration, Not Scale

2024-04-25 - Services company Weatherford International executives are focused on making deals that, regardless of size or scale, can be integrated into the business, President and CEO Girish Saligram said.