Scala Energy’s Bluto State Unit 2312 – 1H in Culberson County, Texas, is the furthest western Upper Wolfcamp horizontal in the Delaware Basin. (Source: Jonas Harrell/Scala Energy)

[Editor's note: A version of this story appears in the June 2019 edition of Oil and Gas Investor. Subscribe to the magazine here.]

The Permian Basin continues to make headlines nearly every day for its production growth, value creation and challenging midstream woes. Exxon Mobil Corp. and Chevron Corp. have recently unveiled their big ambitions for the Permian. The dramatic takeover fight for Anadarko Petroleum Corp. centers on Permian heavyweight Occidental Petroleum Corp.’s ambitions for developing APC’s Permian acreage.

But let’s not forget that scores of smaller, private E&Ps are chasing big Permian dreams too. They will continue to lease acreage and build their production throughout the Permian and innovate through technology. Several are pushing the economic boundaries to the west in the Delaware part of the basin, and further north and south in the Midland Basin.

This special report profiles several private companies whose executives spoke at Hart Energy’s recent DUG Permian conference in Fort Worth, Texas. It is a rare opportunity to learn more about the assets and strategies of these E&P companies, many of which are backed by private-equity firms. Which ones are building toward an exit soon, and which ones are building for longer-term, full-field development?

Whatever their plans, they join the chorus of Permian players who extoll the benefits of this basin and contribute to its rapidly growing production.

—The Editors

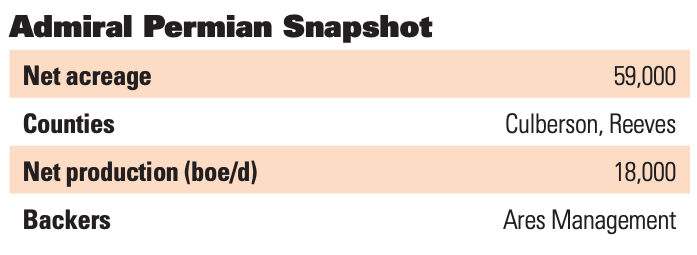

Admiral Permian Resources LLC

Adding value to the western Delaware Basin’s Combo Play

Midland-based Admiral Permian Resources LLC was formed two years ago during what CEO Denzil West concedes was a difficult time in the industry. The executive team knew that buying acreage in the core of the Permian Basin would be too expensive. They decided to focus instead on the western edge of the Delaware Basin, with the company’s main acreage now on the Reeves-Culberson county line in West Texas.

Although this acreage is pushing the boundaries of the basin to the west, nearby operators, including EOG Resources Inc., Cimarex Energy Co., Chevron and BPX Energy, indicate the zip code is good, geologically speaking. Some are calling it the Combo Play as it produces oil, gas and liquids.

“We knew that going to the core was going to be expensive, and as a private company we weren’t going to make any money if we overpaid for acreage. We knew we were going to need to stick to the periphery and prove things there through execution and operations,” said West.

“This was an area that has a somewhat dubious background and some questions about it. But the petrophysics are great, comparable to what was in Loving County nearby; the only difference is its about 1,500 feet shallower, which actually helps us on our economics quite a bit, as far as drilling and development costs.”

In April 2018, Admiral Permian acquired leasehold interests and related assets from another private E&P, Three Rivers Operating Co. III LLC. This deal included more than 59,000 net acres in Reeves and Culberson counties (1,400 owned surface acres). The properties produced more than 15,000 net barrels of oil equivalent per day (boe/d) at the time. Since then, production has increased to 18,000 net boe/d, mainly in Culberson County. Some 21 wells have been completed.

“Because of the volume of gas and the ability for it to help drive our production, gas has become an asset.”

Denzil West, CEO of Admiral Permian Resources LLC

Simultaneously to the Three Rivers deal, Ares Management contributed private equity to the Midland-based company. The team has a deep operating background, having drilled 400 wells from 2006 to 2016 as a private E&P with no outside financial backing, so the Ares capital infusion was a big step.

“The objective that first year of operations was to take the main zone that we knew and core that up, and that’s the Wolfcamp A. But we were also keenly interested in developing potentially a second zone. That would be a home run as far as valuation.”

Since it acquired that acreage, the company has grown production substantially, “and we control a lot of our infrastructure.”

During the first year after the transaction, Admiral Permian was busy focusing on the Wolfcamp A. “And, there was this acreage that wasn’t really proven up. We wanted to expand that systematically to improve our value,” West said. “As development and results warranted, we wanted to develop infrastructure that would support us long term. We’ve got a large contiguous acreage set which allows us to develop infrastructure very well.” Indeed, Admiral Permian now has 150,000 barrels of saltwater disposal (SWD) capacity.

The company’s well results have been good. The best, Daltex 42-43 8A, reported an IP30 of 1,100 barrels per day (bbl/d) and almost 10 million cubic feet a day (MMcf/d), extending productive acreage in the southern part of the Delaware Basin. It was drilled to 7,402 feet.

As Admiral Permian moved south and west in the area, there were challenges, but West said he felt this was the opportunity to prove up what the company has and try to expand the core. Two Wolfcamp B tests were drilled in the middle of the acreage (near where ConocoPhillips Co. had drilled years ago with marginal results). Admiral Permian’s first well in this area showed an IP30 of 700 bbl/d and nearly 11 MMcf/d of gas.

Admiral Permian’s first-year production in this area totaled about 348,000 boe/d, more than what many others had achieved, including about 150,000 bbl of liquids. The laterals were 1.5 miles long and drilling time has declined to less than 20 days, spud to spud, regardless of lateral length. Admiral Permian’s completion costs have fallen 33% while frack intensity has increased 25%.

“Because of the volume of gas and the ability for it to help drive our production, gas has become an asset,” West said. “We are really strong in oil compared to everybody else, but we are top tier on gas and liquids production.”

West admitted nobody is happy with gas prices in the Delaware Basin, which in recent weeks had declined to below zero at the Waha hub.

“This is not a gas area, it’s a liquids-rich play, and we have very resilient breakevens. So we’re excited because we feel like we’ve taken some acreage that was dubiously thought of and proved it up with a second Wolfcamp zone, and we’re now moving into full pad development.”

Ajax Resources II LLC

A model exit sets the stage for a new start-up.

Ajax Resources I is an example of a spectacular private-equity-backed exit, one of several large deals that have occurred in the prolific Permian Basin in the past two or three years. Lessons from the company’s growth trajectory inform the industry and will color how Ajax II proceeds in its next endeavors.

Ajax I, formed in 2015, purchased 25,800 acres in the increasingly active northern Midland Basin from W&T Offshore Inc., for $376 million, aided by backing from private-equity firm Kelso & Co. At the time of this transaction, the prospectivity of the northern Midland was thought to be somewhat marginal, but Ajax ended up proving otherwise—selling it less than three years later for $1.2 billion ($900 million in cash). The buyer, Diamondback Energy Inc., held acreage immediately adjacent to and just north and south of where Ajax was drilling.

When Ajax bought the original W&T package it included 200 vertical and horizontal wells, primarily in Martin and Andrews counties, and production was about 3,000 bbl/d. By the time it sold to Diamondback, it had grown production to 12,000 boe/d (88% oil). Ajax was able to prove up the acreage with some 367 net horizontal locations left in inventory for the buyer.

What drives this kind of value creation? For one thing, Ajax’s team has been together for 15 years, since the early Haynesville Shale days, and it has drilled over 500 wells. A culture of operational efficiency, drive and an emphasis on G&G analysis (geological and geophysical) was key, according to COO Daniel Rohling. In past iterations the team had drilled over 300 wells in the Permian alone, and those learnings were applied to the new asset acquired from W&T.

“Diamondback started to notice that our wells performed as good as theirs, some even better, but we were drilling three benches and they were only drilling one,” recalled CEO Rich Little, speaking about the fast growth of Ajax I during the annual IPAA Private Capital Conference this past January.

Today, the Ajax team is scouting for further opportunities in the Permian with Ajax II.

At the time of the 2015 purchase, the industry faced a lot of headwinds because of the oil price downturn. “The debt and equity markets were either headed for the hills or they were already there,” Rohling said, “so being able to put together a program to purchase this and then put together a delineation program was pretty substantial. But what we saw coming in was there was a lot of resource there. There were multiple benches that weren’t being played yet that we thought we could delineate, and not only delineate, but we felt that they would compete for capital with the primary target, which was the Lower Spraberry at the time.”

The investment thesis was to be consistent, to validate the Lower Spraberry, work over the existing wells that had been acquired, and drill in the Middle Spraberry and Wolfcamp A, said Little.

“From a value perspective, it starts and ends with a reservoir. Everything we do gets back to G&G.”

Daniel Rohling, Ajax Resources II LLC COO

As Ajax put down some great wells in the Lower Spraberry, it also successfully tested the Middle Spraberry and Wolfcamp A. In addition, it made several operational improvements, as it took the average drilling time of 40 days from spud to rig release down to 20 days, and lease operating expenses dropped from $7 or $8 to about $4/boe.

By 2017, it had taken cores and performed high-end log suites, and did a spacing test on 640 acres before getting ready to sanction full development, Little said. In the 12 months from October 2017 to October 2018 (the exit to Diamondback), Ajax grew production 75%. “By September, we were drilling within cash flow,” Little said, with two six-well pads.

At about this point, however, Ajax realized the next step it needed was to build more scale. It had some deals in the pipeline to acquire more acreage in the area with the aim of growing production. But meanwhile, the Diamondback team came calling—it was operating right next door and had enough scale, its acreage surrounded that of Ajax, and it could see the good well results Ajax was getting.

“They were able to see that they could parlay both ours and their well results with their capital structure and realize a ton of value from day one. So we worked together through October 2018 to close on what was a great story and great deal for Ajax,” Rohling said.

“Scale comes in a lot of different aspects, but we tend to think about it from the PDP [proved developed producing] side. For us, we think it always starts and ends with the reservoir,” Rohling said. “Everything gets back to G&G. Everything else we do is secondary to that point. We’ve got to be able to get out there and put together wells that will compete for capital across anybody’s discipline or acreage. By that, we mean continually driving operational efficiencies while we increase EURs and IPs.”

Doing this will create value, which in turn, allows the acreage to compete for capital vs. other opportunities. Achieving scale is important whether a company is trying to compete for capital, create a good reserve number to underpin a borrowing base, or become an acquisition target, Rohling said.

“We didn’t talk a whole lot about it, but as you get into whether or not you’re going to do full-scale development in a cube style, container style, single well or pad development, it’s all about value and being transparent to your investors, no matter if it’s shareholders or LPs.”

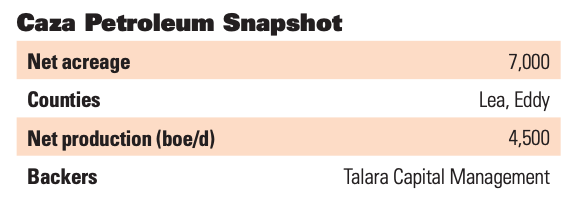

Caza Petroleum LLC

Go-private pure player uses capital infusion to move into pad development.

Caza Petroleum LLC, the Houston-based pure-play Delaware Basin operator in southeastern New Mexico, has rebounded since it was recapitalized in 2015 by Talara Capital Management, a Houston- and New York-based investment firm focused on private equity for the energy sector.

Talara spent $45.5 million to acquire and restructure Caza, paying off debt and taking control of its assets in the Delaware Basin. The investment firm retired the company’s first-lien debt, convertible bonds and the payables at a significant discount, creating an aligned waterfall structure with management for future reward. It also injected $85 million of growth capital to develop its assets.

The restructuring and injection of new capital allowed the company, which had been on the verge of bankruptcy, to start drilling on the property in Lea and Eddy counties in New Mexico.

Since 2016, Caza changed its capital structure and was able to develop a drilling program and grow its reserves by 400%, said Randy Nickerson, COO of Houston-based Caza. Previously, Nickerson served as vice president of exploration for Caza and chief geophysicist for Sanchez Oil & Gas from 2004 to 2011. The company’s assets in the Delaware Basin are now worth $465 million in total reserve value, including $161 million in PDP assets.

Talara’s recapitalization of Caza allowed the company to “get into development mode,” he said. Now the company touts acreage proven up with multiple benches and plans to develop and increase its PDP assets with Talara. Caza has a total of 7,000 net acres with 207 locations.

Caza Petroleum COO Randy Nickerson said many operators waste too much money on delineation and science.

“We are focused on finding and producing lowcost hydrocarbons through the drillbit and recycling our cash flow. We are essentially a manufacturer.”

Caza is operating in two core areas—Lea and Eddy counties, N.M., with production of 4,500 net boe/d. In Lea County, the company operates 5,000 net acres that is “premier acreage with 10 stacked pay zones with nine planned wells in 2019, including one well that is already drilled and completed,” Nickerson said. Also, Caza operates 2,000 net acres in Eddy County, which has eight stacked pay zones, with plans to drill four wells this year.

Caza is running one rig and intends to develop on pads going forward, drilling out a single zone at a time to minimize parent-child well issues.

One strategy that Caza deploys to maintain its capital is to systematically hedge a “good percentage” of its wells to lower their risk for the downside of oil prices, he said. The company is mostly HBP (held by production)..

Compared to Caza’s operations in 2013, the basin now has been completely developed and is “coming into the core instead of the fringe,” Nickerson said. In the North Laguna Area targeting Third Bone Spring Sand, the first two wells drilled exceeded expectations.

“We’re actually performing better than a lot of the other ones out there, and we’re on the fringe,” he said. “The number of wells has expanded dramatically. The basin has changed and is very giving.”

Production here is 76% liquids, Nickerson said.

While Caza experienced a slow point in 2018 similar to its competitors and dropped a rig due to oil differentials impacting the industry, the company has been able to increase its production while decreasing its lifting costs for a boe through its water and SWD agreements, electricity costs and improvement of its chemical treatments and analytics.

The company has also teamed up with Salt Creek’s crude gathering system. By the end of 2019, Caza will have pipelines connected to 95% of its oil production and decrease transportation costs. It has up to 20,000 bbl/d dedicated to both the Salt Creek and the EPIC pipeline, which are expected to start up in third-quarter 2019.

This development gives the company flexibility to transport oil to Corpus Christi, Texas, or Cushing, Okla.

“We’re risk averse and trying to maximize our returns for our owners,” Nickerson said.

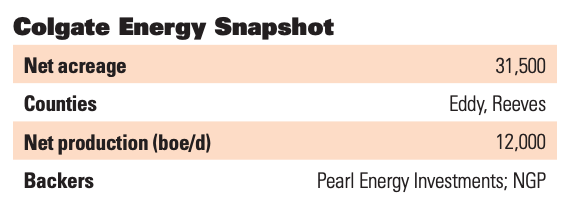

Colgate Energy LLC

Delaware Basin-focused company pivots to prepare for the long haul.

This Midland-based company was formed in 2015 with a focus on taking advantage of that down market period and staying focused on the core of the best basin—the Permian. “We have a company motto that we do not like to take geologic risk,” said Will Hickey, co-founder and co-CEO. His partner is James Walter.

An initial capital commitment of $75 million announced in February 2016 has since grown to $450 million, all from Pearl Energy Investments and Natural Gas Partners. “As it stands today, we’ve grown the company to 31,500 net acres; about two-thirds is in Reeves County, Texas, and about a third is in New Mexico, mostly in Eddy County.”

Net production is now over 12,000 boe/d. The company has drilled 17 wells in six different benches (primarily Wolfcamp A and B) and 12 of those are online. Hickey said he’s projecting to have $200 million of EBITDA over the next 12 months and be cash-flow positive by year-end. A single 10,000-foot well investment of about $12 million generates a PDP, PV-10 value of about $40 million, he said.

“You can really ramp EBITDA quickly with a two-rig program.”

Later this year, Colgate will test its first well in New Mexico, as well as test the Second and Third Bone Spring benches in Texas. “We’re going to finish our appraisal program and finish our HBP program; we are about 75% held by production now and expect to be finished sometime later this year. Then we’re going to transition to large-scale development in 2020. I’d say we as a company, and our investors, are very excited about the potential of this asset.”

Like most E&P companies, Colgate has witnessed a transition in the private-equity business model as more E&P investors demand cash flow and returns, and fewer large public E&Ps want to buy. Colgate has altered its strategy somewhat as a result.

“When we formed the company, as you can imagine, we were in a time when all of our peers had laid out a proven and consistent model and we did not plan on deviating from that model. We were going to lease and buy ... spend numerous hours and time trying to consolidate, put land together for long lateral development, drill a couple of wells on each bench to prove the rock was good, and then we were going to sell it, as the public E&Ps were in need of inventory and were happy to buy acreage.

“James and I were excited. So we picked up our first rig in 2017 and drilled our first two horizontal wells, relatively shorter-lateral Wolfcamp A wells. Both had made consistently over 1,000 bbl a day of oil … both paid for themselves in the first year. At this point, we had followed our plan to a T. We had infrastructure in place, so we said, ‘Next step, let’s sell this thing.’

“Then around the second quarter of 2017, [capital markets and M&A] just came to a halt…. Nobody needs to be buying their 15th year of inventory. With this backdrop in this new world, we rethought what we’re doing and decided this is an opportunity to really grow the business into something that was more what the world was looking for.”

The Colgate team decided it needed to HBP more acreage, get the midstream infrastructure in place and transition into full development mode. It need to appraise the primary target bench with short laterals and then, drill the 2-mile laterals and test all the benches.

“We had to grow production and EBITDA to get it in place that we’d have the ability to finance a six-well, eight-well, 10-well pad before you see a dollar of revenue coming back,” Hickey said.

Will Hickey, co-CEO, said Colgate Energy LLC revised its strategy when the typical private-equity business model changed. He projects the firm will be cash-flow positive later this year.

To make sure the effort returned dollars back to the equity owners, Colgate had to make sure its infrastructure was built out ahead of time, he said. “I mean, these wells move so much fluid that if you don’t have oil, gas and water takeaway on pipe, it’s very difficult to make money,” he said.

“I would say that we noticed as you move toward full development, it creates additional opportunities of ways to take advantage of your asset base. This comes with buying minerals ahead of the drillbit and building out the gathering system.”

To meet its new goals, Colgate drilled eight wells. Its average IP30 was 284 boe/d per 1,000 feet of lateral. It drilled mostly 10,000-foot wells but drilled two that had laterals of 12,000 feet. The wells consistently outperformed expectations, Hickey said, with cumulative production of 330,000 bbl in 160 days.

“The Wolfcamp A in this area is a great mix with 70% to 75% oil cut. Only two of the eight we drilled are on artificial lift. But it’s not just about the A. As you think about cube development, you need to test the other benches too. We’ve drilled three Wolfcamp B wells … I would say they compete as well as anything. The B wells are equally good as the As. They are still relatively low water-oil ratio and extremely high-pressured.”

Colgate has increased its net daily production from about 4,000 boe/d in October 2017 to about 12,000 boe/d now.

“We’ve been fortunate that the prolific nature of these wells has allowed us to grow strictly off a typical RBL [reserve-based loan]. We haven’t had to dip into equity funds. Early appraisal: we love the A, we love the B, we love the C.”

How does Colgate intend to drill these locations without parent-child issues? In one particular 1,280-acre unit, it started by drilling one Wolfcamp A and B some 330 feet off the eastern lease line and in about six months, it will come back and drill a third well on the west side of the lease, leaving a 4,500-acre fairway down the middle that can be drilled later when full development kicks in.

“The point of this whole thing is cash flow,” Hickey said. “We’ve grown our EBITDA from about $50 million a year in 2017 to $200 million a year, and we’re projecting that with a two-rig program, we’ll be cash-flow positive sometime later this year. Then we’ll transition to large-scale development in 2020.”

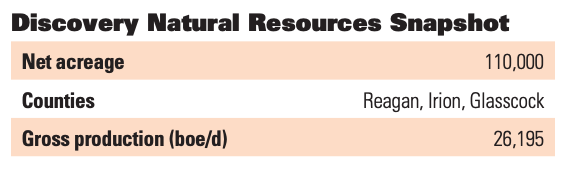

Discovery Natural Resources LLC

Reinvigorating the southern Midland Basin.

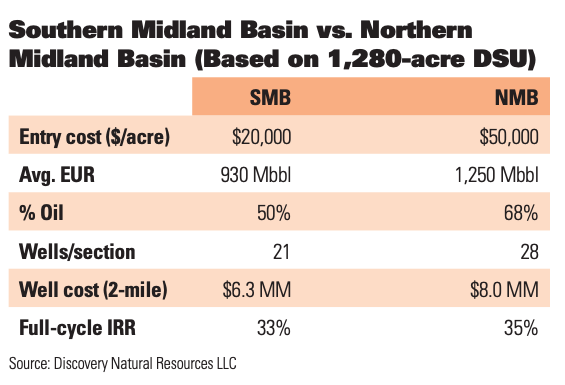

Since 2017, activity has revived in the southern part of the Midland Basin. Larger operators are re-entering the area, and many private E&Ps are in the play. These companies have seen a step-change in well performance and an uptick in horizontal drilling permits (238 in the past six months).

Discovery Natural Resources is all in.

This Permian pure play was formed in 2003 with some backing by an affiliate of Fidelity Investments. The Denver-based company had operated in multiple basins over time, but today focuses on the southern Midland Basin where the Wolfcamp thickens to the southeast. Through acreage swaps and acquisitions the company now has 110,000 acres in the area, primarily in Reagan County, Texas, and some in nearby Irion County. It has 825 producing wells and 1,300 horizontal locations.

Steve Turk, CEO, Discovery Natural Resources LLC, favors the southern Midland Basin, citing its lower costs, improving well results and uplift from NGL.

Gross production in 2018 was about 26,000 boe/d, but “with the application of two or three rigs this year, we expect to increase that production by about 20%,” said CEO Steve Turk. He joined Discovery in 2017 after serving as COO for SandRidge Energy Inc. and, before that, for HighMount Exploration & Production Co.

In the mid-2000s, the company began moving into Crockett County, where it started developing a gas play and still operates it as the gassy Adams Baggett Field. In 2010, the company began assembling its Reagan County acreage position. Some in the industry considered the southern Midland too gassy and maybe even uneconomic, but Turk disagrees.

“Why do we like the southern Midland Basin and our position there? It’s an exceptional opportunity, with a thick and consistent 1,500-foot section of Wolfcamp that is 70% to 75% liquids rich. We think the oil in place is roughly 150 million bbl per section, and we’re fortunate to have a contiguous position. A plus, we lease 80% of our acreage from only one mineral owner, the Texas Scottish Rite Hospital for Children in Dallas. They’re a wonderful group of people to work with.”

The majority of the company’s inventory supports longer laterals of 2 to 3 miles. “It is unlikely that in the foreseeable future we will drill anything less than a 10,000-foot lateral,” Turk said.

Infrastructure is in place to handle development. “Our east-well Bell Corridor ranges from 4 to 7 miles in width, and we have solid infrastructure in place. We leveraged our experience and the saltwater disposal assets that we developed during the vertical phase of this asset, and now we have water infrastructure where we can move both fresh and salt water.

“This gives us the advantage and moves our horizontal drilling costs down into the $2/bbl range. We have plans to extend this infrastructure to the northeastern and southeastern part of our acreage to fully access and move water to points where it is most needed. This allows us to move into what we call rolling development phase.”

This phase allows the company to simultaneously develop five zones in the Wolfcamp: two in the A, two in the B and one in the C, and it also limits parent-child impacts, Turk explained.

“In rolling development we build two pads, put two rigs on those pads and drill 10 to 12 wells. Then we move the rigs off and come in and complete those wells. Then we move next door and build an additional couple of pads and begin drilling those wells. At this time, we turn on the first pad, but the pad in between the new area and the previously developed area of two pads is dormant—we’re not turning them on, to mitigate any parent-child issues that might be present.”

Turk said Discovery Natural is focused on technology to optimize the asset. Some 95% of the acreage has seismic data, and the team uses various models such as the geo-cellular model, the earth model, reservoir models and a frack model to optimize results. The company can drill a 10,000-foot lateral and frack it with more than 2,000 pounds of sand per foot for roughly $6 million. Operating costs have also come down.

“This year we’ll be able to drive our fully loaded operating costs down below $10 a barrel, and that does include G&A,” he said.

The southern Midland Basin is a great neighborhood, Turk said, with some of the offset operators including Pioneer Natural Resources Corp. and Apache Corp., although this area is now dominated by private E&Ps. Initial efforts by the industry in the 2010 to 2014 period led to the basin’s reputation as being too gassy and potentially not as good as the northern Midland. Too, many of the largest operators left to focus on the Delaware Basin. However, with new technology being applied and modern fracks, the returns are significantly better or competitive with other basins, not only in Texas but elsewhere, Turk said. Many operators have returned since the 2016 downturn. Since 2017, over 1,000 horizontal wells have been drilled in the southern Midland.

Turk said the higher costs found in the northern Midland Basin, and the higher oil content, are offset by lower entry and lower drilling costs in the southern portion of the basin. NGL uplift also helps. A low oil-to-water ratio of about 2-1 mitigates some of the issues found in the Delaware, where the water cut is much higher and disposal issues are more acute.

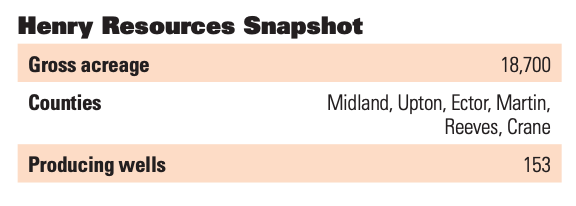

Henry Resources LLC

Long-time family operator weighs decision to “mow down or slow down.”

Henry Resources LLC shifted its efforts to horizontal drilling during the past few years, which has proven to be profitable, said president David Bledsoe. A long-time Midland oil operator, the company’s CEO, Jim Henry, was credited with discovering the Wolfberry play, the largest Midland Basin discovery in more than 50 years.

In 2013, Henry Resources turned its attention to the horizontal potential in the Midland Basin, and the company drilled its first Spraberry/Wolfcamp wells in 2014, said Bledsoe, who has 33 years of oil and gas experience and joined Henry Resources in 2007. Bledsoe spent six years at Occidental Petroleum in the business development group. Prior to that, he was the division engineering manager at Bass Enterprises, where he worked for 11 years. Bledsoe worked for Amoco Production before moving to Bass.

By 2015, Henry Resources turned its capital focus to horizontal drilling, said Bledsoe. Since 2012, the company has drilled and completed around 240 vertical wells as well as 72 horizontal wells since 2014.

The company is currently running one horizontal rig although it laid down a second rig in March. For the past three years, Henry has run one horizontal rig consistently as long as there was enough cash flow, he said.

The company’s strategy now is to make “fringe in the core” instead of the opposite. Its plan is to cobble together difficult acreage, making it drillable in the core, he said.

“This is the thing we’re wrestling with the most today,” Henry Resources president David Bledsoe said, regarding multibench development.

“As a small operator, we don’t have real deep pockets.”

Unlike vertical drilling, where the company could take some operational and financial risk, Henry Resources cannot take any geological risk in horizontal drilling, Bledsoe said. “We’ve stuck to the core acreage, drilling $8- to $10 million wells. If it’s not economic, it’s painful; we can't afford to do that.”

The strategy of the company now includes a “plan with the end in mind” and includes testing all target benches first, Bledsoe said. He reiterated that early testing for spacing is important because it dictates the parent-child well relationships for the rest of the development life and also dictates well spacing.

Henry is adapting to horizontal development vs. vertical development. “If you’re going to mow down a section, then you’re going to spend $80- to $100 million before you get a drop of oil out of the ground. [That’s] a deep, deep capital hole. That is a significant issue for a small, capital-constrained operator,” he said.

The alternative, he said, is to slow down and drill smaller four- to six-well pads, rotating on and off the section every six to 12 months, which smooths out cash flow. However, that strategy elevates the risk of parent-child well degradation.

“This is the thing we’re wrestling with the most today. As a small operator, we don’t have real deep pockets.”

The company currently produces about 8,000 net bbl/d, an all-time high, he said. Reserve growth in the company has increased from 8 million boe in 2013 to 28 million boe today.

One of company’s strategies is to maintain nearly no debt or a low debt position, “not because the capital markets tell me to, but because I have a man down the hall telling me to,” he said, referring to Jim Henry. “You’ve got to keep our name in the phone book.” But the company has a line of credit that is used to meet cash flow needs occasionally, Bledsoe said, which is usually paid off in four to six months.

In the Delaware Basin, the company has 1,900 gross acres and two producing wells with plans to run one to two rigs during the next three years. The company’s project, Wild Turkey, in Reeves County, includes 1,280 gross acres with two PDP wells with plans to drill 12 wells during the next two years.

The deal for Wild Turkey was signed in July 2018 with only a permit, leaving Henry Resources with only 17 days to move its rig from the Midland Basin to cross the lease line before it expired in August. By November, the company had two wells online and is currently drilling a three-well pad.

In the Central Basin Platform, Henry has 2,800 gross acres and 13 vertical PDP wells. The company is also planning to run one rig over the next year, but is considering divesting it to fund its horizontal projects.

In the Midland Basin, Henry operates about 14,000 gross acres with 138 PDP wells, including 100 low-risk locations in inventory. The goal is to run one to two rigs during the next three years.

The company continues to operate its BITS joint venture in Midland County with Chevron. It involves 3,100 gross acres in which Henry holds a 25% working interest. In addition to prior vertical wells, since 2015, Henry has drilled 29 horizontal wells into the Lower Spraberry and one Wolfcamp A well, which Bledsoe characterized as “very good” considering it’s at the edge of the platform.

Henry is budgeting $80- to $140 million annually over the next three years to keep one to two horizontal rigs in action. It will maintain one vertical rig for another year to drill up its Crane County acreage.

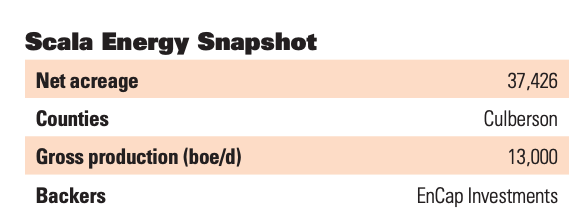

Scala Energy LLC

Far western Delaware explorer finds profit on the fringe.

The risk that Houston-based Scala Energy LLC took when the company was formed is paying off, said Allen May, executive vice president of business development and exploration. Scala Energy has concentrated its drilling program on the western edge of the Delaware Basin in Texas, a place private-equity-backed companies had avoided. Now, Scala has 38,000 net acres in the basin with 12 wells down and is targeting up to $1 billion invested in assets.

“We think it’s the best basin in the world,” May said. “The western Delaware is a good place to make money.”

In 2012, before Scala was founded, the western Delaware Basin had little vertical production and limited Wolfcamp logs, May said. Early horizontal explorers experienced high gas volumes but little oil in the Lower Wolfcamp, and uneconomic oil volumes in the Bone Spring. These hurdles discouraged oil companies and private-equity companies from being interested in this part of the basin.

The company received an equity commitment of $500 million from EnCap Investments in 2015 to go farther west, and made its initial purchase from Panther Energy in 2017. Scala is led by CEO Steve Hinchman, who formerly served as CEO of HighMount E&P. And the step-out is paying off, May said.

“You can see the density of drilling that’s happened [since then], there are developments out here and there are multibench tests all throughout,” he said. “We’ve drilled the most western well in the basin now, and it’s an Upper Wolfcamp well. That’s the sweet spot.”

The western progression of increasing oil/liquids/gas volumes has risen rapidly: the average 12-month cumulative for wells drilled in 2012 was 100,000 boe compared to the average 12-month cumulative in 2018 at 400,000 boe.

The assets in the western basin are tightly held by three companies—Scala Energy, Chevron and Cimarex Energy.

Scala’s first long-lateral well, the Norman, drilled in 2017 in the Upper Wolfcamp A, is an “awesome well that came on with a 30-day IP of 942 barrels of oil a day, 584 barrels of NGL and 3,607 Mcf per day of residue gas,” May said. “It’s a very strong well.” After producing for the past two years, this well has been holding up “very well,” he said, aided by the gas in production. In the first 12 months it produced 200,000 bbl of oil.

“Most people thought it was pretty much a gas play before this well was drilled.”

The company is receiving 61% liquids from its wells with half consisting of oil and half gas liquids, while the remaining is “a lot” of residue gas. “Waha is really hurting us right now, but there are so many liquids in this that we’re still making really good returns from the Mcfs on our wells.”

Scala stimulations pump some 2,500 pounds per foot on 2-mile laterals. Scala has identified three landing zones in Upper Wolfcamp Sands, but the Lower Wolfcamp is even thicker, with two landing targets in C and two in D—“so that’s playing out well.”

The big question of pressurization has been answered, he said. “The Wolfcamp is overpressured all the way out to our western acreage,” which also leads to lower declines.

Another advantage of the region is the 4,100-foot column of pay across 11 benches. “There’s a lot of organic rock in there, and it’s very rich,” May said. But not all are created equal.

“The Upper Wolfcamp and Lower Third Bone are the most economic right now, but the C and the D are coming on really strong in the Wolfcamp. It will be a play that carries on for a very long time because of all these benches.”

Neighbor Cimarex drilled a Third Bone Sand well last year, and “it’s the biggest oil well on this west side right now. It’s right next to us, so the Bone Spring is moving our way and we think that’s going to play out well.”

“We’ve drilled the most western well in the basin now, and it’s an Upper Wolfcamp well,” said Allen May, executive vice president of business development and exploration for Scala Energy.

“That’s the sweet spot.”

Infrastructure is a challenge in the western desert, he confessed: there isn’t any. “We’ve had to put everything in,” including a gathering system and two saltwater disposal wells. “We do everything we can to avoid trucking water.” The infrastructure is planned with the intent of developing the asset, he said.

Scala production reached 13,000 boe/d this year, including 2,800 bbl/d of oil and 4,400 bbl of NGL. The company plans to continue to delineate westward, including a test with Chevron upcoming, and to scale up development later this year and into next.

Cimarex and Chevron have moved into full development in several locations in the Upper and Lower Wolfcamp, and Scala Energy plans to move to full development in 2019.

“One of the challenges is how much do we put in the cube if we move into development?” he asked. A Scala cube development would include at least the Upper Wolfcamp zones, possibly Lower Wolfcamp as well, and potentially a Bone Spring well. “That cube [development] should start by the end of the year.”

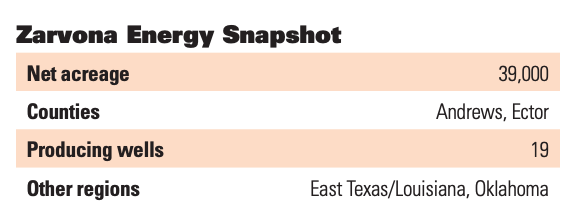

Zarvona Energy LLC

Making a play on the Permian’s Lower Barnett.

Zarvona Energy’s bet on the Permian Basin Lower Barnett Oil Play is emerging as a lucrative decision.

The privately held oil and gas company, headquartered in Houston, was founded in 2010 by Kathryn MacAskie, who was previously senior vice president of acquisitions for EV Energy Partners. Zarvona Energy was backed through a joint venture with Salient Partners in 2011. The company currently holds interests in West and East Texas, Louisiana and western Oklahoma. It has invested over $600 million in acquisitions and capital projects since inception with more than 400 operated wells generating 19,000 boe/d.

“We’re finding emerging plays in existing basins,” said Rob MacAskie, Zarvona CFO and vice president of acquisitions. “We’re looking to make them into highly economic developable opportunities.”

Such is the case in the Lower Barnett play.

Zarvona holds 25,000 net acres prospective for the Lower Barnett in Andrews County, Texas, with rights in three core areas: South Andrews, Big Max and North Andrews.

While the Mississippian-aged Barnett Shale Formation has historically been developed horizontally in the Fort Worth and Anadarko basins, the Permian has a large accumulation “that has not been produced almost at all,” said MacAskie.

“We’ve found a way to produce economically, and it’s been an execution-focused story.”

Historically, companies faced hurdles drilling in the region because of the high clay content in the shale, he said. Wells that exhibited high initial IPs went to zero pretty quickly, he noted. Instead, Zarvona targets its landing zone 50 feet or so below the shale into the Upper Mississippian Lime, a shaley carbonate, also called the Lower Barnett.

“As long as you … stay below the Barnett Shale, you can typically make a pretty good well,” MacAskie said. “It’s highly frackable and very easy to complete.” And though the lateral is below the shale, most of the production comes from the shale itself, he said.

The history of the south Andrews County Lower Barnett play began when Zarvona drilled its first vertical well, the University Cobra #3012, to test potential horizontal performance of multiple landing points from Clearfork through the base of the Mississippi Lime.

“We were very bullish on the amount of oil,” he said. “We wanted to make sure we could execute it.”

The company’s process included fracking each potential landing point and performing tracer analysis to assess the long-term production performance. The log and tracer analysis indicated that the Lower Barnett play of shaley carbonate held the best potential for economic horizontal development.

Through the testing, the company chose to focus its drilling efforts on the Lower Barnett region.

“It’s a phenomenal, low cost resource to produce,” MacAskie said. “The economic viability is both on the topline and bottom line with high margin producers and very low maintenance. It’s just a great asset to have.”

In 2016, Zarvona, in partnership with Elevation Resources, drilled a discovery well in the Lower Barnett in Andrews County—University 1-30 #1H. The EUR for the well is 880 Mboe (60% oil; 75% liquids), with 350,000 bbl accumulated to date from a 5,500-foot lateral. Importantly, the well exhibited a mere 5% water cut.

Rob MacAskie, Zarvona Energy CFO and vice president of acquisitions, said the Lower Barnett oil play has barely been tapped historically.

“We’ve found a way to produce economically, and it’s been an execution-focused story.”

Since, the Elevation/Zarvona partnership has drilled 19 Lower Barnett wells, which average 300,000 boe in the first 435 days (80% oil; less than 20% water post-flowback). Other companies that have drilled or permitted wells in the area include Occidental Petroleum, XTO Energy Inc. and Diamondback.

The company’s 10 Lower Barnett horizontal wells are currently producing from the South Andrews and Big Max areas, with an additional six wells waiting on completion. Total gross production currently exceeds 6,000 boe/d (70% oil). Zarvona said that its future wells are planned for 10,000-foot laterals or greater.

Current EUR for a 2-mile lateral is 1.2 MMbbl of oil, and about 2 MMboe EUR (80% liquids). “That’s a great resource from a single lateral. That gets you to an economic return of about $14 million net PV-10 and about 100% IRR on a 10,000-foot well.” This is on a $10 million well cost, improving to $8 million on pad drilling.

But the Lower Barnett does not exist in just Andrews County, and MacAskie is confident it’s present across the Permian Basin. Zarvona joined with Novo Oil & Gas in Ector County on a contiguous 14,000-acre position to test the concept. Geology and preliminary well tests indicate that this county could produce results similar to those achieved in the South Andrews area. The initial Zarvona test well (Cowden #602H) was spudded recently.

While MacAskie contends it is exciting to be part of an emerging play, he reiterates that the Permian Basin was itself emerging a decade ago. “This is one of the many opportunities to continue looking for new developed resources across the Permian and existing positions,” he said.

Recommended Reading

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.

Energy Transfer Ups Quarterly Cash Distribution

2024-04-25 - Energy Transfer will increase its dividend by about 3%.

ProPetro Ups Share Repurchases by $100MM

2024-04-25 - ProPetro Holding Corp. is increasing its share repurchase program to a total of $200 million of common shares.

Baker Hughes Hikes Quarterly Dividend

2024-04-25 - Baker Hughes Co. increased its quarterly dividend by 11% year-over-year.

Weatherford M&A Efforts Focused on Integration, Not Scale

2024-04-25 - Services company Weatherford International executives are focused on making deals that, regardless of size or scale, can be integrated into the business, President and CEO Girish Saligram said.