The first phase of facility construction, which Dow calls the “Path2Zero Project,” will be completed in 2027, with a planned capacity of 1.285 million tonnes per year of ethylene and polyethylene capacity. (Source: Shutterstock/ Pembina Pipeline)

Pembina Pipeline, which saw a 12% fourth-quarter boost in transported NGLs, has entered into a long-term agreement to provide Dow with 50,000 bbl/d of ethane.

“This ethane is going to be supplied from a mix of the existing portfolio, as well as new. And the new ethane will come from some of the various projects that we're currently evaluating,” said Scott Burrows, Pembina's president and CEO.

In November 2023, Dow announced plans to build a new ethylene cracker and derivatives facility in Fort Saskatchewan, Alberta. The facility will be a major boost to the oil and gas industry in the Western Canadian Sedimentary Basin.

“This will call for an ‘all-hands-on-deck’ approach to increasing Alberta’s access to ethane supplies from numerous sources,” RBN Energy analyst Martin King wrote.

Ethane is a by-product from refinery production or natural-gas processing, and is used primarily for ethylene production. The first phase of facility construction, which Dow calls the “Path2Zero Project,” will be completed in 2027, with a planned capacity of 1.285 million tonnes per year of ethylene and polyethylene capacity.

“Given Pembina’s existing leading ethane supply and transportation business and integrated value chain, there are multiple opportunities for the company to benefit from this new development through both, the existing asset base and new investment opportunities,” Burrows said.

Pembina executives discussed future projects for the company’s natural-gas production, particularly a long-awaited decision to move forward with a floating LNG export facility.

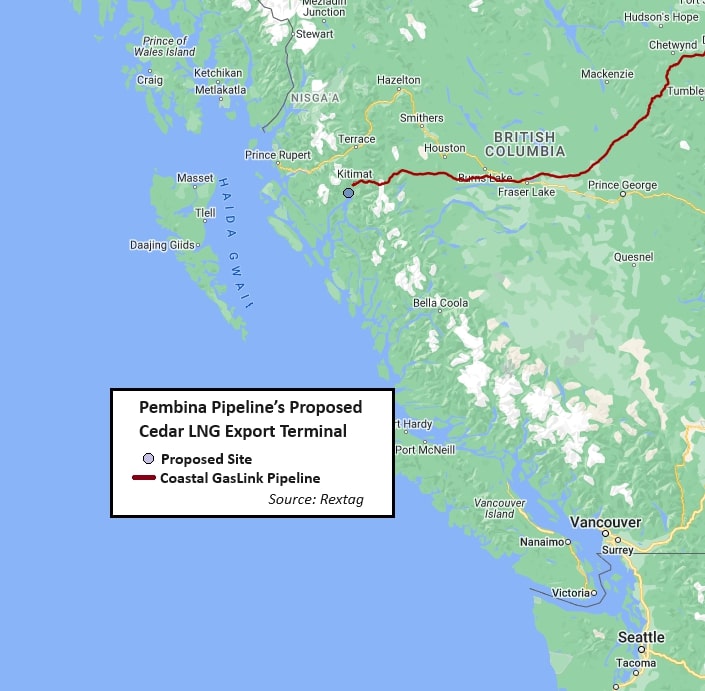

Executives said they would hold off until the middle of 2024 on an FID decision for its Cedar LNG project on the Canadian West Coast, near Kitimat, British Columbia. The project has already passed through several developmental steps, Burrows said. The proposed facility has all major regulatory approvals, and Samsung Heavy Industries and Black & Veatch have signed contracting agreements for engineering and construction.

The facility will be connected to the Coastal GasLink pipeline owned by TC Energy.

“While a lot has been accomplished, there remain a number of schedule-driven interconnected elements that require resolution prior to making the final investment decision,” Burrows said. Some of the decisions for executives include making binding agreements for LNG export and securing project financing.

The company reported a record financial year in 2023, with earnings of CA$1.78 billion (US$1.32 billion) and an adjusted EBITDA of CA$3.824 billion (US$2.83 billion).

Recommended Reading

TotalEnergies Acquires Eagle Ford Interest, Ups Texas NatGas Production

2024-04-08 - TotalEnergies’ 20% interest in the Eagle Ford’s Dorado Field will increase its natural gas production in Texas by 50 MMcf/d in 2024.

Tech Trends: Halliburton’s Carbon Capturing Cement Solution

2024-02-20 - Halliburton’s new CorrosaLock cement solution provides chemical resistance to CO2 and minimizes the impact of cyclic loading on the cement barrier.

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

Range Resources Expecting Production Increase in 4Q Production Results

2024-02-08 - Range Resources reports settlement gains from 2020 North Louisiana asset sale.

Sinopec Brings West Sichuan Gas Field Onstream

2024-03-14 - The 100 Bcm sour gas onshore field, West Sichuan Gas Field, is expected to produce 2 Bcm per year.