“It’s great to conclude my time as CEO on a high note,” Bryan Sheffield said before turning the call over to Matt Gallagher, who will succeed Sheffield as CEO of Parsley Energy starting in January. (Source: Parsley Energy Inc./Hart Energy)

On his last call as CEO of Parsley Energy Inc. (NYSE: PE), Bryan Sheffield recalled founding a company in the “sleepy Midland Basin” with no ownership or production but the responsibility to operate vertical wells.

A decade later, it’s remarkable that Parsley owns the rights to “200,000 of the most coveted net acres in the world,” Sheffield said on a Nov. 2 earnings call.

“We value scale, but at the end of the day what we’re really driving for is value,” he said.

RELATED: Parsley CEO Sheffield Stepping Into New Role In 2019; Successor Named

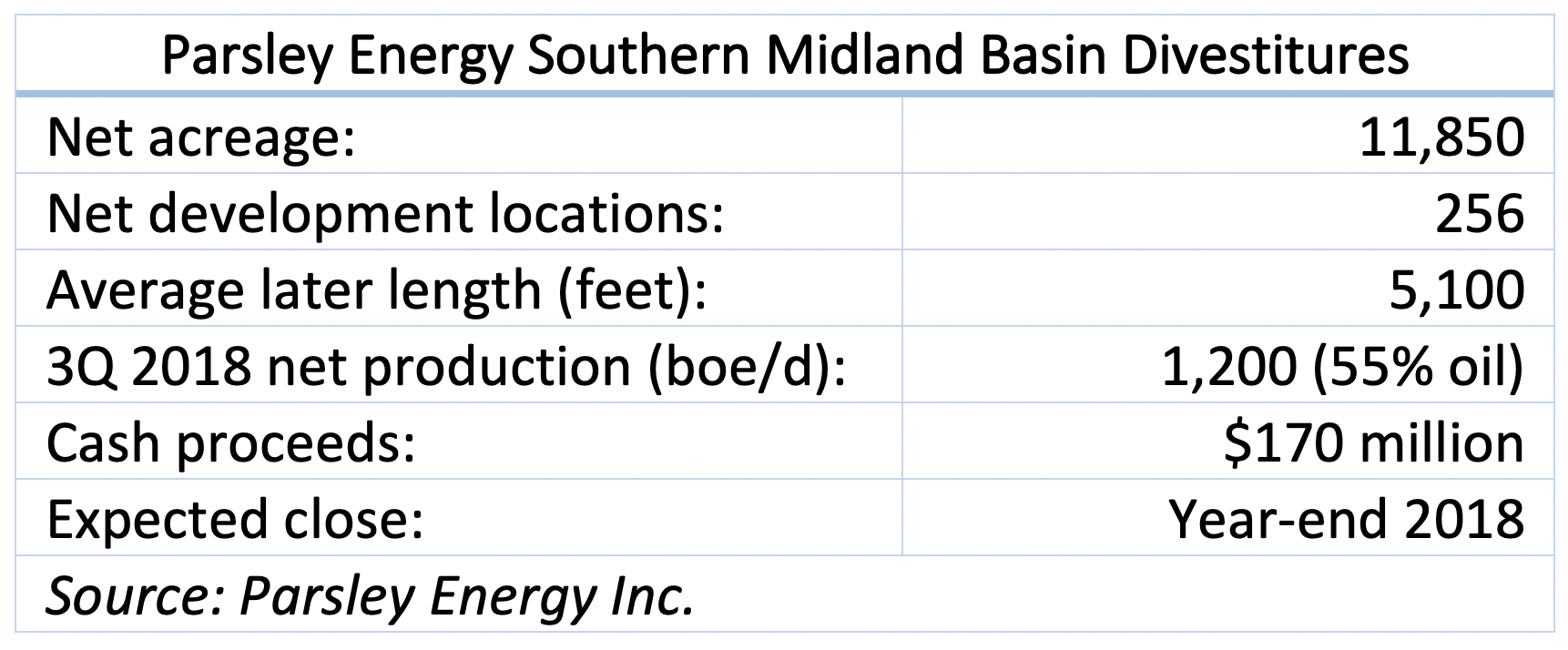

As part of creating value, Parsley also said it would divest what it called “tail-end inventory” in the Southern Midland Basin, including parts of Reagan, Upton and Howard counties, Texas, for about $170 million.

As part of “pruning the portfolio” Parsley will part with about 11,850 net acres and 256 locations through multiple sales and a trade for acreage and cash. None of the other transaction parties were named.

Parsley’s divested acreage averaged 1,200 barrels of oil equivalent per day (boe/d) in third-quarter 2018, with about 55% of the volumes oil. The company’s 2018 guidance is 108,000 boe/d. The divestitures will not affect the company’s guidance, Parsley said.

Parsley holds 155,000 net acres in the Midland and another 45,000 net acres in the Delaware Basin.

Parsley CFO Ryan Dalton said the divested acreage was high quality but wasn’t part of its near-term development plans. The proceeds also cover some of Parsley’s capital overspend as the company heads toward free cash flow generation by the end of 2019.

“There’s some production going out with these properties,” he said on an earnings call, adding the impact to volumes in the fourth quarter would be “a few hundred boe per day.”

The deal is expected to close by year-end 2018.

Sheffield said Parsley has the acreage, team and talent to move forward as he transitions to executive chairman.

“It’s great to conclude my time as CEO on a high note,” he said before turning the call over to Matt Gallagher, who will succeed Sheffield as CEO of Parsley Energy starting in January.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

How Diversified Already Surpassed its 2030 Emissions Goals

2024-04-12 - Through Diversified Energy’s “aggressive” voluntary leak detection and repair program, the company has already hit its 2030 emission goal and is en route to 2040 targets, the company says.

BKV CEO Chris Kalnin says ‘Forgotten’ Barnett Ripe for Refracs

2024-04-02 - The Barnett Shale is “ripe for fracs” and offers opportunities to boost natural gas production to historic levels, BKV Corp. CEO and Founder Chris Kalnin said at the DUG GAS+ Conference and Expo.