Midstream company Williams saw overall demand growth as heavy gas volumes passed through its network. (Source: Shutterstock.com)

Natural gas prices spent most of first-quarter 2024 in the doldrums, dropping below $2 per MMbtu at the Henry Hub in February and only rallying back nearly three months later. On April 8, the future spot price was sitting at $2.25 per MMbtu.

For midstream company Williams, the stretch hasn’t been a problem in the first quarter. The company reported a record contracted transmission capacity of 33.9 Bcf/d; cleared seven projects through the Federal Energy Regulatory Commission (FERC); and raised its 2024 dividend by 6.1%.

Demand for cheap natural gas is high and growing, said Alan Armstrong, Williams’ president, CEO and director.

“Natural gas demand is not just growing, it is accelerating,” Armstrong said during the company’s May 7 first-quarter earnings call. “This period of low natural gas prices is reaffirming the great bargain that natural gas offers as a practical, low-cost, clean energy solution, and the power-hungry world we live in is rapidly turning to natural gas to generate this power.”

Armstrong said the U.S. natural gas market is oversupplied right now, which has helped Williams’ storage sector. In December 2023, the company acquired 115 Bcf of natural gas storage in geological formations along the Louisiana and Mississippi coasts for $1.95 billion.

Storage will become a more important factor for the natural gas market in the future, said Chad Zamarin, Williams’ executive vice president for corporate strategic development.

“We see long-term storage value, both in markets where there are dislocations from a price perspective, but also because of the long-term need for reliability and the important role that storage plays in providing reliability,” Zamarin said.

Overall demand for natural gas continues to grow in unexpected ways, Armstrong said. LNG exports are expected to double over the next two years. Williams has also been working with power utilities to prepare for a growing artificial intelligence sector that will require new energy.

“Reliability” will be key factor for natural gas customers in the future, he said. LNG companies will need to react quickly to price conditions at the shipping point and will need to store natural gas to have a ready supply on hand.

Following the trend of using more wind and solar generation, power companies will need fast access to natural gas as a backup.

However, the company is also seeing demand from a growing trend of industrial reshoring — when a manufacturing company that moved its operations overseas returns to the U.S.

Geopolitical tensions and the supply-chain disruptions caused by COVID-19 caused many companies to reconsider their manufacturing locations. In January, for example, Apple announced it had invested more than $16 billion in production since 2019 to relocate out of China into other countries, including the U.S.

In 2022, Congress passed the CHIPS Act to encourage the relocation of semiconductor manufacturing operations to the U.S. Some companies have since moved to or increased their domestic operational output.

The re-industrialization will require power, and the U.S.’ large supply of gas has attracted some businesses, Armstrong said.

“Even though data centers and AI get all the hype, it's actually broader than that,” Armstrong said. “A lot of reshoring of industrial loads is occurring as well. And part of that is because natural gas is so low-cost here.”

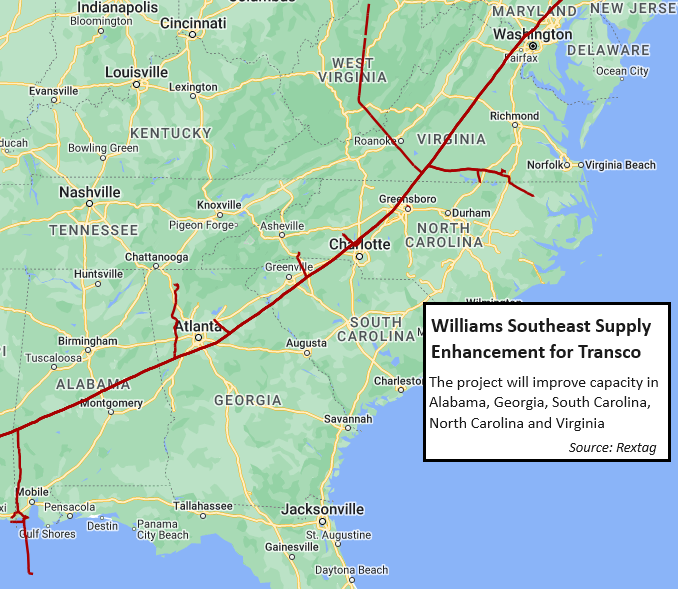

During the first quarter, Williams continued adding to its network. The company pre-filed with FERC for the Southeast Supply Enhancement Project and plans to make the official filing later this year. The project would expand the Transco Pipeline’s capacity by about 1.6 Bcf/d and serve states in the Mid-Atlantic and southeastern U.S.

Litigation, earnings

Williams did not share any updates on its legal disputes with Energy Transfer over Williams’ Louisiana Energy Gateway project. The two have been battling in court after Energy Transfer denied Williams, and some other companies, the rights-of-way to cross some of Energy Transfer’s pipelines.

Michael Dunn, Williams’ executive vice president and COO, said that the company has more than 2,000 pipelines crossing Energy Transfer’s lines already, and that any concerns had usually been disputed on site until the recent legal challenge.

Williams’ Louisiana Energy Gateway, a project to expand capacity from the Haynesville shale in Louisiana to the Gulf Coast, is now waiting for its day in court. The dispute has delayed its completion to the second half of 2025.

The most recent legal ruling on the cases, in which an appeals court judge ruled against Energy Transfer in favor of DT Midstream, support Williams’ argument, Dunn said.

For the quarter, Williams reported increased adjusted EBITDA of $1.934 billion, up $139 million increase over first-quarter 2023. Cash flow from operations came to $1.234 billion. Williams kept its guidance for 2024 growth capex at the same level, between $1.45 billion and $1.75 billion.

Recommended Reading

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Mitsubishi Makes Investment in MidOcean Energy LNG

2024-04-02 - MidOcean said Mitsubishi’s investment will help push a competitive long-term LNG growth platform for the company.

Tellurian Reports Driftwood LNG Progress Amid Low NatGas Production

2024-05-02 - Tellurian’s Driftwood LNG received an extension through 2029 with authorization from the Federal Energy Regulatory Commission and the U.S. Army Corps of Engineers.

TotalEnergies to Invest $400MM in LPG

2024-05-14 - TotalEnergies is investing more than $400 million into LPG to provide more than 100 million people in Africa and Asia access to clean cooking methods by 2030.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.