(Source: JNix/Shutterstock.com)

Next year could be another challenging one for natural gas with analysts forecasting a slowdown in natural gas production growth based on downward guidance from producers.

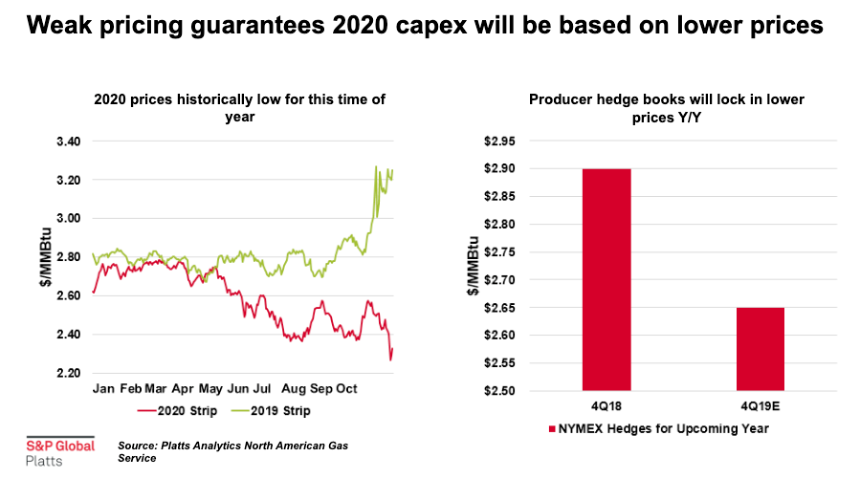

Natural gas prices, which have consistently traded lower than $3 per MMBtu throughout the year, aren’t expected to help the situation much. Neither is demand from Mexico, and LNG export concerns could add to worries. The gas glut remains.

However, even if the outlook turned positive—surprising to the upside—capacity constraints could become an obstacle in some basins, analysts with S&P Global Platts said during its recent North American natural gas winter outlook webinar.

The slowdown is already visible in the Appalachian Basin in the Northeast, where S&P Global Platts natural gas analyst Luke Jackson said the rig count has fallen from about 84 rigs earlier this year to about 50 today. While efficiency gains have enabled production to still grow, reaching as much as 34 billion cubic feet per day (Bcf/d) despite the lower rig count, future output could be impacted as producers cope with weak prices.

“We do believe we’re sort of approaching that tipping point. We think that tipping point is very near likely starting this month or even into January,” Jackson said.

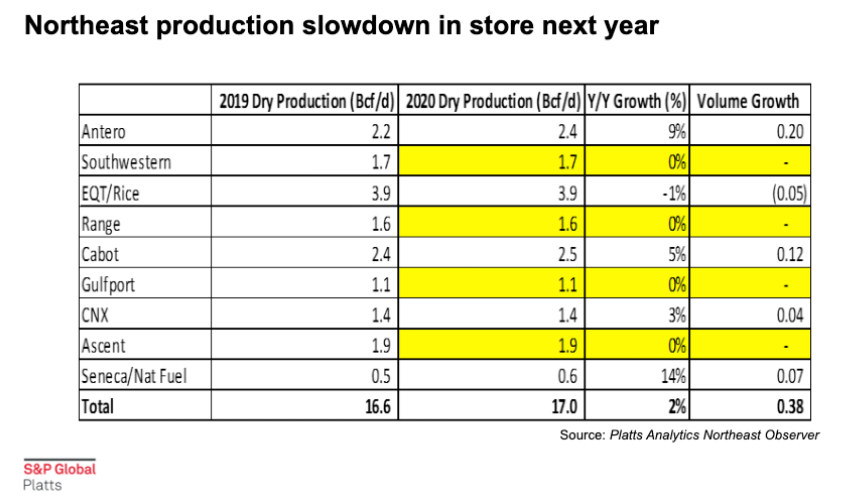

Looking at 2020 dry gas production guidance in Appalachia from the top nine producers, which account for about 70% of the region’s production, Jackson pointed out that “most are guiding a substantially slower growth rate year-over-year.”

Four of the producers planned no production growth for 2020, while three planned for single-digit growth and one double-digit, according to Jackson, team lead of North American natural gas analytics for the firm. Seneca Resources Co., the E&P segment of Houston-based National Fuel Gas Co., aims to grow production by 14% next year.

In all, the top producers in the Northeast are planning to produce a combined 17 billion cubic feet of gas per day (Bcf/d), up 2% from 2019. “The growth rate year-over-year is only around 300 to 400 million cubic feet per day,” Jackson said. “If we compare this same peer group and looked at their growth rates in 2019 versus 2018, we would see that they collectively grew around 2, maybe 2.5 Bcf/d year-on-year. So definitely a much, much steeper drop in growth.”

Capacity constraints leave little room for incremental growth.

Kevin Sakofs, senior analyst for North American natural gas for S&P Global Platts, said activity levels across key dry gas plays have dropped precipitously since June, and “this is largely due to a softening dry gas commodity backdrop.”

Chevron Corp. said Dec. 11 it expects $10 billion to $11 billion in write-downs in fourth-quarter 2019, mostly due to its Appalachia shale gas assets. The company said it will spend less money in 2020 on gas-related projects, including those in Appalachia, and is considering divestments.

“The announcement continues a wave of write-downs related to price downgrades,” Tom Ellacott, senior vice president, corporate analysts, at Wood Mackenzie said in a statement. “U.S. shale gas assets have been hardest hit, reflecting the weak outlook for U.S. gas prices. “We expect the trend of write-downs to continue as price outlooks are adjusted down.”

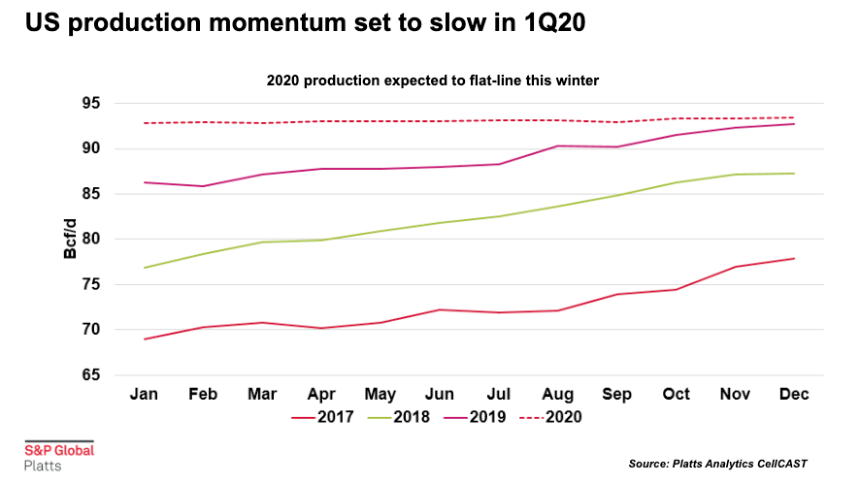

Analysts are forecasting gas supply will again outpace demand next year.

The market entered this upcoming winter with 3.75 Tcf [trillion cubic feet] of supply, which is roughly 500 Bcf [billion cubic feet] higher than last year, Sakofs said. Assuming normal weather, Platts estimated the year-on-year surplus would expand to about 2 Tcf by the end of March.

U.S. gas supply is forecast to grow by 5.9 Bcf/d this winter compared to a year ago, according to the outlook.

The key wildcard, Sakofs said, is associated gas from producers targeting oil and NGL—something he said has kept production from declining in 2020.

Adding to worries is a challenged global gas market and its potential impact on LNG exports, which Sakofs said is a critical component of the demand forecast. About 2.7 Bcf/d of additional liquefaction capacity is expected in 2020, pushing feed gas flow to terminals to new highs, the analysts said. However, market conditions could impact the growth.

“A lot is riding on Asia having a cold winter,” but it doesn’t have much storage. That means LNG molecules must flow elsewhere, Sakofs said, questioning whether Europe—which has high storage—could be the balancing mechanism again next year.

Jackson later added that the Asian and European markets are already oversupplied.

“We think that that is a trend that could continue into next summer and cause some issues in terms of dispatch of U.S. LNG exports,” he said.

Recommended Reading

Plus 16 Bcf/d: Power Hungry AI Chips to Amp US NatGas Draw

2024-04-09 - Top U.S. natural gas producers, including Chesapeake Energy and EQT Corp., anticipate up to 16 Bcf/d more U.S. demand for powering AI-chipped data centers in the coming half-dozen years.

Turning Down the Volumes: EQT Latest E&P to Retreat from Painful NatGas Prices

2024-03-05 - Despite moves by EQT, Chesapeake and other gassy E&Ps, natural gas prices will likely remain in a funk for at least the next quarter, analysts said.

CNX Joins Crowd of Companies Cutting Back NatGas Production

2024-03-12 - Appalachian gas producer CNX Resources is reducing natural gas production in 2024 and announced delays for well completions on three shale pads.

Midstream Builds in a Bearish Market

2024-03-11 - Midstream companies are sticking to long term plans for an expanded customer base, despite low gas prices, high storage levels and an uncertain political LNG future.

Exclusive: Can NatGas Save the 'Fragile' Electric Grid?

2024-02-28 - John Harpole, the founder and president of Mercator Energy, says he is concerned about meeting peak electric demand and if investors will hesitate on making LNG export facilities investment decisions after the Biden administration's recent LNG pause, in this Hart Energy LIVE Exclusive interview.