Ørsted and other offshore wind developers have struggled lately with inflationary pressures, rising interest rates and supply chain delays. (Source: Shutterstock.com)

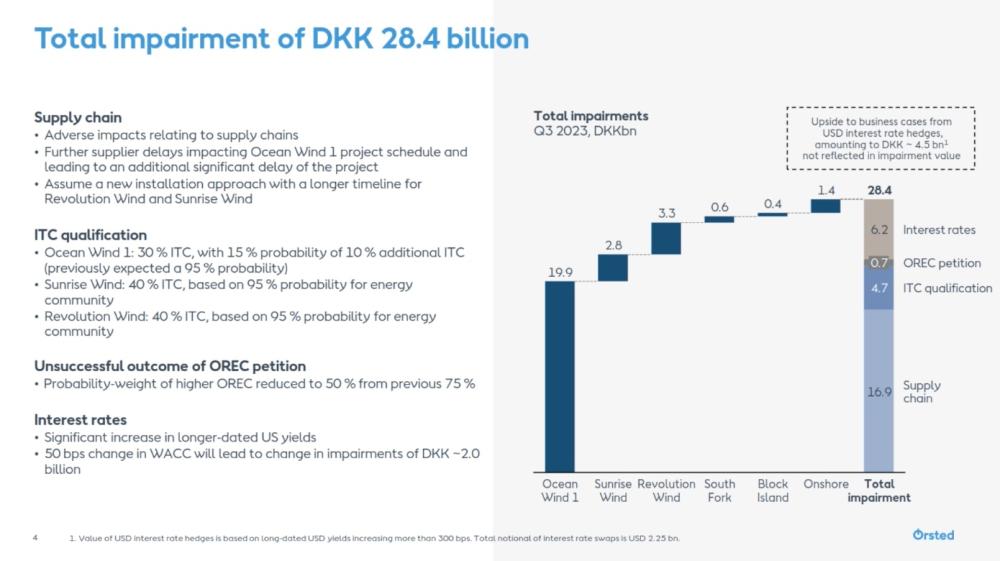

Shares of Danish wind developer Ørsted took a massive blow Nov. 1, falling more than 25%, a day after the company said it would cease development of two 1.1-gigawatt (GW) wind projects offshore New Jersey and book about U.S.$4 billion of impairment charges for third-quarter 2023.

The company said higher interest rates and supplier delays, coupled with an unsuccessful request in New York to raise rates and lower probability of investment tax credit qualification, prompted it to halt the Ocean Wind 1 and Ocean Wind 2 projects offshore New Jersey.

Shares traded at $270 at open, down about 20% from the previous close. Throughout the day, the stock price continued to drop, reaching $252.50 around midday CT on Nov. 1.

“The key drivers are additional supplier delays further impacting our project schedule as well as an updated view on certain assumptions around likelihood and timing of final permits and quality of tax credit monetization,” Ørsted group president and CEO Mads Nipper said Nov. 1 on the company’s latest earnings call with analysts. “As part of this process to cease the development of Ocean Wind 1, the key focus going forward is how to secure the highest reuse value of the contract.”

The renewable energy developer had warned of financial woes in August, but the writedown was bigger than the $2.3 billion expected. The company has been reviewing its investments, focusing on U.S. offshore projects in an effort to de-risk its portfolio.

“We firmly believe the U.S. needs offshore wind to achieve its carbon emissions reduction ambition, and we remain committed to the U.S. renewables market and truly value the efforts by the U.S. government to support the build-up of the U.S. offshore wind industry,” Mads Nipper said in a statement. “However, the significant adverse developments from supply chain challenges, leading to delays in the project schedule, and rising interest rates have led us to this decision, and we will now assess the best way to preserve value while we cease development of the projects.”

Offshore wind developers have struggled lately amid inflationary pressure, rising interest rates and supply chain delays. Higher costs led some to terminate power purchase agreements this year, and failed attempts by Ørsted and other companies to renegotiate rates for wind projects offshore New York delivered another hit.

Ørsted is not alone. BP and Equinor also booked third quarter 2023 impairments related to offshore wind developments.

BP’s request to renegotiate its power purchase agreements with New York was rejected in June. The company took a $540 million pre-tax impairment charge as a result, BP interim CFO Katherine Thomson said during an earnings call.

“We’ll work with our partners closely on the way forward as you’d imagine us to say that those decisions will be based on value,” Thomson said. “We need to see those projects continue to meet a 6% to 8% unlevered return, which is what we’ve been clear on with regard to offshore wind and our requirements. So, let’s see how it evolves.”

The challenges, which mark setbacks for U.S. efforts to grow offshore wind capacity to 30 GW by 2030, come even as the Inflation Reduction Act aims to incentivize development with tax credits.

Some projects, however, are moving forward. Ørsted decided to progress the Revolution Wind project into the construction phase. Eversource is Ørsted’s partner in the project offshore Rhode Island.

“The 704-megawatt project holds an attractive forward-looking return above our guided range,” Nipper said. “We expect to start offshore construction work in 2024 and commission the project towards the end of 2025.”

Speaking to analysts on a conference call Nov. 1, Nipper said Ørsted has de-risked the most painful part of its portfolio. The Bureau of Ocean Energy Management approved the company’s construction and operations plan for Ocean Wind 1 in September.

Ørsted said its gross investments for this year is now expected to be between about $5.7 billion and $6.2 billion, reflecting its termination of Ocean Wind 1 investments.

The company plans to update the market no later than fourth-quarter 2023 on its long-term strategic and financial targets based on its review.

Bernstein analyst Deepa Venkateswaran said Ørsted’s writedowns were expected.

“You can say the market has punished them,” Venkateswaran told Reuters. “I think there is a worry that things could get worse and spread to other parts of the portfolio, as well as a lack of confidence in the management team.”

However, she added stopping the Ocean Wind development was a “positive signal that they are committed to only proceeding with valuable projects.”

New Jersey Gov. Phil Murphy had other thoughts. He called the move “outrageous,” but acknowledged how offshore wind projects awarded before 2020 have faced interest rate escalation, supply chain cost increases and inflation.

“And while today is a setback, the future of offshore wind in New Jersey remains strong,” Murphy said. “In recent weeks, we’ve seen a historically high number of bids into New Jersey’s ongoing third offshore wind solicitation, and the Board of Public Utilities will shortly announce two additional solicitations related to our first-in-the-nation State Agreement Approach to build an offshore wind transmission infrastructure.”

Recommended Reading

Barnett & Beyond: Marathon, Oxy, Peers Testing Deeper Permian Zones

2024-04-29 - Marathon Oil, Occidental, Continental Resources and others are reaching under the Permian’s popular benches for new drilling locations. Analysts think there are areas of the basin where the Permian’s deeper zones can compete for capital.

Petrobras to Step Up Exploration with $7.5B in Capex, CEO Says

2024-03-26 - Petrobras CEO Jean Paul Prates said the company is considering exploration opportunities from the Equatorial margin of South America to West Africa.

E&P Highlights: March 4, 2024

2024-03-04 - Here’s a roundup of the latest E&P headlines, including a reserves update and new contract awards.

E&P Highlights: March 11, 2024

2024-03-11 - Here’s a roundup of the latest E&P headlines, including a new bid round offshore Bangladesh and new contract awards.

E&P Highlights: March 15, 2024

2024-03-15 - Here’s a roundup of the latest E&P headlines, including a new discovery and offshore contract awards.