About 4.4% of current U.S. fossil gas demand could be displaced by RNG from waste, a new Deloitte report shows. (Source: Shutterstock.com/ Deloitte)

With vast amounts of waste, technical know-how and federal incentives available, public-private partnerships could pave the way for a surge in renewable natural gas (RNG) production, lower emissions and the displacement of about 4.4% of current U.S. fossil gas demand.

The findings, released in a February report by Deloitte, estimate that if biogas was captured from all public and private landfills and wastewater plants and turned into renewable natural gas, the RNG created could also meet more than half of chemicals sector demand and meet 16.5% of the core gas customer demand.

RNG, produced from biogas, with feedstock sources such as landfill waste and wastewater, is formed when contaminants are removed from methane to elevate the gas into pipeline quality gas that is used in the same ways as fossil gas.

The carbon intensity of RNG can be considerably lower than fossil gas, though it varies depending on the feedstock used. The fuel source is already playing a role in lowering emissions as utilities and investors take interest.

However, the opportunity has yet to be seized by many municipal facilities.

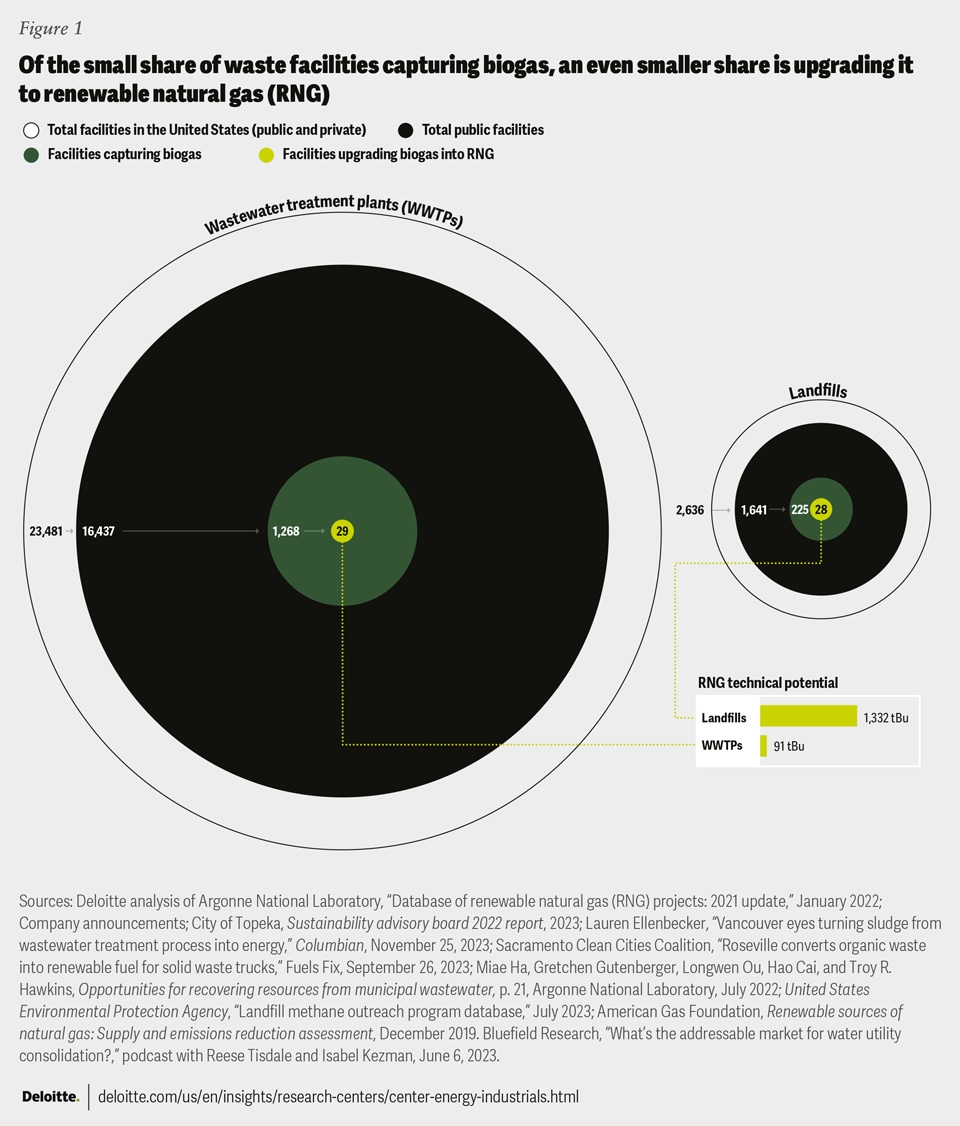

Deloitte’s report shows less than one-tenth of U.S. municipal wastewater treatment plants capture biogas. Only 2% of the plants upgrade the captured biogas to RNG.

The story is similar for publicly owned municipal landfills. Only 225 of the 1,641 publicly owned municipal landfills in the U.S. capture biogas through anaerobic digestion. Captured biogas is used mostly to generate electricity. Just 28 landfills produce RNG, according to the report.

“Meanwhile, a third of privately-owned landfills, which account for a third of all landfills, capture biogas, and 55 of these 283 landfills upgrade to renewable natural gas, suggesting significant untapped renewable natural gas production potential at municipal landfills,” according to Deloitte.

Demand drivers

Capital constraints, little experience and few resources are among the reasons for municipal landfills and wastewater plants’ lack of RNG pursuit, according to Jim Thomson, U.S. power, utilities and renewables leader for Deloitte.

“Looking ahead, greater demand pull may spur more municipal landfills and wastewater treatment plants to pursue RNG projects,” Thomson told Hart Energy. “States, corporations and utilities with decarbonization targets are fueling a growing voluntary market for renewable natural gas.”

Some states, including Massachusetts and Vermont, have established clean heat standards that require gas utilities to provide customers with an increasing percentage of lower carbon options to provide clean heat services. In California, regulators have mandated utilities supply increasing amounts of RNG to customers, replacing about 12% of traditional fossil gas with RNG by 2030.

In addition, “forty states have an interconnection standard or tariff and/or a voluntary utility or residential renewable natural gas program facilitating renewable natural gas integration and delivery to customers via existing gas infrastructure and cost recovery mechanisms,” Thomson said. “Half of these states have a renewable portfolio standard inclusive of biomass. RNG is an immediately available pathway for companies to meet GHG [greenhouse-gas] emission [standards] in high-heat, hard-to-abate sectors that are most difficult and costly to electrify.”

Another factor that could tilt the scale to RNG in the short term: the U.S. Environmental Protection Agency has delayed setting up a program that would allow electricity from biogas or RNG to qualify for electric renewable identification numbers, or eRINs, to power electric vehicles, Thomson added.

“Most municipal landfills and wastewater treatment use biogas to generate electricity rather than RNG, and some companies had been holding back on conversions of these sites to RNG in anticipation of an eRIN program,” he said.

Abundant resources

While the demand is present to incentivize municipalities to jump into RNG, lack of feedstock is not expected to be a deterrent. Deloitte reports that municipal owners of local gas distribution companies own and operate most of solid waste and wastewater facilities in the U.S. Collectively, they account for more than three-quarters of RNG gas feedstock by volume.

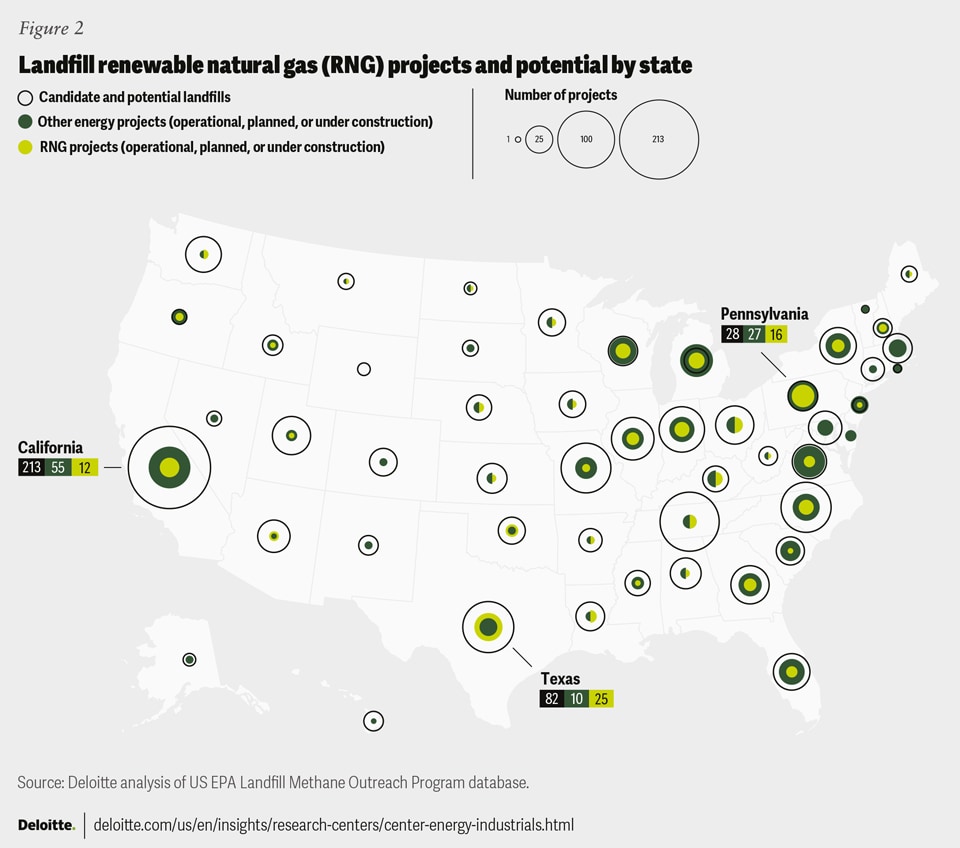

The number of RNG projects in the U.S. is rising, with planned landfill RNG projects across 37 states set to double, according to the report.

However, “all [states] have opportunities to develop more,” Deloitte’s report said. “Landfills are capturing biogas for energy projects in all but one state. And 1,538 landfills countrywide range from having some potential for an energy project to being a strong candidate with a million tons of waste or more. Two-thirds of these landfills are publicly owned.”

Project costs are among the hurdles for municipalities, but Thomson singled out multiple tax credit options to improve project economics.

“Tax credits from [the] IRA are key to reduce upfront capital costs—especially for wastewater where upfront costs may be higher. Key for operating costs are state/federal level production credit programs (LCFS/RINs) and emerging production credits (45Z for transportation and 45V for hydrogen),” Thomson said. There’s “prime opportunity in 2024 with favorable investment tax credits in place and production credits on the horizon for 2025. Furthermore, D3 RIN prices are expected to increase with new RFS production targets almost doubling cellulosic biofuel volumes through 2025.”

Negotiating longer-term, fixed price offtake agreements could also improve project economics, he said, later turning to technology. Emerging modular RNG production equipment could also be deployed to help lower costs.

Partnership, revenue opportunities

Teaming up with gas utilities, municipalities can boost RNG production for use in local distribution networks and add revenue streams. Money-making possibilities include generating renewable energy credits in the EPA’s Renewable Fuel Standard program.

“The value of D3 renewable identification numbers reached US$39.78 per MMBtu of renewable natural gas at the end of 2023,” according to Deloitte. “The EPA’s latest rules more than doubled D3 cellulosic biofuel mandates for renewable natural gas from 0.63 billion gallons in 2022 to 1.38 billion gallons in 2025, boosting project development.”

Some municipalities working with gas utilities and large energy companies are already proving partnerships can pay off.

These include the Western Virginia Water Authority and Roanoke Gas Co.’s RNG partnership for vehicle fuels. Both brought in revenue from the sale of renewable energy credits.

Another potential revenue stream includes longer-term offtake agreements.

“With favorable federal tax credits expiring at the end of 2024, now could be the time for public gas utilities and municipal waste facilities to assess renewable natural gas opportunities,” Deloitte said in the report. “Areas to evaluate include potential partners, incentives, mandates and offtakers. Projects could support municipal decarbonization, public health and resilience goals.”

Recommended Reading

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

TPH: Lower 48 to Shed Rigs Through 3Q Before Gas Plays Rebound

2024-03-13 - TPH&Co. analysis shows the Permian Basin will lose rigs near term, but as activity in gassy plays ticks up later this year, the Permian may be headed towards muted activity into 2025.

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.