(Source: Shutterstock.com)

OKEA ASA is moving forward with developing Brasse as a subsea tieback to the Brage Field in the North Sea, the company said April 8.

OKEA operates both licenses. Brasse is targeting an estimated 24 MMboe of recoverable reserves.

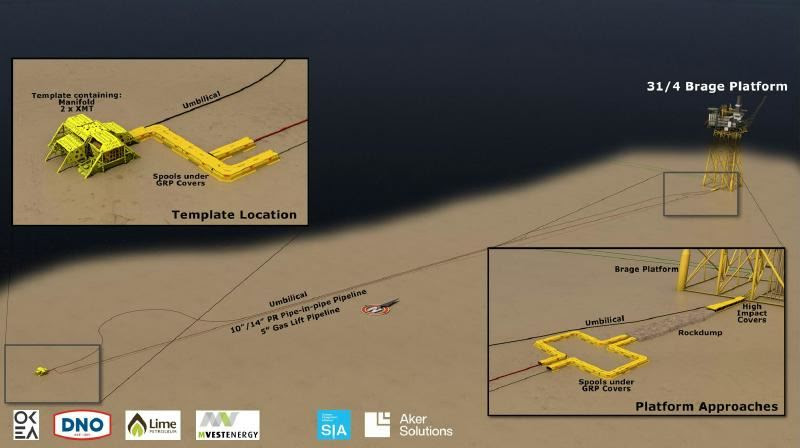

Brasse in PL740 is 13 km south of the Brage Field, and Brasse partners in 2023 agreed to fast track the development.

Brasse, discovered in 2016, will be developed as a two-well subsea tieback to the Brage facility, which will handle production, processing and exports when the field goes online in 2027.

The field is expected to operate through 2031 and possibly longer. OKEA anticipates plateau production of 26,000 boe/d.

OKEA said the Brasse development will use standard solutions and proven technology.

OKEA has awarded a contract to Aker Solutions for the topside scope.

Aker Solutions said on April 8 it had already carried out the FEED study for the topside modifications to the Brage platform. Under the scope of the new contract, valued at somewhere between $47 million and $140 million, Aker Solutions will handle engineering, procurement, construction, installation and commissioning on Brage to prepare the topside of the platform for receiving oil and gas from Brasse.

Aker Solutions said its project management team and key resources will be mainly based in Stavanger, Norway, and pre-fabrication will be done at Aker Solutions’ yard in Egersund, Norway.

OKEA also awarded a contract to Subsea7 and OneSubsea for the subsea scope. Contracts for rig and drilling services will be awarded in the second-quarter 2024.

OKEA said the Brasse plan for development and operation (PDO) will be submitted during April, and Brasse will be renamed Bestla —the name of Odin’s mother in Norse mythology — upon approval of the PDO.

OKEA operates PL740 with 39.3% interest on behalf of partners DNO Norge AS with 39.3%, Lime Petroleum AS with 17%, and M Vest Energy AS with 4.4%.

The Brage Unit partnership consists of operator OKEA with 35.2% and partners Lime with 33.8%, DNO with 14.3%, Petrolia Noco AS with 12.3%, and M Vest with 4.4%.

Recommended Reading

Diamondback Stockholders All in for $26B Endeavor Deal

2024-04-29 - Diamondback Energy shareholders have approved the $26 billion merger with Endeavor Energy Resources.

TotalEnergies Eyes Suriname FID by Year-end 2024

2024-04-29 - France’s TotalEnergies and U.S. partner APA Corp. look to place their long lead orders ahead of a final investment decision related to their joint development offshore Suriname in Block 58.

ProPetro to Provide eFrac Services to Exxon’s Permian Operations

2024-04-29 - ProPetro has entered a three-year agreement to provide electric hydraulic fracturing services for Exxon Mobil’s operations in the Permian Basin.

Keeping it Simple: Antero Stays on Profitable Course in 1Q

2024-04-26 - Bucking trend, Antero Resources posted a slight increase in natural gas production as other companies curtailed production.

Oil and Gas Chain Reaction: E&P M&A Begets OFS Consolidation

2024-04-26 - Record-breaking E&P consolidation is rippling into oilfield services, with much more M&A on the way.