Oil prices jumped more than 5% on Dec. 7 as big Middle East producers in OPEC and its allies agreed to reduce output to drain global fuel inventories and support the market.

Benchmark Brent crude oil rose $3.26 a barrel to a high of $63.32 by 7:55 a.m. CST (13:55 GMT). In early trade, Brent had fallen below $60 when it looked as if oil exporters might not agree.

U.S. light crude rose $2.62 to a high of $54.11 a barrel before slipping to around $53.90.

The cuts were larger than expected after a two-day marathon session which saw Russia and Iran take turns holding up progress. In the end, Bloomberg reported: “The cartel and its partners agreed to remove 1.2 million barrels a day (bbl/d) from the market, with OPEC itself shouldering 800,000 barrels of the burden. Iran emerged as a winner from the contentious talks, saying it’s secured an exemption from cuts as it suffers the effects of U.S. sanctions.”

A Russian Energy Ministry source told Reuters Moscow was ready to contribute a cut of around 200,000 bbl/d and sources said other non-OPEC producers could contribute a further 200,000 bbl/d of output cuts, bringing an overall cut to 1.2 million bbl/d.

“[A cut of] 1.2 million bbl/d, if implemented promptly and fully, should be enough to largely attenuate, but not eliminate, expected implied global inventory builds in the first half of next year,” BNP Paribas strategist Harry Tchilinguirian told Reuters Global Oil Forum.

“Given how much expectations were downplayed yesterday, this comes as a welcome surprise for the market,” he added.

Producers will use October production levels as a baseline for cuts and the agreement will be reviewed in April.

Reuters contributed to this report.

Recommended Reading

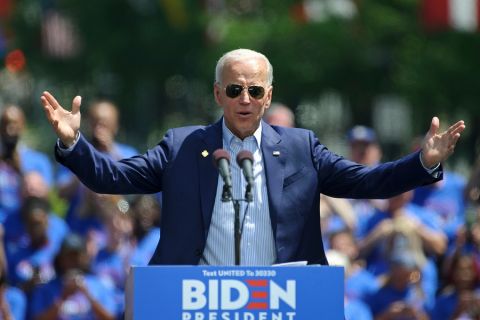

Belcher: Election Year LNG ‘Pause’ Will Have Huge Negative Impacts

2024-03-01 - The Biden administration’s decision to pause permitting of LNG projects has damaged the U.S.’ reputation in ways impossible to calculate.

Hirs: LNG Plan is a Global Fail

2024-03-13 - Only by expanding U.S. LNG output can we provide the certainty that customers require to build new gas power plants, says Ed Hirs.

The Problem with the Pause: US LNG Trade Gets Political

2024-02-13 - Industry leaders worry that the DOE’s suspension of approvals for LNG projects will persuade global customers to seek other suppliers, wreaking havoc on energy security.

Pitts: Producers Ponder Ramifications of Biden’s LNG Strategy

2024-03-13 - While existing offtake agreements have been spared by the Biden administration's LNG permitting pause, the ramifications fall on supplying the Asian market post-2030, many analysts argue.

Watson: Implications of LNG Pause

2024-03-07 - Critical questions remain for LNG on the heels of the Biden administration's pause on LNG export permits to non-Free Trade Agreement countries.