(Source: QiuJu Song/Shutterstock.com)

Though the near-term outlook for the oil market remains fickle, with demand being a key factor, analysts forecast the price for Brent crude could rebound to $60/bbl by 2022-2023.

That means the journey could be a long one with the price at just above $43/bbl July 17.

Speaking during a webinar on July 16, Keith Myers, president of research for the U.K.-based Westwood Global Energy Group, called the price “painful but not terminal for many companies,” considering the price had recovered from historic lows of less than $10/bbl in April. “The outlook still remains uncertain. In the short term, much depends on demand rebound and more.”

A resurgence of COVID-19 cases, which sapped demand in recent months as the world locked down to slow the spread of the virus, threatens to decelerate the pace of the recovery. Some have called for the return of lockdowns, which had eased in parts of the world, and a rollback of reopening measures—specifically in the U.S.—adding uncertainty to demand for fuel and other products.

The U.S. Energy Information Administration (EIA) said it expects Brent crude to average about $41/bbl in second-half 2020, rising to $50/bbl next year and $53 by year-end 2021.

“However, this price path reflects global oil consumption of 96 MMbbl/d during the second half of 2020 along with relatively strict compliance to announced OPEC+ production cuts, both of which are uncertain,” the EIA said in its latest short-term energy outlook. “Also, the degree to which the U.S. shale industry responds to the recent relative strength in oil prices compared with their recent lows in April will affect the oil price path in the coming quarters.”

Expectations are for WTI to average about $3/bbl less than Brent prices in 2020 and $4/bbl in 2021, reflecting lower U.S. crude oil production and export volumes.

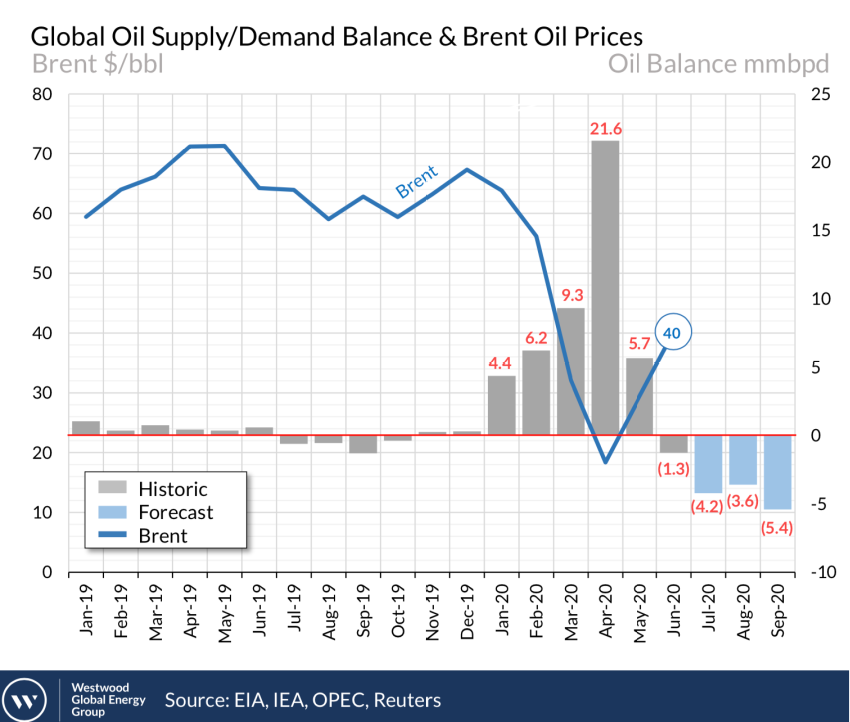

“The oil market has continued its cautious recovery,” having experienced unprecedented swings in supply and demand, added Thom Payne, head of offshore for Westwood. The industry had an oversupply of about 22 MMbbl/d in April due to the lockdowns and the dissolution of OPEC+ following the Saudi-Russia breakup, he said.

However, renewed OPEC+ commitments ushered in a new wave of cuts with high compliance rates. Though the 9.7 MMbbl/d of cuts will drop to 7.7 MMbbl/d, Payne noted that serial noncompliers—Iraq and Nigeria—would need to make up for their previous noncompliance, which could push up potential cuts for the next two months to 8.5 MMbbl/d.

This comes as U.S. oil production falls, dropping about 2.1 MMbbl/d since March, Payne said.

In all, “the oversupply for the first half of the year is now estimated at around 7.6 MMbbl/d.”

Demand has also recovered some, and demand destruction wasn’t as bad as feared. Westwood pointed out that June consumption rose by 10 MMbbl/d, compared to April.

Beliefs are that the market flipped to a net draw undersupply position of about 1.3 MMbbl/d, Payne said, pointing to the erosion of inventories, falling premium storage stocks and a drop in U.S. inventories.

“This undersupply is expected to continue through the balance of the year and average 4.4 MMbbl/d in the third quarter,” Payne said. “This is going to be really critical in clearing the 1.2 billion barrels of excess crude that has been produced over the first half of the year, without that significant build position.”

Looking ahead, the two burning questions on the supply side, he said, are: Will OPEC+ continue to comply with pledged production cuts and will U.S. shale increase production to pre-crash levels?

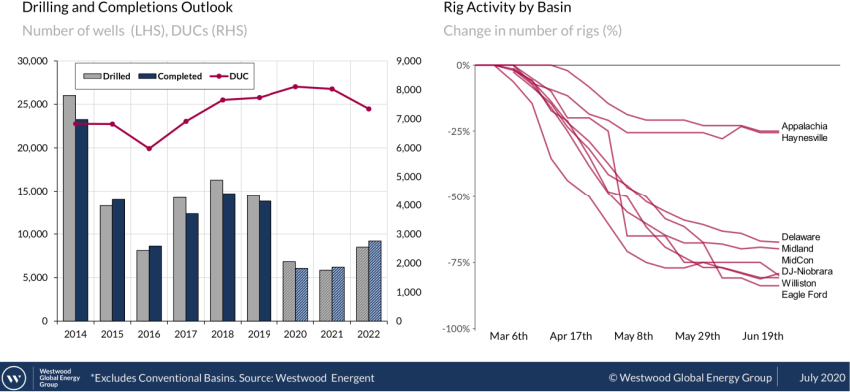

“From 2019 to 2020, we’re at least anticipating a 53% decline in the number of wells drilled,” Todd Bush, head of onshore for Westwood, said of U.S. unconventionals.

That would mark a drop below 10,000, a first since 2016.

“In ‘21, we’re anticipating a slight drop, but then a recovery with WTI as well in 2022,” he said.

Completion activity has also fallen below levels seen in 2016, down about 56%, he added. Improvement is expected next year and 2022.

The backlog of drilled-but-uncompleted wells is expected to fall from more than 8,000 in 2020-21 to nearly 7,000 in 2022.

“That’s certainly something to keep an eye on as we move into the $40 to $50 range for WTI,” Bush said.

As for hard-hit frac crews, which Westwood satellite imagery show plummeted from 133 crews at the beginning of the year to 18 in the Permian Basin, a “rough” second half of the year is expected, according to Bush.

“But we do anticipate activity coming back in the third and fourth quarter of this year from a frac crew perspective,” Bush said. “So, while 18 is probably the bottom that we’re going to see, we are expecting that to increase probably to about the 30 to 40 range for the Permian.”